Application For Business Operations Tax Certificate (Business License) Form - City Of Seaside, Ca

ADVERTISEMENT

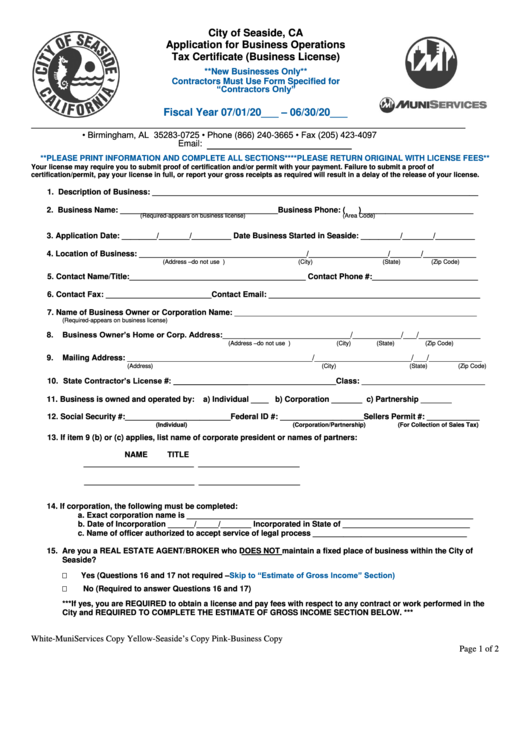

City of Seaside, CA

Application for Business Operations

Tax Certificate (Business License)

**New Businesses Only**

Contractors Must Use Form Specified for

“Contractors Only”

Fiscal Year 07/01/20___ – 06/30/20___

___________________________________________________________________________________

P.O. Box 830725 • Birmingham, AL 35283-0725 • Phone (866) 240-3665 • Fax (205) 423-4097

Email:

**PLEASE PRINT INFORMATION AND COMPLETE ALL SECTIONS****PLEASE RETURN ORIGINAL WITH LICENSE FEES**

Your license may require you to submit proof of certification and/or permit with your payment. Failure to submit a proof of

certification/permit, pay your license in full, or report your gross receipts as required will result in a delay of the release of your license.

1.

Description of Business: __________________________________________________________________________

2.

Business Name: ____________________________________Business Phone: (

) _________________________

(Required-appears on business license)

(Area Code)

3.

Application Date: ________/_______/_________ Date Business Started in Seaside: _________/_______/_________

4.

Location of Business: ______________________________________/__________________/_______/____________

(Address – do not use P.O. Box)

(City)

(State)

(Zip Code)

5.

Contact Name/Title:________________________________________ Contact Phone #:________________________

6.

Contact Fax: ________________________Contact Email: ________________________________________________

7.

Name of Business Owner or Corporation Name: _______________________________________________________

(Required-appears on business license)

Business Owner’s Home or Corp. Address:_____________________________/___________/___/______________

8.

(Address – do not use P.O. Box)

(City)

(State)

(Zip Code)

9.

Mailing Address: __________________________________________/______________________/___/____________

(Address)

(City)

(State)

(Zip Code)

10. State Contractor’s License #: _____________________________________Class: ____________________________

11. Business is owned and operated by:

a) Individual ____ b) Corporation _______ c) Partnership _______

12. Social Security #:________________________Federal ID #: ___________________Sellers Permit #: ____________

(Individual)

(Corporation/Partnership)

(For Collection of Sales Tax)

13. If item 9 (b) or (c) applies, list name of corporate president or names of partners:

NAME

TITLE

_________________________

_______________________

_________________________

_______________________

14. If corporation, the following must be completed:

a.

Exact corporation name is _________________________________________________________________

b.

Date of Incorporation ______/_____/_______ Incorporated in State of _____________________________

c.

Name of officer authorized to accept service of legal process ___________________________________

15. Are you a REAL ESTATE AGENT/BROKER who DOES NOT maintain a fixed place of business within the City of

Seaside?

Yes (Questions 16 and 17 not required –

Skip to “Estimate of Gross Income” Section)

No (Required to answer Questions 16 and 17)

***If yes, you are REQUIRED to obtain a license and pay fees with respect to any contract or work performed in the

City and REQUIRED TO COMPLETE THE ESTIMATE OF GROSS INCOME SECTION BELOW. ***

Yellow-Seaside’s Copy

White-MuniServices Copy

Pink-Business Copy

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2