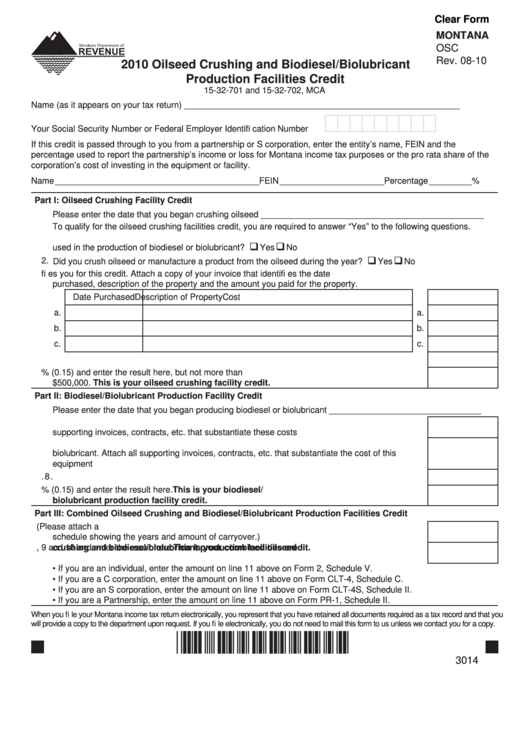

Clear Form

MONTANA

OSC

Rev. 08-10

2010 Oilseed Crushing and Biodiesel/Biolubricant

Production Facilities Credit

15-32-701 and 15-32-702, MCA

Name (as it appears on your tax return) __________________________________________________________

Your Social Security Number or Federal Employer Identifi cation Number

If this credit is passed through to you from a partnership or S corporation, enter the entity’s name, FEIN and the

percentage used to report the partnership’s income or loss for Montana income tax purposes or the pro rata share of the

corporation’s cost of investing in the equipment or facility.

Name ___________________________________________ FEIN ______________________ Percentage _________ %

Part I: Oilseed Crushing Facility Credit

Please enter the date that you began crushing oilseed _______________________________________________

To qualify for the oilseed crushing facilities credit, you are required to answer “Yes” to the following questions.

1. Is the machinery or equipment located in Montana used primarily to crush oilseed to be

used in the production of biodiesel or biolubricant? ......................................................................

Yes

No

2. Did you crush oilseed or manufacture a product from the oilseed during the year? .....................

Yes

No

3. List the property purchased that qualifi es you for this credit. Attach a copy of your invoice that identifi es the date

purchased, description of the property and the amount you paid for the property.

Date Purchased

Description of Property

Cost

a.

a.

b.

b.

c.

c.

4. Add lines 3a through 3c above and enter the result here .............................................................. 4.

5. Multiply the amount on line 4 by 15% (0.15) and enter the result here, but not more than

$500,000. This is your oilseed crushing facility credit............................................................. 5.

Part II: Biodiesel/Biolubricant Production Facility Credit

Please enter the date that you began producing biodiesel or biolubricant ________________________________

6. Enter the total cost of constructing a facility used to produce biodiesel/biolubricant. Attach all

supporting invoices, contracts, etc. that substantiate these costs ................................................. 6.

7. Enter the total cost of any equipment purchased to operate a facility used to produce biodiesel/

biolubricant. Attach all supporting invoices, contracts, etc. that substantiate the cost of this

equipment ...................................................................................................................................... 7.

8. Add lines 6 and 7 and enter the result here................................................................................... 8.

9. Multiply the amount on line 8 by 15% (0.15) and enter the result here. This is your biodiesel/

biolubricant production facility credit. ...................................................................................... 9.

Part III: Combined Oilseed Crushing and Biodiesel/Biolubricant Production Facilities Credit

10. Enter the amount of tax credit being carried forward from previous years. (Please attach a

schedule showing the years and amount of carryover.) .............................................................. 10.

11. Add the amounts on lines 5, 9 and 10 and enter the result here. This is your combined oilseed

crushing and biodiesel/biolubricant production facilities credit. ......................................... 11.

• If you are an individual, enter the amount on line 11 above on Form 2, Schedule V.

• If you are a C corporation, enter the amount on line 11 above on Form CLT-4, Schedule C.

• If you are an S corporation, enter the amount on line 11 above on Form CLT-4S, Schedule II.

• If you are a Partnership, enter the amount on line 11 above on Form PR-1, Schedule II.

When you fi le your Montana income tax return electronically, you represent that you have retained all documents required as a tax record and that you

will provide a copy to the department upon request. If you fi le electronically, you do not need to mail this form to us unless we contact you for a copy.

*30140101*

3014

1

1