Instructions For Business License Application Form

ADVERTISEMENT

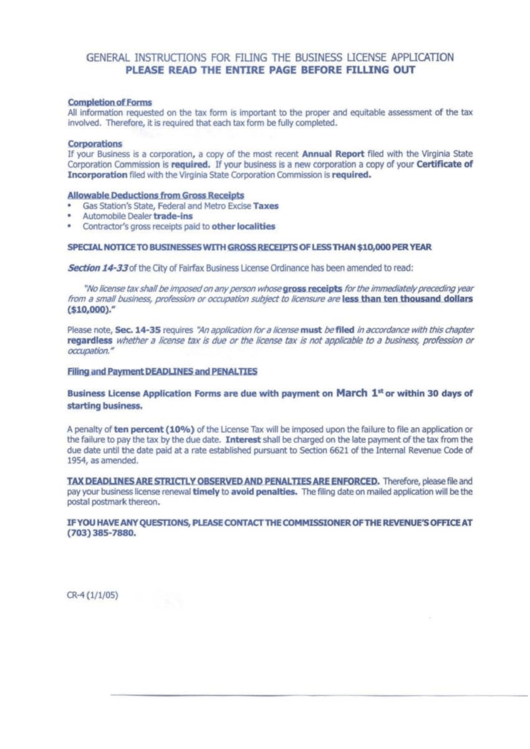

GENERAL INSTRUCTIONS FOR FlUNG THE BUSINESS UCENSE APPUCATION

PLEASE READ THE ENTIRE PAGE BEFORE FILUNG OUT

Completion of Fonns

AU Information requested on the tax form is important

to

the proper and equitable assessment of the tax

involved. Therefore, it is required that each tax form be fully completed.

Corporations

If your Business is a corporation, a copy of the most recent Annual Report filed with the Virginia State

Corporation Commission is

required.

If your business is a new corporation a copy of your Certificate of

Incorporation

filed with the Virginia State Corporation Commission is

required.

Allowable Deductions

from

Gross Receipts

•

Gas Station's

State,

Federal and Metro Excise

Taxes

•

Automobile Dealer

trade-ins

•

Contractor's gross receipts paid to

other localities

SPECAL NonCE TO BUSINESSES WITH GROSS RECEIPTS OF LESSTHAN $10,000 PERYEAR

Section

14-33 of the

City

of Fairfax Business Ucense Ordinance has been amended to read:

"No license tax shall be imposed on any person whose

gross

receipts

for the immediately preceding year

from a small

busin~

profession or occupation subject

to

licensure are less

than ten thousand dollars

($10.000)."

Please note,

Sec.

14-35 requires ' : 417 application for a license

must befiled

in accordance with this chapter

regardless

whether a license tax is due or the license tax is not applicable to a business, profession or

occupation."

Rling

and Payment DEAPUNES and PENALTIES

Business License Application Forms are due with payment on

March 1

st

or within

30

days of

starting business.

A penalty of

ten percent (10%)

of the Ucense Tax will be imposed upon the failure to file an application or

the failure to pay the tax by the due date.

Interest

shall be charged on the late payment of the tax from the

due date until the date paid at a rate established pursuant to Section 6621 of the Internal Revenue Code

of

1954, as amended.

TAX DEAPUNES ARE

SJRImy

OBSERVED AND PENALTIES ARE ENFORCED.

Therefore, please file and

pay your business license renewal

timely

to

avoid penalties.

The filing date on mailed application will be the

postal postmark thereon.

IF YOU HAVE ANY QUESTlONS, PLEASE CONTACTntE COMMISSIONER OFntE REVENUE'S OFFICE AT

(703) 385-7880.

CR-4 (1/1/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1