Instructions For Business License Application (Form Rd-101) And Prior Year Adjusted Return (Form Rd-104)

ADVERTISEMENT

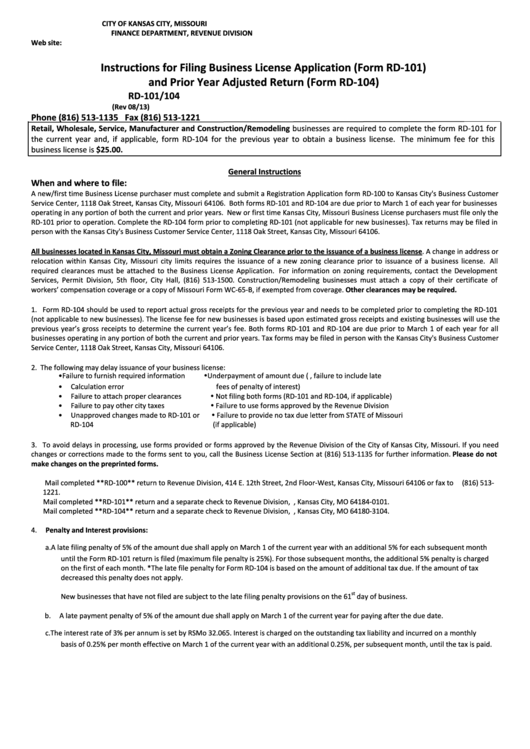

CITY OF KANSAS CITY, MISSOURI

FINANCE DEPARTMENT, REVENUE DIVISION

Web site:

Instructions for Filing Business License Application (Form RD-101)

and Prior Year Adjusted Return (Form RD-104)

RD-101/104

(Rev 08/13)

Phone (816) 513-1135 Fax (816) 513-1221

Retail, Wholesale, Service, Manufacturer and Construction/Remodeling businesses are required to complete the form RD-101 for

the current year and, if applicable, form RD-104 for the previous year to obtain a business license. The minimum fee for this

business license is $25.00.

General Instructions

When and where to file:

A new/first time Business License purchaser must complete and submit a Registration Application form RD-100 to Kansas City's Business Customer

Service Center, 1118 Oak Street, Kansas City, Missouri 64106. Both forms RD-101 and RD-104 are due prior to March 1 of each year for businesses

operating in any portion of both the current and prior years. New or first time Kansas City, Missouri Business License purchasers must file only the

RD-101 prior to operation. Complete the RD-104 form prior to completing RD-101 (not applicable for new businesses). Tax returns may be filed in

person with the Kansas City's Business Customer Service Center, 1118 Oak Street, Kansas City, Missouri 64106.

All businesses located in Kansas City, Missouri must obtain a Zoning Clearance prior to the issuance of a business license. A change in address or

relocation within Kansas City, Missouri city limits requires the issuance of a new zoning clearance prior to issuance of a business license. All

required clearances must be attached to the Business License Application. For information on zoning requirements, contact the Development

Services, Permit Division, 5th floor, City Hall, (816) 513-1500. Construction/Remodeling businesses must attach a copy of their certificate of

workers’ compensation coverage or a copy of Missouri Form WC-65-B, if exempted from coverage. Other clearances may be required.

1. Form RD-104 should be used to report actual gross receipts for the previous year and needs to be completed prior to completing the RD-101

(not applicable to new businesses). The license fee for new businesses is based upon estimated gross receipts and existing businesses will use the

previous year’s gross receipts to determine the current year’s fee. Both forms RD-101 and RD-104 are due prior to March 1 of each year for all

businesses operating in any portion of both the current and prior years. Tax forms may be filed in person with the Kansas City's Business Customer

Service Center, 1118 Oak Street, Kansas City, Missouri 64106.

2. The following may delay issuance of your business license:

Underpayment of amount due (i.e., failure to include late

• Failure to furnish required information

•

Calculation error

fees of penalty of interest)

Not filing both forms (RD-101 and RD-104, if applicable)

•

Failure to attach proper clearances

Failure to use forms approved by the Revenue Division

•

Failure to pay other city taxes

Failure to provide no tax due letter from STATE of Missouri

•

Unapproved changes made to RD-101 or

RD-104

(if applicable)

3. To avoid delays in processing, use forms provided or forms approved by the Revenue Division of the City of Kansas City, Missouri. If you need

changes or corrections made to the forms sent to you, call the Business License Section at (816) 513-1135 for further information. Please do not

make changes on the preprinted forms.

Mail completed **RD-100** return to Revenue Division, 414 E. 12th Street, 2nd Floor-West, Kansas City, Missouri 64106 or fax to

(816) 513-

1221.

Mail completed **RD-101** return and a separate check to Revenue Division, P.O. Box 840101, Kansas City, MO 64184-0101.

Mail completed **RD-104** return and a separate check to Revenue Division, P.O. Box 803104, Kansas City, MO 64180-3104.

4.

Penalty and Interest provisions:

a.

A late filing penalty of 5% of the amount due shall apply on March 1 of the current year with an additional 5% for each subsequent month

until the Form RD-101 return is filed (maximum file penalty is 25%). For those subsequent months, the additional 5% penalty is charged

on the first of each month. *The late file penalty for Form RD-104 is based on the amount of additional tax due. If the amount of tax

decreased this penalty does not apply.

st

New businesses that have not filed are subject to the late filing penalty provisions on the 61

day of business.

b.

A late payment penalty of 5% of the amount due shall apply on March 1 of the current year for paying after the due date.

c.

The interest rate of 3% per annum is set by RSMo 32.065. Interest is charged on the outstanding tax liability and incurred on a monthly

basis of 0.25% per month effective on March 1 of the current year with an additional 0.25%, per subsequent month, until the tax is paid.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3