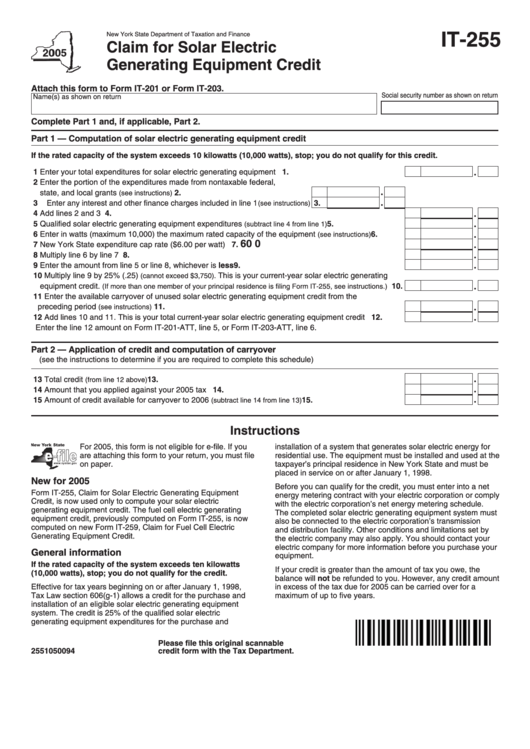

IT-255

New York State Department of Taxation and Finance

Claim for Solar Electric

Generating Equipment Credit

Attach this form to Form IT-201 or Form IT-203.

Social security number as shown on return

Name(s) as shown on return

Complete Part 1 and, if applicable, Part 2.

Part 1 — Computation of solar electric generating equipment credit

If the rated capacity of the system exceeds 10 kilowatts (10,000 watts), stop; you do not qualify for this credit.

1 Enter your total expenditures for solar electric generating equipment .......................................................

1.

2 Enter the portion of the expenditures made from nontaxable federal,

2.

state, and local grants

........................................................

(see instructions)

3 Enter any interest and other finance charges included in line 1

3.

(see instructions)

4 Add lines 2 and 3........................................................................................................................................

4.

5 Qualified solar electric generating equipment expenditures

5.

...............................

(subtract line 4 from line 1)

6 Enter in watts (maximum 10,000) the maximum rated capacity of the equipment

6.

...........

(see instructions)

6 0 0

7 New York State expenditure cap rate ($6.00 per watt) ...............................................................................

7.

8 Multiply line 6 by line 7 ...............................................................................................................................

8.

9 Enter the amount from line 5 or line 8, whichever is less ..........................................................................

9.

10 Multiply line 9 by 25% (.25)

This is your current-year solar electric generating

(cannot exceed $3,750).

equipment credit.

10.

(If more than one member of your principal residence is filing Form IT-255, see instructions.)

11 Enter the available carryover of unused solar electric generating equipment credit from the

........................................................................................................... 11.

preceding period

(see instructions)

12 Add lines 10 and 11. This is your total current-year solar electric generating equipment credit................. 12.

Enter the line 12 amount on Form IT-201-ATT, line 5, or Form IT-203-ATT, line 6.

Part 2 — Application of credit and computation of carryover

(see the instructions to determine if you are required to complete this schedule)

13 Total credit

.................................................................................................................... 13.

(from line 12 above)

14 Amount that you applied against your 2005 tax ........................................................................................ 14.

15 Amount of credit available for carryover to 2006

............................................. 15.

(subtract line 14 from line 13)

Instructions

For 2005, this form is not eligible for e-file. If you

installation of a system that generates solar electric energy for

are attaching this form to your return, you must file

residential use. The equipment must be installed and used at the

on paper.

taxpayer’s principal residence in New York State and must be

placed in service on or after January 1, 1998.

New for 2005

Before you can qualify for the credit, you must enter into a net

Form IT-255, Claim for Solar Electric Generating Equipment

energy metering contract with your electric corporation or comply

Credit, is now used only to compute your solar electric

with the electric corporation’s net energy metering schedule.

generating equipment credit. The fuel cell electric generating

The completed solar electric generating equipment system must

equipment credit, previously computed on Form IT-255, is now

also be connected to the electric corporation’s transmission

computed on new Form IT-259, Claim for Fuel Cell Electric

and distribution facility. Other conditions and limitations set by

Generating Equipment Credit.

the electric company may also apply. You should contact your

electric company for more information before you purchase your

General information

equipment.

If the rated capacity of the system exceeds ten kilowatts

If your credit is greater than the amount of tax you owe, the

(10,000 watts), stop; you do not qualify for the credit.

balance will not be refunded to you. However, any credit amount

Effective for tax years beginning on or after January 1, 1998,

in excess of the tax due for 2005 can be carried over for a

Tax Law section 606(g-1) allows a credit for the purchase and

maximum of up to five years.

installation of an eligible solar electric generating equipment

system. The credit is 25% of the qualified solar electric

generating equipment expenditures for the purchase and

Please file this original scannable

2551050094

credit form with the Tax Department.

1

1