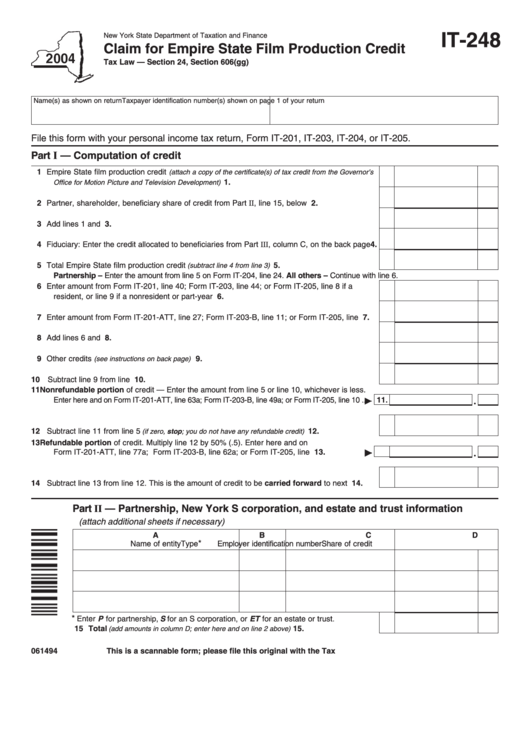

IT-248

New York State Department of Taxation and Finance

Claim for Empire State Film Production Credit

Tax Law — Section 24, Section 606(gg)

Name(s) as shown on return

Taxpayer identification number(s) shown on page 1 of your return

File this form with your personal income tax return, Form IT-201, IT-203, IT-204, or IT-205.

Part I — Computation of credit

1 Empire State film production credit

(attach a copy of the certificate(s) of tax credit from the Governor’s

......................................................................

1.

Office for Motion Picture and Television Development)

2 Partner, shareholder, beneficiary share of credit from Part II, line 15, below ...............................

2.

3 Add lines 1 and 2 ...........................................................................................................................

3.

4 Fiduciary: Enter the credit allocated to beneficiaries from Part III, column C, on the back page

4.

5 Total Empire State film production credit

...............................................

5.

(subtract line 4 from line 3)

Partnership – Enter the amount from line 5 on Form IT-204, line 24. All others – Continue with line 6.

6 Enter amount from Form IT-201, line 40; Form IT-203, line 44; or Form IT-205, line 8 if a

resident, or line 9 if a nonresident or part-year resident ............................................................

6.

7 Enter amount from Form IT-201-ATT, line 27; Form IT-203-B, line 11; or Form IT-205, line 12 .....

7.

8 Add lines 6 and 7 ...........................................................................................................................

8.

9 Other credits

...................................................................................

9.

(see instructions on back page)

10 Subtract line 9 from line 8 ............................................................................................................. 10.

11 Nonrefundable portion of credit — Enter the amount from line 5 or line 10, whichever is less.

Enter here and on Form IT-201-ATT, line 63a; Form IT-203-B, line 49a; or Form IT-205, line 10 ...

11.

12 Subtract line 11 from line 5

............................... 12.

(if zero, stop; you do not have any refundable credit)

13 Refundable portion of credit. Multiply line 12 by 50% (.5). Enter here and on

Form IT-201-ATT, line 77a; Form IT-203-B, line 62a; or Form IT-205, line 33 ......................

13.

14 Subtract line 13 from line 12. This is the amount of credit to be carried forward to next year ..... 14.

Part II — Partnership, New York S corporation, and estate and trust information

(attach additional sheets if necessary)

A

B

C

D

*

Name of entity

Type

Employer identification number

Share of credit

*

Enter P for partnership, S for an S corporation, or ET for an estate or trust.

15 Total

...................................... 15.

(add amounts in column D; enter here and on line 2 above)

061494

This is a scannable form; please file this original with the Tax Department.

IT-248 2004

1

1 2

2