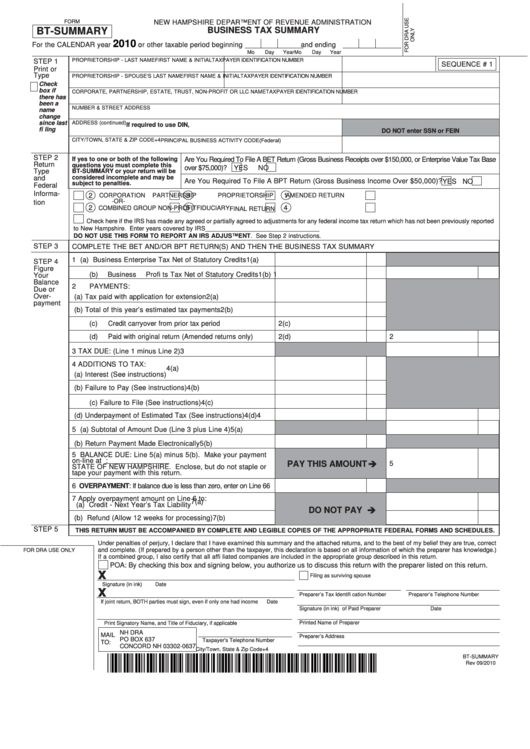

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

BT-SUMMARY

BUSINESS TAX SUMMARY

2010

For the CALENDAR year

or other taxable period beginning

and ending

Mo

Day

Year

Mo

Day

Year

PROPRIETORSHIP - LAST NAME

FIRST NAME & INITIAL

TAXPAYER IDENTIFICATION NUMBER

STEP 1

SEQUENCE # 1

Print or

Type

PROPRIETORSHIP - SPOUSE'S LAST NAME

FIRST NAME & INITIAL

TAXPAYER IDENTIFICATION NUMBER

Check

box if

CORPORATE, PARTNERSHIP, ESTATE, TRUST, NON-PROFIT OR LLC NAME

TAXPAYER IDENTIFICATION NUMBER

there has

been a

NUMBER & STREET ADDRESS

name

change

since last

ADDRESS (continued)

If required to use DIN,

fi ling

DO NOT enter SSN or FEIN

CITY/TOWN, STATE & ZIP CODE+4

PRINCIPAL BUSINESS ACTIVITY CODE (Federal)

STEP 2

If yes to one or both of the following

Are You Required To File A BET Return (Gross Business Receipts over $150,000, or Enterprise Value Tax Base

Return

questions you must complete this

over $75,000)?

YES

NO

Type

BT-SUMMARY or your return will be

considered incomplete and may be

and

Are You Required To File A BPT Return (Gross Business Income Over $50,000)?

YES

NO

subject to penalties.

Federal

Informa-

2

3

1

CORPORATION

PARTNERSHIP

PROPRIETORSHIP

AMENDED RETURN

-OR-

tion

2

5

4

COMBINED GROUP

NON-PROFIT

FIDUCIARY

FINAL RETURN

Check here if the IRS has made any agreed or partially agreed to adjustments for any federal income tax return which has not been previously reported

to New Hampshire. Enter years covered by IRS_________________________________

DO NOT USE THIS FORM TO REPORT AN IRS ADJUSTMENT. See Step 2 instructions.

STEP 3

COMPLETE THE BET AND/OR BPT RETURN(S) AND THEN THE BUSINESS TAX SUMMARY

1

(a)

Business Enterprise Tax Net of Statutory Credits

1(a)

STEP 4

Figure

(b)

Business Profi ts Tax Net of Statutory Credits

1(b)

1

Your

Balance

2

PAYMENTS:

Due or

Over-

(a)

Tax paid with application for extension

2(a)

payment

(b)

Total of this year’s estimated tax payments

2(b)

(c)

Credit carryover from prior tax period

2(c)

(d)

Paid with original return (Amended returns only)

2(d)

2

3

TAX DUE: (Line 1 minus Line 2)

3

4

ADDITIONS TO TAX:

4(a)

(a)

Interest (See instructions)

(b)

Failure to Pay (See instructions)

4(b)

(c)

Failure to File (See instructions)

4(c)

(d)

Underpayment of Estimated Tax (See instructions)

4(d)

4

5

(a)

Subtotal of Amount Due (Line 3 plus Line 4)

5(a)

(b)

Return Payment Made Electronically

5(b)

5 BALANCE DUE: Line 5(a) minus 5(b). Make your payment

on-line at or make check payable to:

PAY THIS AMOUNT

5

STATE OF NEW HAMPSHIRE. Enclose, but do not staple or

tape your payment with this return.

6 OVERPAYMENT: If balance due is less than zero, enter on Line 6

6

7

Apply overpayment amount on Line 6 to:

7(a)

(a) Credit - Next Year’s Tax Liability

DO NOT PAY

(b) Refund (Allow 12 weeks for processing)

7(b)

STEP 5

THIS RETURN MUST BE ACCOMPANIED BY COMPLETE AND LEGIBLE COPIES OF THE APPROPRIATE FEDERAL FORMS AND SCHEDULES.

Under penalties of perjury, I declare that I have examined this summary and the attached returns, and to the best of my belief they are true, correct

FOR DRA USE ONLY

and complete. (If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has knowledge.)

If a combined group, I also certify that all affi liated companies are included in the appropriate group described in this return.

POA: By checking this box and signing below, you authorize us to discuss this return with the preparer listed on this return.

x

Filing as surviving spouse

Signature (in ink)

Date

x

Preparer’s Tax Identifi cation Number

Preparer’s Telephone Number

If joint return, BOTH parties must sign, even if only one had income

Date

Signature (in ink) of Paid Preparer

Date

Printed Name of Preparer

Print Signatory Name, and Title of Fiduciary, if applicable

NH DRA

MAIL

Preparer’s Address

PO BOX 637

Taxpayer's Telephone Number

TO:

CONCORD NH 03302-0637

City/Town, State & Zip Code+4

BT-SUMMARY

Rev 09/2010

1

1