Form Cert-142 - Items Used Directly In The Renewable Energy And Clean Energy Technology Industries - Connecticut Department Of Revenue Services

ADVERTISEMENT

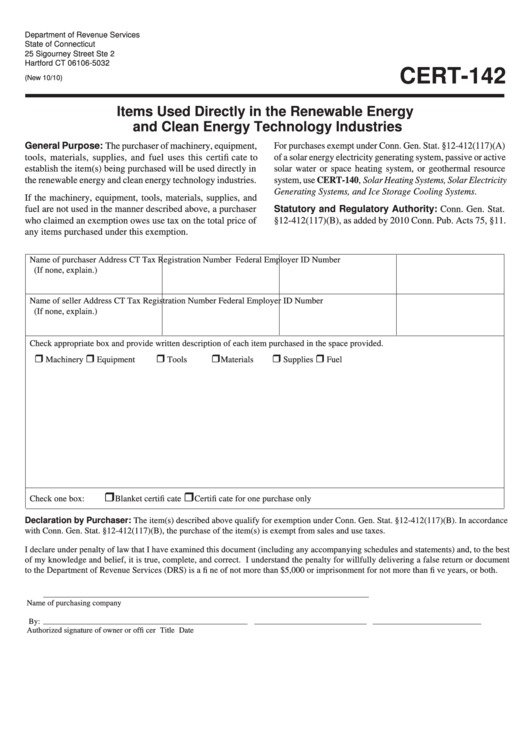

Department of Revenue Services

State of Connecticut

25 Sigourney Street Ste 2

Hartford CT 06106-5032

CERT-142

(New 10/10)

Items Used Directly in the Renewable Energy

and Clean Energy Technology Industries

General Purpose:

For purchases exempt under Conn. Gen. Stat. §12-412(117)(A)

The purchaser of machinery, equipment,

tools, materials, supplies, and fuel uses this certifi cate to

of a solar energy electricity generating system, passive or active

establish the item(s) being purchased will be used directly in

solar water or space heating system, or geothermal resource

the renewable energy and clean energy technology industries.

system, use CERT-140, Solar Heating Systems, Solar Electricity

Generating Systems, and Ice Storage Cooling Systems.

If the machinery, equipment, tools, materials, supplies, and

Statutory and Regulatory Authority: Conn. Gen. Stat.

fuel are not used in the manner described above, a purchaser

who claimed an exemption owes use tax on the total price of

§12-412(117)(B), as added by 2010 Conn. Pub. Acts 75, §11.

any items purchased under this exemption.

Name of purchaser

Address

CT Tax Registration Number

Federal Employer ID Number

(If none, explain.)

Name of seller

Address

CT Tax Registration Number

Federal Employer ID Number

(If none, explain.)

Check appropriate box and provide written description of each item purchased in the space provided.

Machinery

Equipment

Tools

Materials

Supplies

Fuel

Check one box:

Blanket certifi cate

Certifi cate for one purchase only

Declaration by Purchaser: The item(s) described above qualify for exemption under Conn. Gen. Stat. §12-412(117)(B). In accordance

with Conn. Gen. Stat. §12-412(117)(B), the purchase of the item(s) is exempt from sales and use taxes.

I declare under penalty of law that I have examined this document (including any accompanying schedules and statements) and, to the best

of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document

to the Department of Revenue Services (DRS) is a fi ne of not more than $5,000 or imprisonment for not more than fi ve years, or both.

Name of purchasing company

By:

Authorized signature of owner or offi cer

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2