Employer'S Quarterly Returns Of Tax Withheld Forms

ADVERTISEMENT

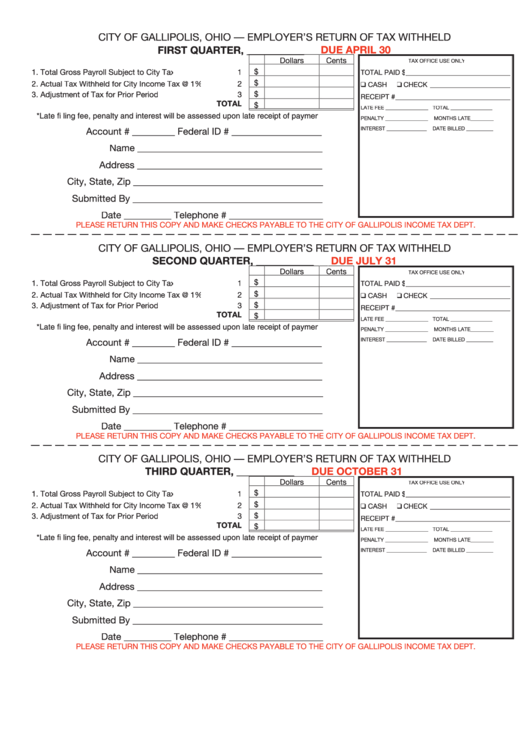

CITY OF GALLIPOLIS, OHIO –– EMPLOYER’S RETURN OF TAX WITHHELD

FIRST QUARTER, ___________

FIRST QUARTER, ___________

FIRST QUARTER, ___________

FIRST QUARTER, ___________

DUE APRIL 30

Dollars

Cents

TAX OFFICE USE ONLY

$

1. Total Gross Payroll Subject to City Tax .............................1

TOTAL PAID $ ______________________________

$

2. Actual Tax Withheld for City Income Tax @ 1% ................2

❑ CASH

❑ CHECK _______________________

3. Adjustment of Tax for Prior Period ....................................3

$

RECEIPT #_________________________________

TOTAL

$ $

LATE FEE ________________ TOTAL _________________

*Late filing fee, penalty and interest will be assessed upon late receipt of payment.

PENALTY ________________

MONTHS LATE__________

INTEREST _______________

DATE BILLED ___________

Account # _________ Federal ID # ___________________

Name _______________________________________

Address _______________________________________

City, State, Zip ________________________________________

Submitted By ________________________________________

Date __________ Telephone # ____________________

PLEASE RETURN THIS COPY AND MAKE CHECKS PAYABLE TO THE CITY OF GALLIPOLIS INCOME TAX DEPT.

CITY OF GALLIPOLIS, OHIO –– EMPLOYER’S RETURN OF TAX WITHHELD

SECOND QUARTER, ___________

SECOND QUARTER, ___________

SECOND QUARTER, ___________

SECOND QUARTER, ___________

SECOND QUARTER, ___________

SECOND QUARTER, ___________

DUE JULY 31

Dollars

Cents

TAX OFFICE USE ONLY

$

1. Total Gross Payroll Subject to City Tax .............................1

TOTAL PAID $ ______________________________

$

2. Actual Tax Withheld for City Income Tax @ 1% ................2

❑ CASH

❑ CHECK _______________________

$

3. Adjustment of Tax for Prior Period ....................................3

RECEIPT #_________________________________

TOTAL

$ $

LATE FEE ________________ TOTAL _________________

*Late filing fee, penalty and interest will be assessed upon late receipt of payment.

PENALTY ________________

MONTHS LATE__________

Account # _________ Federal ID # ___________________

INTEREST _______________

DATE BILLED ___________

Name _______________________________________

Address _______________________________________

City, State, Zip ________________________________________

Submitted By ________________________________________

Date __________ Telephone # ____________________

PLEASE RETURN THIS COPY AND MAKE CHECKS PAYABLE TO THE CITY OF GALLIPOLIS INCOME TAX DEPT.

CITY OF GALLIPOLIS, OHIO –– EMPLOYER’S RETURN OF TAX WITHHELD

THIRD QUARTER, ___________

THIRD QUARTER, ___________

THIRD QUARTER, ___________

THIRD QUARTER, ___________

DUE OCTOBER 31

Dollars

Cents

TAX OFFICE USE ONLY

$

1. Total Gross Payroll Subject to City Tax .............................1

TOTAL PAID $ ______________________________

$

2. Actual Tax Withheld for City Income Tax @ 1% ................2

❑ CASH

❑ CHECK _______________________

$

3. Adjustment of Tax for Prior Period ....................................3

RECEIPT #_________________________________

TOTAL

$ $

LATE FEE ________________ TOTAL _________________

*Late filing fee, penalty and interest will be assessed upon late receipt of payment.

PENALTY ________________

MONTHS LATE__________

Account # _________ Federal ID # ___________________

INTEREST _______________

DATE BILLED ___________

Name _______________________________________

Address _______________________________________

City, State, Zip ________________________________________

Submitted By ________________________________________

Date __________ Telephone # ____________________

PLEASE RETURN THIS COPY AND MAKE CHECKS PAYABLE TO THE CITY OF GALLIPOLIS INCOME TAX DEPT.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2