City Of Phoenix Privilege (Sales) Tax Return Form - 2002

ADVERTISEMENT

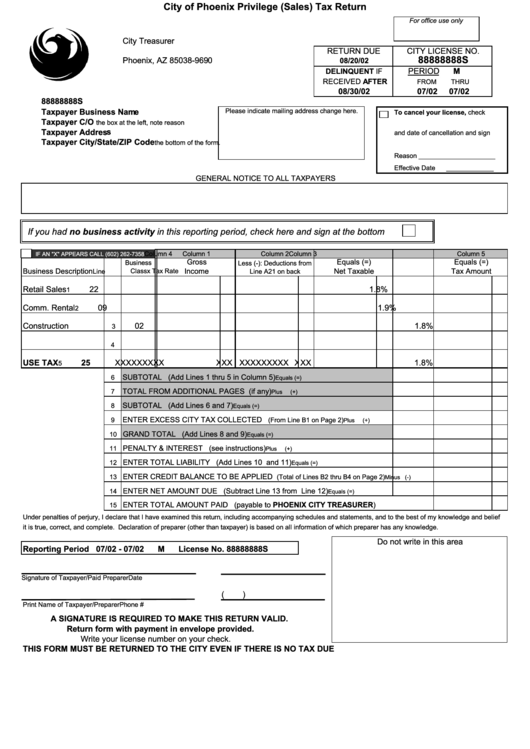

City of Phoenix Privilege (Sales) Tax Return

For office use only

City Treasurer

P.O. Box 29690

RETURN DUE

CITY LICENSE NO.

88888888S

Phoenix, AZ 85038-9690

08/20/02

PERIOD

M

DELINQUENT IF

RECEIVED AFTER

FROM

THRU

08/30/02

07/02

07/02

88888888S

Please indicate mailing address change here.

Taxpayer Business Name

To cancel your license, check

Taxpayer C/O

the box at the left, note reason

Taxpayer Address

and date of cancellation and sign

Taxpayer City/State/ZIP Code

the bottom of the form.

Reason _____________________

Effective Date

_____________

GENERAL NOTICE TO ALL TAXPAYERS

If you had no business activity in this reporting period, check here and sign at the bottom

Column 1

Column 2

Column 3

Column 4

Column 5

IF AN "X" APPEARS CALL (602) 262-7358

Gross

Equals (=)

Equals (=)

Business

Less (-): Deductions from

Business Description

Income

Net Taxable

Tax Amount

Line

Class

Line A21 on back

x Tax Rate

Retail Sales

22

1.8%

1

Comm. Rental

09

1.9%

2

Construction

02

1.8%

3

4

USE TAX

25

XXXXXXXXXXXX

XXXXXXXXXXXX

1.8%

5

SUBTOTAL (Add Lines 1 thru 5 in Column 5)

6

Equals (=)

TOTAL FROM ADDITIONAL PAGES (if any)

7

Plus

(+)

SUBTOTAL (Add Lines 6 and 7)

8

Equals (=)

ENTER EXCESS CITY TAX COLLECTED

9

(From Line B1 on Page 2)

Plus

(+)

GRAND TOTAL (Add Lines 8 and 9)

10

Equals (=)

PENALTY & INTEREST (see instructions)

11

Plus

(+)

ENTER TOTAL LIABILITY (Add Lines 10 and 11)

12

Equals (=)

ENTER CREDIT BALANCE TO BE APPLIED

13

(Total of Lines B2 thru B4 on Page 2)

Minus (-)

ENTER NET AMOUNT DUE (Subtract Line 13 from Line 12)

14

Equals (=)

ENTER TOTAL AMOUNT PAID (payable to PHOENIX CITY TREASURER)

15

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief

it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Do not write in this area

Reporting Period 07/02 - 07/02

M

License No. 88888888S

Signature of Taxpayer/Paid Preparer

Date

(

)

Print Name of Taxpayer/Preparer

Phone #

A SIGNATURE IS REQUIRED TO MAKE THIS RETURN VALID.

Return form with payment in envelope provided.

Write your license number on your check.

THIS FORM MUST BE RETURNED TO THE CITY EVEN IF THERE IS NO TAX DUE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2