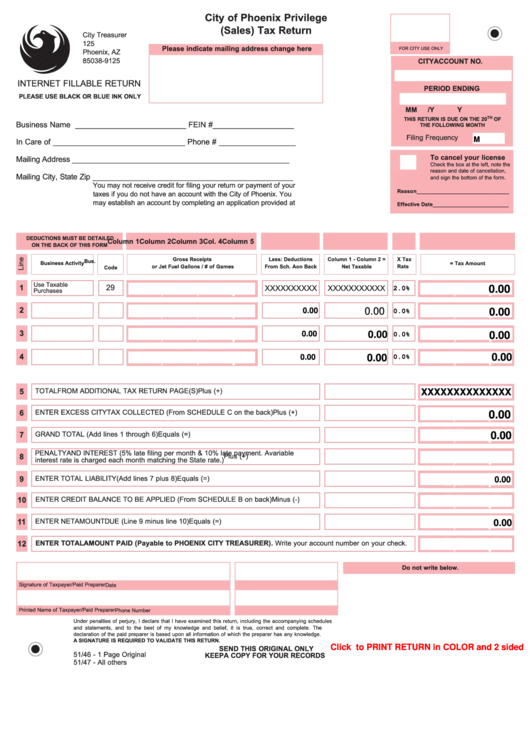

City of Phoenix Privilege

(Sales) Tax Return

City Treasurer

P.O. Box 29125

Please indicate mailing address change here

Phoenix, AZ

FOR CITY USE ONLY

85038-9125

CITY ACCOUNT NO.

INTERNET FILLABLE RETURN

PERIOD ENDING

PLEASE USE BLACK OR BLUE INK ONLY

M

M

/

Y

Y

THIS RETURN IS DUE ON THE 20

OF

Business Name __________________________ FEIN # ___________________

TH

THE FOLLOWING MONTH

Filing Frequency

In Care of _______________________________ Phone # __________________

M

To cancel your license

Mailing Address ____________________________________________________

Check the box at the left, note the

reason and date of cancellation,

Mailing City, State Zip ________________________________________________

and sign the bottom of the form.

You may not receive credit for filing your return or payment of your

taxes if you do not have an account with the City of Phoenix. You

Reason______________________________

may establish an account by completing an application provided at

Effective Date_________________________

DEDUCTIONS MUST BE DETAILED

Column 1

Column 2

Column 3

Col. 4

Column 5

ON THE BACK OF THIS FORM

Gross Receipts

Less: Deductions

Column 1 - Column 2 =

X Tax

Bus.

Business Activity

= Tax Amount

or Jet Fuel Gallons / # of Games

From Sch. A on Back

Net Taxable

Rate

Code

1

Use Taxable

29

XXXXXXXXXX

XXXXXXXXXXX

Purchases

,

,

.

,

.

0.00

2.0%

2

,

,

.

,

.

0.00

0.00

0.00

0.0%

3

,

,

.

,

.

0.00

0.00

0.00

0.0%

4

,

,

,

.

.

0.00

0.00

0.00

0.0%

5

TOTAL FROM ADDITIONAL TAX RETURN PAGE(S)

Plus (+)

,

.

XXXXXXXXXXXXXX

6

ENTER EXCESS CITY TAX COLLECTED (From SCHEDULE C on the back)

Plus (+)

,

.

0.00

7

GRAND TOTAL (Add lines 1 through 6)

Equals (=)

,

.

0.00

PENALTY AND INTEREST (5% late filing per month & 10% late payment. A variable

8

Plus (+)

interest rate is charged each month matching the State rate.)

,

.

9

ENTER TOTAL LIABILITY (Add lines 7 plus 8)

Equals (=)

,

.

0.00

10

ENTER CREDIT BALANCE TO BE APPLIED (From SCHEDULE B on back)

Minus (-)

,

.

11

ENTER NET AMOUNT DUE (Line 9 minus line 10)

Equals (=)

,

.

0.00

12

ENTER TOTAL AMOUNT PAID (Payable to PHOENIX CITY TREASURER). Write your account number on your check.

,

.

Do not write below.

Signature of Taxpayer/Paid Preparer

Date

Printed Name of Taxpayer/Paid Preparer

Phone Number

Under penalties of perjury, I declare that I have examined this return, including the accompanying schedules

and statements, and to the best of my knowledge and belief, it is true, correct and complete. The

declaration of the paid preparer is based upon all information of which the preparer has any knowledge.

A SIGNATURE IS REQUIRED TO VALIDATE THIS RETURN.

SEND THIS ORIGINAL ONLY

51/46 - 1 Page Original

Click to PRINT RETURN in COLOR and 2 sided

KEEP A COPY FOR YOUR RECORDS

51/47 - All others

1

1 2

2