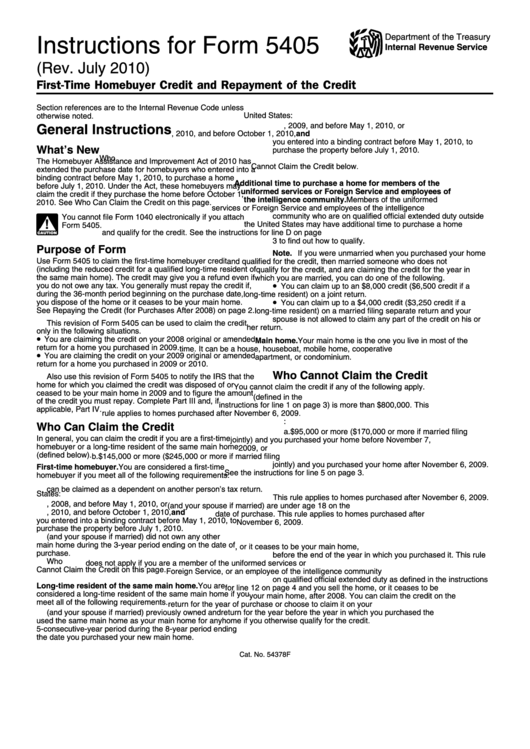

Instructions For Form 5405 (Rev. July 2010)

ADVERTISEMENT

Instructions for Form 5405

Department of the Treasury

Internal Revenue Service

(Rev. July 2010)

First-Time Homebuyer Credit and Repayment of the Credit

Section references are to the Internal Revenue Code unless

2. You purchased your new main home located in the

United States:

otherwise noted.

General Instructions

a. After November 6, 2009, and before May 1, 2010, or

b. After April 30, 2010, and before October 1, 2010, and

you entered into a binding contract before May 1, 2010, to

What’s New

purchase the property before July 1, 2010.

3. You do not meet any of the conditions listed under Who

The Homebuyer Assistance and Improvement Act of 2010 has

Cannot Claim the Credit below.

extended the purchase date for homebuyers who entered into a

binding contract before May 1, 2010, to purchase a home

Additional time to purchase a home for members of the

before July 1, 2010. Under the Act, these homebuyers may

uniformed services or Foreign Service and employees of

claim the credit if they purchase the home before October 1,

the intelligence community. Members of the uniformed

2010. See Who Can Claim the Credit on this page.

services or Foreign Service and employees of the intelligence

community who are on qualified official extended duty outside

You cannot file Form 1040 electronically if you attach

!

the United States may have additional time to purchase a home

Form 5405.

and qualify for the credit. See the instructions for line D on page

CAUTION

3 to find out how to qualify.

Purpose of Form

Note. If you were unmarried when you purchased your home

Use Form 5405 to claim the first-time homebuyer credit

and qualified for the credit, then married someone who does not

(including the reduced credit for a qualified long-time resident of

qualify for the credit, and are claiming the credit for the year in

the same main home). The credit may give you a refund even if

which you are married, you can do one of the following.

•

you do not owe any tax. You generally must repay the credit if,

You can claim up to an $8,000 credit ($6,500 credit if a

during the 36-month period beginning on the purchase date,

long-time resident) on a joint return.

•

you dispose of the home or it ceases to be your main home.

You can claim up to a $4,000 credit ($3,250 credit if a

See Repaying the Credit (for Purchases After 2008) on page 2.

long-time resident) on a married filing separate return and your

spouse is not allowed to claim any part of the credit on his or

This revision of Form 5405 can be used to claim the credit

her return.

only in the following situations.

•

You are claiming the credit on your 2008 original or amended

Main home. Your main home is the one you live in most of the

return for a home you purchased in 2009.

time. It can be a house, houseboat, mobile home, cooperative

•

You are claiming the credit on your 2009 original or amended

apartment, or condominium.

return for a home you purchased in 2009 or 2010.

Who Cannot Claim the Credit

Also use this revision of Form 5405 to notify the IRS that the

home for which you claimed the credit was disposed of or

You cannot claim the credit if any of the following apply.

ceased to be your main home in 2009 and to figure the amount

1. The purchase price of the home (defined in the

of the credit you must repay. Complete Part III and, if

instructions for line 1 on page 3) is more than $800,000. This

applicable, Part IV.

rule applies to homes purchased after November 6, 2009.

2. Your modified adjusted gross income is:

Who Can Claim the Credit

a. $95,000 or more ($170,000 or more if married filing

In general, you can claim the credit if you are a first-time

jointly) and you purchased your home before November 7,

homebuyer or a long-time resident of the same main home

2009, or

(defined below).

b. $145,000 or more ($245,000 or more if married filing

jointly) and you purchased your home after November 6, 2009.

First-time homebuyer. You are considered a first-time

See the instructions for line 5 on page 3.

homebuyer if you meet all of the following requirements.

3. You cannot claim the credit for any year for which you

1. You purchased your main home located in the United

can be claimed as a dependent on another person’s tax return.

States:

This rule applies to homes purchased after November 6, 2009.

a. After December 31, 2008, and before May 1, 2010, or

4. You (and your spouse if married) are under age 18 on the

b. After April 30, 2010, and before October 1, 2010, and

date of purchase. This rule applies to homes purchased after

you entered into a binding contract before May 1, 2010, to

November 6, 2009.

purchase the property before July 1, 2010.

5. You are a nonresident alien.

2. You (and your spouse if married) did not own any other

6. Your home is located outside the United States.

main home during the 3-year period ending on the date of

7. You sell the home, or it ceases to be your main home,

purchase.

before the end of the year in which you purchased it. This rule

3. You do not meet any of the conditions listed under Who

does not apply if you are a member of the uniformed services or

Cannot Claim the Credit on this page.

Foreign Service, or an employee of the intelligence community

on qualified official extended duty as defined in the instructions

Long-time resident of the same main home. You are

for line 12 on page 4 and you sell the home, or it ceases to be

considered a long-time resident of the same main home if you

your main home, after 2008. You can claim the credit on the

meet all of the following requirements.

return for the year of purchase or choose to claim it on your

1. You (and your spouse if married) previously owned and

return for the year before the year in which you purchased the

used the same main home as your main home for any

home if you otherwise qualify for the credit.

5-consecutive-year period during the 8-year period ending on

8. You acquired the home by gift or inheritance.

the date you purchased your new main home.

Cat. No. 54378F

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4