Instructions For Form 8606 - Nondeductible Iras - 2010

ADVERTISEMENT

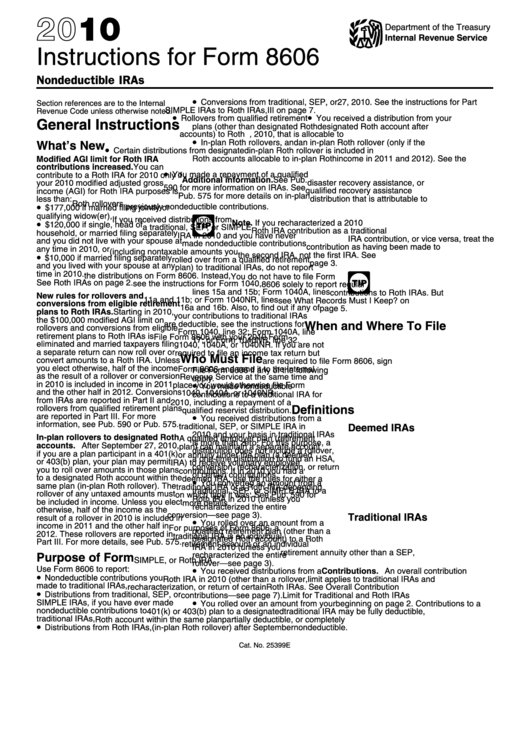

2010

Department of the Treasury

Internal Revenue Service

Instructions for Form 8606

Nondeductible IRAs

•

Conversions from traditional, SEP, or

27, 2010. See the instructions for Part

Section references are to the Internal

SIMPLE IRAs to Roth IRAs,

III on page 7.

Revenue Code unless otherwise noted.

•

•

Rollovers from qualified retirement

You received a distribution from your

General Instructions

plans (other than designated Roth

designated Roth account after

accounts) to Roth IRAs.

September 27, 2010, that is allocable to

•

In-plan Roth rollovers, and

an in-plan Roth rollover (only if the

What’s New

•

Certain distributions from designated

in-plan Roth rollover is included in

Modified AGI limit for Roth IRA

Roth accounts allocable to in-plan Roth

income in 2011 and 2012). See the

rollovers.

instructions for Part IV on page 7.

contributions increased. You can

•

contribute to a Roth IRA for 2010 only if

You made a repayment of a qualified

Additional information. See Pub.

disaster recovery assistance, or

your 2010 modified adjusted gross

590 for more information on IRAs. See

qualified recovery assistance

income (AGI) for Roth IRA purposes is

Pub. 575 for more details on in-plan

distribution that is attributable to

less than:

Roth rollovers.

•

previously nondeductible contributions.

$177,000 if married filing jointly or

qualifying widow(er),

If you received distributions from

•

Note. If you recharacterized a 2010

$120,000 if single, head of

TIP

a traditional, SEP, or SIMPLE

Roth IRA contribution as a traditional

household, or married filing separately

IRA in 2010 and you have never

IRA contribution, or vice versa, treat the

and you did not live with your spouse at

made nondeductible contributions

contribution as having been made to

any time in 2010, or

(including nontaxable amounts you

the second IRA, not the first IRA. See

•

$10,000 if married filing separately

rolled over from a qualified retirement

page 3.

and you lived with your spouse at any

plan) to traditional IRAs, do not report

time in 2010.

the distributions on Form 8606. Instead,

You do not have to file Form

See Roth IRAs on page 2.

see the instructions for Form 1040,

TIP

8606 solely to report regular

lines 15a and 15b; Form 1040A, lines

contributions to Roth IRAs. But

New rules for rollovers and

11a and 11b; or Form 1040NR, lines

see What Records Must I Keep? on

conversions from eligible retirement

16a and 16b. Also, to find out if any of

page 5.

plans to Roth IRAs. Starting in 2010,

your contributions to traditional IRAs

the $100,000 modified AGI limit on

When and Where To File

are deductible, see the instructions for

rollovers and conversions from eligible

Form 1040, line 32; Form 1040A, line

retirement plans to Roth IRAs is

File Form 8606 with your 2010 Form

17; or Form 1040NR, line 32.

eliminated and married taxpayers filing

1040, 1040A, or 1040NR. If you are not

a separate return can now roll over or

required to file an income tax return but

Who Must File

convert amounts to a Roth IRA. Unless

are required to file Form 8606, sign

you elect otherwise, half of the income

Form 8606 and send it to the Internal

File Form 8606 if any of the following

as the result of a rollover or conversion

Revenue Service at the same time and

apply.

in 2010 is included in income in 2011

•

place you would otherwise file Form

You made nondeductible

and the other half in 2012. Conversions

1040, 1040A, or 1040NR.

contributions to a traditional IRA for

from IRAs are reported in Part II and

2010, including a repayment of a

Definitions

rollovers from qualified retirement plans

qualified reservist distribution.

are reported in Part III. For more

•

You received distributions from a

information, see Pub. 590 or Pub. 575.

Deemed IRAs

traditional, SEP, or SIMPLE IRA in

2010 and your basis in traditional IRAs

In-plan rollovers to designated Roth

A qualified employer plan (retirement

is more than zero. For this purpose, a

accounts. After September 27, 2010,

plan) can maintain a separate account

distribution does not include a rollover,

if you are a plan participant in a 401(k)

or annuity under the plan (a deemed

a one-time distribution to fund an HSA,

or 403(b) plan, your plan may permit

IRA) to receive voluntary employee

conversion, recharacterization, or return

you to roll over amounts in those plans

contributions. If in 2010 you had a

of certain contributions.

to a designated Roth account within the

deemed IRA, use the rules for either a

•

You converted an amount from a

same plan (in-plan Roth rollover). The

traditional IRA or a Roth IRA depending

traditional, SEP, or SIMPLE IRA to a

rollover of any untaxed amounts must

on which type it was. See Pub. 590 for

Roth IRA in 2010 (unless you

be included in income. Unless you elect

more details.

recharacterized the entire

otherwise, half of the income as the

conversion — see page 3).

Traditional IRAs

result of a rollover in 2010 is included in

•

You rolled over an amount from a

income in 2011 and the other half in

For purposes of Form 8606, a

qualified retirement plan (other than a

2012. These rollovers are reported in

traditional IRA is an individual

designated Roth account) to a Roth

Part III. For more details, see Pub. 575.

retirement account or an individual

IRA in 2010 (unless you

retirement annuity other than a SEP,

Purpose of Form

recharacterized the entire

SIMPLE, or Roth IRA.

rollover — see page 3).

Use Form 8606 to report:

•

You received distributions from a

Contributions. An overall contribution

•

Nondeductible contributions you

Roth IRA in 2010 (other than a rollover,

limit applies to traditional IRAs and

made to traditional IRAs,

recharacterization, or return of certain

Roth IRAs. See Overall Contribution

•

Distributions from traditional, SEP, or

contributions — see page 7).

Limit for Traditional and Roth IRAs

•

SIMPLE IRAs, if you have ever made

You rolled over an amount from your

beginning on page 2. Contributions to a

nondeductible contributions to

401(k) or 403(b) plan to a designated

traditional IRA may be fully deductible,

traditional IRAs,

Roth account within the same plan

partially deductible, or completely

•

Distributions from Roth IRAs,

(in-plan Roth rollover) after September

nondeductible.

Cat. No. 25399E

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10