Form Wtd - Employer Monthly Withholding - City Of Pittsburgh - 2005

ADVERTISEMENT

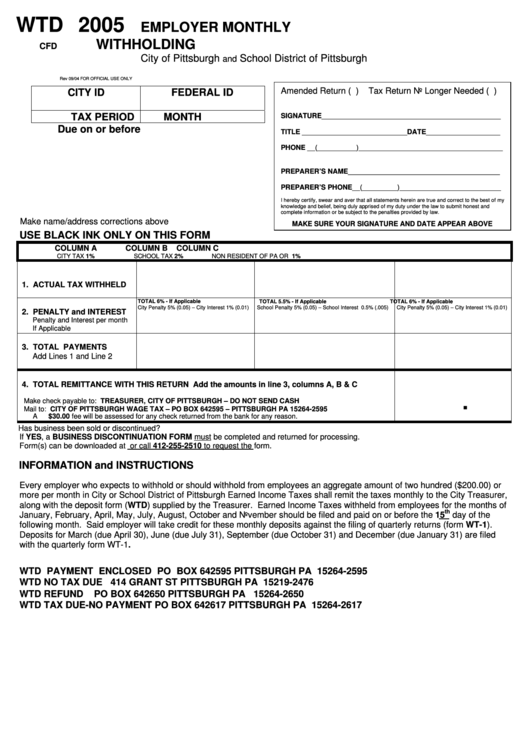

WTD 2005

EMPLOYER MONTHLY

WITHHOLDING

CFD

City of Pittsburgh

School District of Pittsburgh

and

Rev 09/04

FOR OFFICIAL USE ONLY

Amended Return ( )

Tax Return No Longer Needed ( )

CITY ID

FEDERAL ID

TAX PERIOD

MONTH

SIGNATURE______________________________________________

Due on or before

TITLE ___________________________DATE___________________

PHONE __(__________)_____________________________________

PREPARER’S NAME_______________________________________

PREPARER’S PHONE__(_________)__________________________

I hereby certify, swear and aver that all statements herein are true and correct to the best of my

knowledge and belief, being duly apprised of my duty under the law to submit honest and

complete information or be subject to the penalties provided by law.

Make name/address corrections above

MAKE SURE YOUR SIGNATURE AND DATE APPEAR ABOVE

USE BLACK INK ONLY ON THIS FORM

COLUMN A

COLUMN B

COLUMN C

CITY TAX 1%

SCHOOL TAX 2%

NON RESIDENT OF PA OR U.S. 1%

1. ACTUAL TAX WITHHELD

TOTAL 6% - If Applicable

TOTAL 5.5% - If Applicable

TOTAL 6% - If Applicable

City Penalty 5% (0.05) – City Interest 1% (0.01)

School Penalty 5% (0.05) – School Interest 0.5% (.005)

City Penalty 5% (0.05) – City Interest 1% (0.01)

2. PENALTY and INTEREST

Penalty and Interest per month

If Applicable

3. TOTAL PAYMENTS

Add Lines 1 and Line 2

4. TOTAL REMITTANCE WITH THIS RETURN Add the amounts in line 3, columns A, B & C

.

Make check payable to: TREASURER, CITY OF PITTSBURGH – DO NOT SEND CASH

Mail to: CITY OF PITTSBURGH WAGE TAX – PO BOX 642595 – PITTSBURGH PA 15264-2595

A $30.00 fee will be assessed for any check returned from the bank for any reason.

Has business been sold or discontinued?

If YES, a BUSINESS DISCONTINUATION FORM must be completed and returned for processing.

Form(s) can be downloaded at or call 412-255-2510 to request the form.

INFORMATION and INSTRUCTIONS

Every employer who expects to withhold or should withhold from employees an aggregate amount of two hundred ($200.00) or

more per month in City or School District of Pittsburgh Earned Income Taxes shall remit the taxes monthly to the City Treasurer,

along with the deposit form (WTD) supplied by the Treasurer. Earned Income Taxes withheld from employees for the months of

th

January, February, April, May, July, August, October and November should be filed and paid on or before the 15

day of the

following month. Said employer will take credit for these monthly deposits against the filing of quarterly returns (form WT-1).

Deposits for March (due April 30), June (due July 31), September (due October 31) and December (due January 31) are filed

with the quarterly form WT-1.

WTD PAYMENT ENCLOSED

PO BOX 642595

PITTSBURGH PA

15264-2595

WTD NO TAX DUE

414 GRANT ST

PITTSBURGH PA

15219-2476

WTD REFUND

PO BOX 642650

PITTSBURGH PA

15264-2650

WTD TAX DUE-NO PAYMENT

PO BOX 642617

PITTSBURGH PA

15264-2617

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1