Instructions For Making Quarterly Partnership Estimated Income Tax Payments - City Of Grand Rapids Income Tax Department - 2013 Page 2

ADVERTISEMENT

The annual return for the previous year may be used as the basis for computing your estimated tax for the current year.

The same figures used for estimating your federal income tax, adjusted to exclude any income not taxable or deductions

not allowed under the Grand Rapids Income Tax Ordinance, may be used.

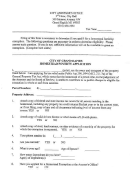

CALCULATION OF THE ESTIMATED TAX PAYMENT DUE EACH QUARTER

If you know the amount of quarterly estimated tax to pay, write the amount of estimated tax in the amount box of the

payment vouched for the quarter (lower right hand corner of Form GR-1065ES, Payment Voucher 1, 2 3, or 4).

If you are unsure of the amount of quarterly estimated tax to pay, follow the lines on the Estimated Income Tax

Computation Worksheet above to calculate the quarterly estimated tax payment.

AMENDED ESTIMATED INCOME TAX PAYMENTS

If, after one or more estimated tax payments have been made, the partnership finds that their estimated tax is

substantially increased or decreased as a result of a change in taxable income, the partnership may amend its estimate at

the time of making any quarterly payment. To do this: 1) recalculate the estimated tax for the year; 2) subtract the

estimated payments previously made for the year; 3) divide the difference remaining due after step 2 by the number of

remaining quarterly estimated payments for the year; and 4) enter the recalculated estimated payment amount on the

next payment voucher and mail the payment voucher and payment to the Income Tax Department.

LATE PAYMENT OR UNDERPAYMENT OF ESTIMATED INCOME TAX

If the partnership fails to make the required quarterly estimated tax payments, pays late or underpays, interest and

penalty may be assessed. The interest rate is one percent above the prime rate. The interest rate is adjusted on January

1 and July 1 each year. The penalty rate is one percent per month to a maximum of 25 percent.

INTEREST AND PENALTY SAFE HAVEN

If the total amount of estimated tax payments is seventy percent (70%), or more, of the tax due for the current or previous

tax year, interest and penalty will not be assessed. The quarterly safe haven payment amount is 70 percent of the annual

tax amount divided by four. Making estimated income tax payments does not excuse a partnership from filing an annual

partnership income tax return.

OTHER TAX PAYMENTS

Income Tax Paid by Partnership: If the partnership is a member of another partnership which elects to file a return and

pay the tax on behalf of its partners, the partnership may subtract from its estimate of Grand Rapids income tax, the

amount of tax expected to be paid by the other partnership for this partnership’s distributive share of net profits.

FORMS OR INFORMATION

Forms or information may be obtained: online at via-e-mail to gr1065tax@grcity.us; by a phone

call to (616) 456-3415, option 5; or at the Grand Rapids Income Tax Department at City Hall, 300 Monroe NW, Room

380, Grand Rapids, Michigan 49503.

PAYMENT RECORD FOR TAX YEAR __________

(Keep this for your records.)

PAYMENT

DATE PAID

CHECK NUMBER

ESTIMATED TAX PAID

FIRST QUARTER

PAYMENT

SECOND QUARTER

PAYMENT

THIRD QUARTER

PAYMENT

FOURTH QUARTER

PAYMENT

TOTAL ESTIMATED TAX PAYMENTS

Mail Forms GR-1065ES with check or money order to:

Mail Form GR-1200ES-EFT to:

Grand Rapids Income Tax Office

Grand Rapids Income Tax Office

PO Box 109

PO Box 109

Grand Rapids, MI 49501-0109

Grand Rapids, MI 49501-0109

Revised: 01/03/2013

Page 2 of 2 pages

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2