Form Dw-3 - Annual Reconciliation W-2 Withholding And 1099 Misc. Earnings Report - 2008

ADVERTISEMENT

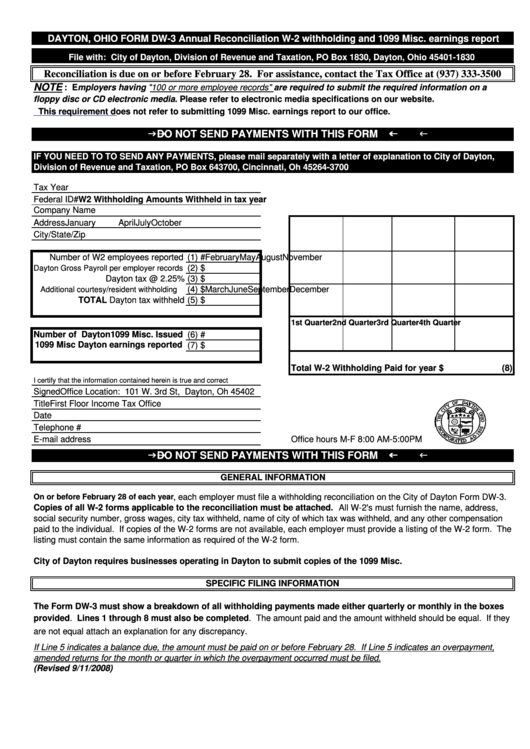

DAYTON, OHIO FORM DW-3 Annual Reconciliation W-2 withholding and 1099 Misc. earnings report

File with: City of Dayton, Division of Revenue and Taxation, PO Box 1830, Dayton, Ohio 45401-1830

Reconciliation is due on or before February 28. For assistance, contact the Tax Office at (937) 333-3500

NOTE

: Employers having "100 or more employee records" are required to submit the required information on a

floppy disc or CD electronic media . Please refer to electronic media specifications on our website.

This requirement does not refer to submitting 1099 Misc. earnings report to our office.

DO NOT SEND PAYMENTS WITH THIS FORM f f f f

IF YOU NEED TO TO SEND ANY PAYMENTS, please mail separately with a letter of explanation to City of Dayton,

Division of Revenue and Taxation, PO Box 643700, Cincinnati, Oh 45264-3700

Tax Year

Federal ID#

W2 Withholding Amounts Withheld in tax year

Company Name

Address

January

April

July

October

City/State/Zip

Number of W2 employees reported

(1) #

February

May

August

November

(2) $

Dayton Gross Payroll per employer records

Dayton tax @ 2.25%

(3) $

(4) $

March

June

September

December

Additional courtesy/resident withholding

TOTAL Dayton tax withheld

(5) $

1st Quarter

2nd Quarter 3rd Quarter

4th Quarter

Number of Dayton1099 Misc. Issued

(6) #

1099 Misc Dayton earnings reported

(7) $

Total W-2 Withholding Paid for year $

(8)

I certify that the information contained herein is true and correct

Signed

Office Location: 101 W. 3rd St, Dayton, Oh 45402

Title

First Floor Income Tax Office

Date

Telephone #

E-mail address

Office hours M-F 8:00 AM-5:00PM

DO NOT SEND PAYMENTS WITH THIS FORM f f f f

GENERAL INFORMATION

, each employer must file a withholding reconciliation on the City of Dayton Form DW-3.

On or before February 28 of each year

Copies of all W-2 forms applicable to the reconciliation must be attached. All W-2's must furnish the name, address,

social security number, gross wages, city tax withheld, name of city of which tax was withheld, and any other compensation

paid to the individual. If copies of the W-2 forms are not available, each employer must provide a listing of the W-2 form. The

listing must contain the same information as required of the W-2 form.

City of Dayton requires businesses operating in Dayton to submit copies of the 1099 Misc.

SPECIFIC FILING INFORMATION

The Form DW-3 must show a breakdown of all withholding payments made either quarterly or monthly in the boxes

provided. Lines 1 through 8 must also be completed. The amount paid and the amount withheld should be equal. If they

are not equal attach an explanation for any discrepancy.

If Line 5 indicates a balance due, the amount must be paid on or before February 28. If Line 5 indicates an overpayment,

amended returns for the month or quarter in which the overpayment occurred must be filed.

(Revised 9/11/2008)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1