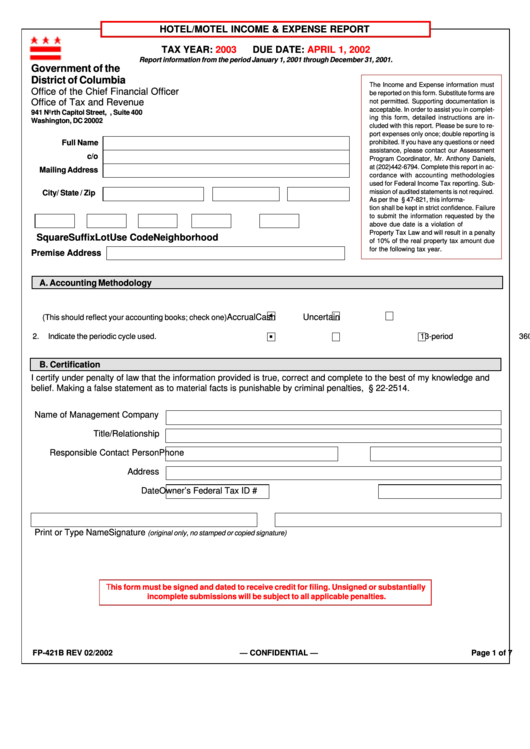

HOTEL/MOTEL INCOME & EXPENSE REPORT

TAX YEAR:

2003

DUE DATE:

APRIL 1, 2002

Report information from the period January 1, 2001 through December 31, 2001.

Government of the

District of Columbia

The Income and Expense information must

Office of the Chief Financial Officer

be reported on this form. Substitute forms are

Office of Tax and Revenue

not permitted. Supporting documentation is

acceptable. In order to assist you in complet-

941 North Capitol Street, N.E., Suite 400

ing this form, detailed instructions are in-

Washington, DC 20002

cluded with this report. Please be sure to re-

port expenses only once; double reporting is

Full Name

prohibited. If you have any questions or need

assistance, please contact our Assessment

c/o

Program Coordinator, Mr. Anthony Daniels,

at (202)442-6794. Complete this report in ac-

Mailing Address

cordance with accounting methodologies

used for Federal Income Tax reporting. Sub-

mission of audited statements is not required.

City / State / Zip

As per the D.C. Code § 47-821, this informa-

tion shall be kept in strict confidence. Failure

to submit the information requested by the

above due date is a violation of D.C. Real

Property Tax Law and will result in a penalty

Square

Suffix

Lot

Use Code

Neighborhood

of 10% of the real property tax amount due

for the following tax year.

Premise Address

A. Accounting Methodology

1. Method used to prepare this statement

Accrual

Cash

Uncertain

(This should reflect your accounting books; check one)

2. Indicate the periodic cycle used.

13-period

360-day year

Other

B. Certification

I certify under penalty of law that the information provided is true, correct and complete to the best of my knowledge and

belief. Making a false statement as to material facts is punishable by criminal penalties, D.C. Code § 22-2514.

Name of Management Company

Title/Relationship

Responsible Contact Person

Phone

Address

Date

Owner’s Federal Tax ID #

Print or Type Name

Signature

(original only, no stamped or copied signature)

This form must be signed and dated to receive credit for filing. Unsigned or substantially

incomplete submissions will be subject to all applicable penalties.

FP-421B REV 02/2002

— CONFIDENTIAL —

Page 1 of 7

1

1 2

2 3

3 4

4 5

5