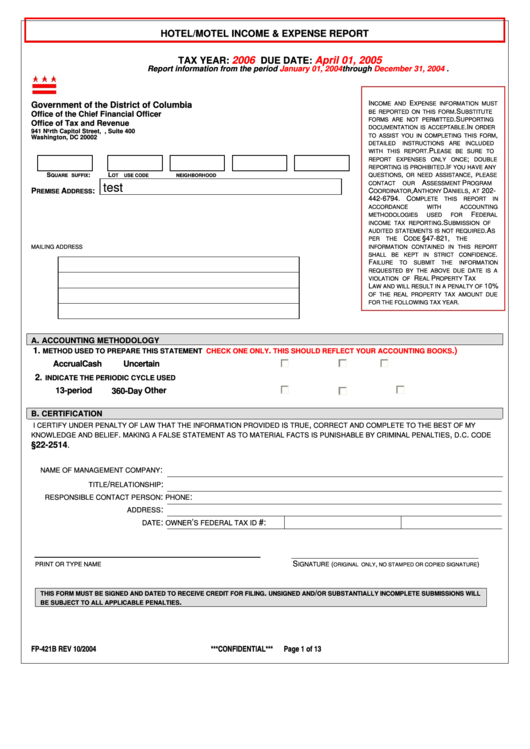

HOTEL/MOTEL INCOME & EXPENSE REPORT

2006

April 01, 2005

TAX YEAR:

DUE DATE:

Report information from the period

January 01, 2004

through

December 31, 2004

.

I

E

Government of the District of Columbia

NCOME AND

XPENSE INFORMATION MUST

. S

BE REPORTED ON THIS FORM

UBSTITUTE

Office of the Chief Financial Officer

. S

FORMS ARE NOT PERMITTED

UPPORTING

Office of Tax and Revenue

. I

DOCUMENTATION IS ACCEPTABLE

N ORDER

941 North Capitol Street, N.E., Suite 400

,

TO ASSIST YOU IN COMPLETING THIS FORM

Washington, DC 20002

DETAILED

INSTRUCTIONS ARE INCLUDED

. P

WITH THIS REPORT

LEASE BE SURE TO

;

REPORT EXPENSES ONLY ONCE

DOUBLE

. I

REPORTING IS PROHIBITED

F YOU HAVE ANY

S

:

L

,

,

QUESTIONS

OR NEED ASSISTANCE

PLEASE

QUARE

SUFFIX

OT

USE CODE

NEIGHBORHOOD

A

P

CONTACT

OUR

SSESSMENT

ROGRAM

test

P

A

:

C

, A

D

,

202-

REMISE

DDRESS

OORDINATOR

NTHONY

ANIELS

AT

442-6794. C

OMPLETE

THIS

REPORT

IN

ACCORDANCE

WITH

ACCOUNTING

F

METHODOLOGIES

USED

FOR

EDERAL

. S

INCOME TAX REPORTING

UBMISSION OF

. A

AUDITED STATEMENTS IS NOT REQUIRED

S

D.C. C

§ 47-821,

PER

THE

ODE

THE

INFORMATION CONTAINED IN THIS REPORT

MAILING ADDRESS

.

SHALL BE KEPT IN STRICT CONFIDENCE

F

AILURE

TO

SUBMIT

THE

INFORMATION

REQUESTED BY THE ABOVE DUE DATE IS A

D.C. R

P

T

VIOLATION OF

EAL

ROPERTY

AX

L

10%

AW AND WILL RESULT IN A PENALTY OF

OF THE REAL PROPERTY TAX AMOUNT DUE

.

FOR THE FOLLOWING TAX YEAR

.

A

ACCOUNTING METHODOLOGY

1.

.

.)

METHOD USED TO PREPARE THIS STATEMENT

CHECK ONE ONLY

THIS SHOULD REFLECT YOUR ACCOUNTING BOOKS

Accrual

Cash

Uncertain

2.

INDICATE THE PERIODIC CYCLE USED

13-period

Other

360-Day

.

B

CERTIFICATION

,

I CERTIFY UNDER PENALTY OF LAW THAT THE INFORMATION PROVIDED IS TRUE

CORRECT AND COMPLETE TO THE BEST OF MY

.

,

.

.

KNOWLEDGE AND BELIEF

MAKING A FALSE STATEMENT AS TO MATERIAL FACTS IS PUNISHABLE BY CRIMINAL PENALTIES

D

C

CODE

§22-2514.

:

NAME OF MANAGEMENT COMPANY

/

:

TITLE

RELATIONSHIP

:

:

RESPONSIBLE CONTACT PERSON

PHONE

:

ADDRESS

:

’

#:

DATE

OWNER

S FEDERAL TAX ID

S

PRINT OR TYPE NAME

IGNATURE

(

,

)

ORIGINAL ONLY

NO STAMPED OR COPIED SIGNATURE

.

/

THIS FORM MUST BE SIGNED AND DATED TO RECEIVE CREDIT FOR FILING

UNSIGNED AND

OR SUBSTANTIALLY INCOMPLETE SUBMISSIONS WILL

.

BE SUBJECT TO ALL APPLICABLE PENALTIES

FP-421B REV 10/2004

***CONFIDENTIAL***

Page 1 of 13

1

1 2

2 3

3 4

4 5

5