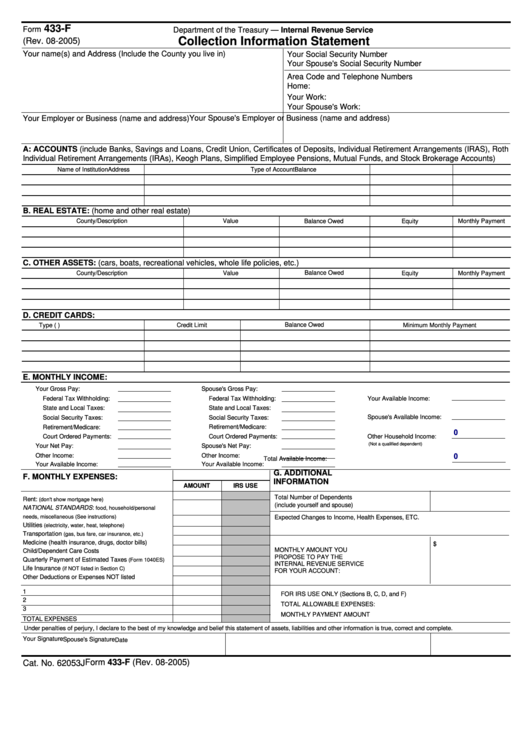

433-F

Form

Department of the Treasury — Internal Revenue Service

Collection Information Statement

(Rev. 08-2005)

Your name(s) and Address (Include the County you live in)

Your Social Security Number

Your Spouse's Social Security Number

Area Code and Telephone Numbers

Home:

Your Work:

Your Spouse's Work:

Your Employer or Business (name and address)

Your Spouse's Employer or Business (name and address)

A: ACCOUNTS (include Banks, Savings and Loans, Credit Union, Certificates of Deposits, Individual Retirement Arrangements (IRAS), Roth

Individual Retirement Arrangements (IRAs), Keogh Plans, Simplified Employee Pensions, Mutual Funds, and Stock Brokerage Accounts)

Name of Institution

Address

Type of Account

Balance

B. REAL ESTATE: (home and other real estate)

Value

Monthly Payment

County/Description

Balance Owed

Equity

C. OTHER ASSETS: (cars, boats, recreational vehicles, whole life policies, etc.)

Balance Owed

County/Description

Value

Equity

Monthly Payment

D. CREDIT CARDS:

Balance Owed

Credit Limit

Type (e.g. VISA/Nations Bank)

Minimum Monthly Payment

E. MONTHLY INCOME:

Your Gross Pay:

Spouse's Gross Pay:

Federal Tax Withholding:

Federal Tax Withholding:

Your Available Income:

State and Local Taxes:

State and Local Taxes:

Spouse's Available Income:

Social Security Taxes:

Social Security Taxes:

Retirement/Medicare:

Retirement/Medicare:

0

Court Ordered Payments:

Court Ordered Payments:

Other Household Income:

(Not a qualified dependent)

Your Net Pay:

Spouse's Net Pay:

0

Other Income:

Other Income:

Total Available Income:

Your Available Income:

Your Available Income:

G. ADDITIONAL

F. MONTHLY EXPENSES:

INFORMATION

AMOUNT

IRS USE

Total Number of Dependents

Rent:

(don't show mortgage here)

(include yourself and spouse)

NATIONAL STANDARDS:

food, household/personal

needs, miscellaneous (See instructions)

Expected Changes to Income, Health Expenses, ETC.

Utilities

(electricity, water, heat, telephone)

Transportation

(gas, bus fare, car insurance, etc.)

Medicine (health insurance, drugs, doctor bills)

$

MONTHLY AMOUNT YOU

Child/Dependent Care Costs

PROPOSE TO PAY THE

Quarterly Payment of Estimated Taxes

(Form 1040ES)

INTERNAL REVENUE SERVICE

Life Insurance

(if NOT listed in Section C)

FOR YOUR ACCOUNT:

Other Deductions or Expenses NOT listed

1

FOR IRS USE ONLY (Sections B, C, D, and F)

2

TOTAL ALLOWABLE EXPENSES:

3

MONTHLY PAYMENT AMOUNT

TOTAL EXPENSES

Under penalties of perjury, I declare to the best of my knowledge and belief this statement of assets, liabilities and other information is true, correct and complete.

Your Signature

Spouse's Signature

Date

Form 433-F (Rev. 08-2005)

Cat. No. 62053J

1

1