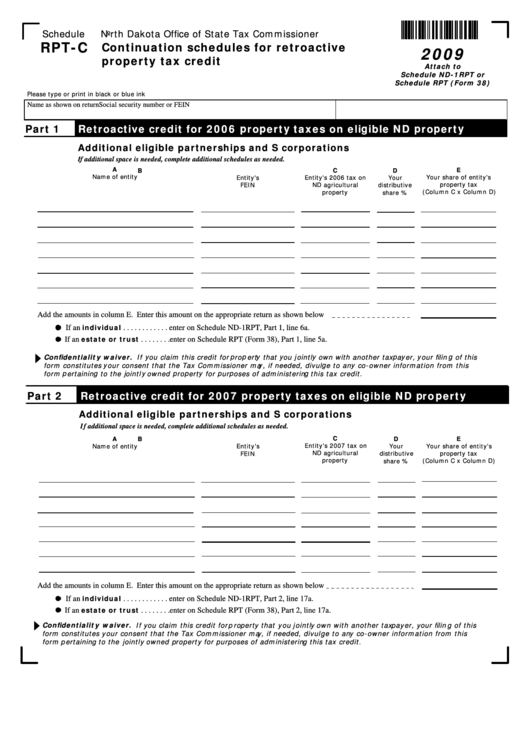

Schedule

North Dakota Office of State Tax Commissioner

RPT-C

Continuation schedules for retroactive

2009

property tax credit

Attach to

Schedule ND-1RPT or

Schedule RPT (Form 38)

Please type or print in black or blue ink

Name as shown on return

Social security number or FEIN

Part 1

Retroactive credit for 2006 property taxes on eligible ND property

Additional eligible partnerships and S corporations

If additional space is needed, complete additional schedules as needed.

A

C

E

B

D

Name of entity

Entity's 2006 tax on

Your share of entity's

Entity's

Your

ND agricultural

property tax

FEIN

distributive

property

(Column C x Column D)

share %

Add the amounts in column E. Enter this amount on the appropriate return as shown below

individual

If an

. . . . . . . . . . . . enter on Schedule ND-1RPT, Part 1, line 6a.

estate or trust

If an

. . . . . . . .enter on Schedule RPT (Form 38), Part 1, line 5a.

Confidentiality waiver. If you claim this credit for property that you jointly own with another taxpayer, your filing of this

form constitutes your consent that the Tax Commissioner may, if needed, divulge to any co-owner information from this

form pertaining to the jointly owned property for purposes of administering this tax credit.

Part 2

Retroactive credit for 2007 property taxes on eligible ND property

Additional eligible partnerships and S corporations

If additional space is needed, complete additional schedules as needed.

C

E

A

B

D

Entity's 2007 tax on

Name of entity

Entity's

Your

Your share of entity's

ND agricultural

FEIN

distributive

property tax

property

share %

(Column C x Column D)

Add the amounts in column E. Enter this amount on the appropriate return as shown below

individual

If an

. . . . . . . . . . . . enter on Schedule ND-1RPT, Part 2, line 17a.

estate or trust

If an

. . . . . . . .enter on Schedule RPT (Form 38), Part 2, line 17a.

Confidentiality waiver. If you claim this credit for property that you jointly own with another taxpayer, your filing of this

form constitutes your consent that the Tax Commissioner may, if needed, divulge to any co-owner information from this

form pertaining to the jointly owned property for purposes of administering this tax credit.

1

1