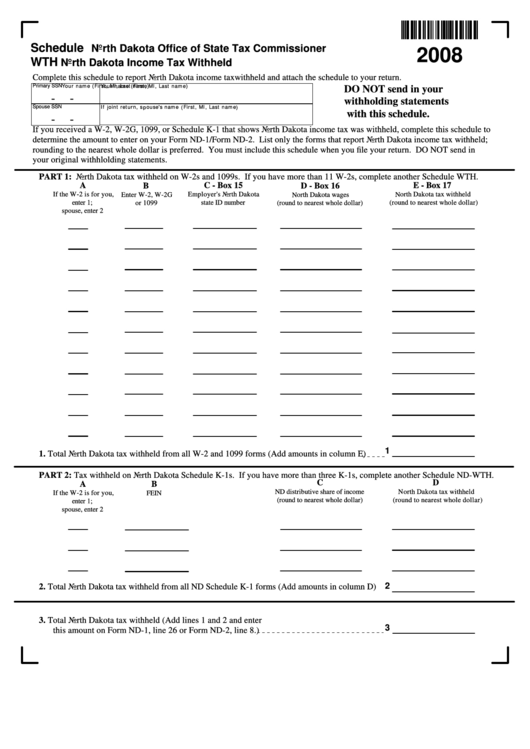

Schedule Wth - North Dakota Income Tax Withheld Form - North Dakota Office Of State Tax Commissioner - 2008

ADVERTISEMENT

Schedule

North Dakota Office of State Tax Commissioner

2008

WTH

North Dakota Income Tax Withheld

Complete this schedule to report North Dakota income taxwithheld and attach the schedule to your return.

Your name (First, MI, Last name)

Your name (First, MI, Last name)

Primary SSN

DO NOT send in your

-

-

withholding statements

If joint return, spouse's name (First, MI, Last name)

Spouse SSN

with this schedule.

-

-

If you received a W-2, W-2G, 1099, or Schedule K-1 that shows North Dakota income tax was withheld, complete this schedule to

determine the amount to enter on your Form ND-1/Form ND-2. List only the forms that report North Dakota income tax withheld;

rounding to the nearest whole dollar is preferred. You must include this schedule when you file your return. DO NOT send in

your original withhlolding statements.

PART 1: North Dakota tax withheld on W-2s and 1099s. If you have more than 11 W-2s, complete another Schedule WTH.

A

C - Box 15

E - Box 17

B

D - Box 16

If the W-2 is for you,

Employer's North Dakota

North Dakota tax withheld

Enter W-2, W-2G

North Dakota wages

enter 1;

or 1099

state ID number

(round to nearest whole dollar)

(round to nearest whole dollar)

spouse, enter 2

1

1. Total North Dakota tax withheld from all W-2 and 1099 forms (Add amounts in column E)

PART 2: Tax withheld on North Dakota Schedule K-1s. If you have more than three K-1s, complete another Schedule ND-WTH.

C

D

A

B

ND distributive share of income

North Dakota tax withheld

If the W-2 is for you,

FEIN

(round to nearest whole dollar)

(round to nearest whole dollar)

enter 1;

spouse, enter 2

2

2. Total North Dakota tax withheld from all ND Schedule K-1 forms (Add amounts in column D)

3. Total North Dakota tax withheld (Add lines 1 and 2 and enter

3

this amount on Form ND-1, line 26 or Form ND-2, line 8.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1