Tax Refund Deposit Authorization Form

ADVERTISEMENT

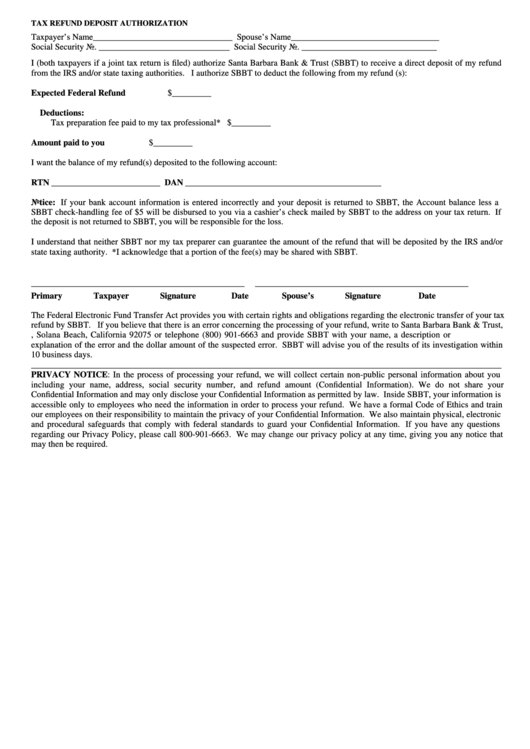

TAX REFUND DEPOSIT AUTHORIZATION

Taxpayer’s Name________________________________

Spouse’s Name__________________________________

Social Security No. ______________________________

Social Security No. _______________________________

I (both taxpayers if a joint tax return is filed) authorize Santa Barbara Bank & Trust (SBBT) to receive a direct deposit of my refund

from the IRS and/or state taxing authorities. I authorize SBBT to deduct the following from my refund (s):

Expected Federal Refund

$_________

Deductions:

Tax preparation fee paid to my tax professional* $_________

Amount paid to you

$_________

I want the balance of my refund(s) deposited to the following account:

RTN _________________________ DAN _____________________________________________

Notice: If your bank account information is entered incorrectly and your deposit is returned to SBBT, the Account balance less a

SBBT check-handling fee of $5 will be disbursed to you via a cashier’s check mailed by SBBT to the address on your tax return. If

the deposit is not returned to SBBT, you will be responsible for the loss.

I understand that neither SBBT nor my tax preparer can guarantee the amount of the refund that will be deposited by the IRS and/or

state taxing authority. *I acknowledge that a portion of the fee(s) may be shared with SBBT.

_________________________________________________

_________________________________________________

Primary Taxpayer Signature

Date

Spouse’s Signature

Date

The Federal Electronic Fund Transfer Act provides you with certain rights and obligations regarding the electronic transfer of your tax

refund by SBBT. If you believe that there is an error concerning the processing of your refund, write to Santa Barbara Bank & Trust,

P.O. Box 1390, Solana Beach, California 92075 or telephone (800) 901-6663 and provide SBBT with your name, a description or

explanation of the error and the dollar amount of the suspected error. SBBT will advise you of the results of its investigation within

10 business days.

____________________________________________________________________________________________________________

PRIVACY NOTICE: In the process of processing your refund, we will collect certain non-public personal information about you

including your name, address, social security number, and refund amount (Confidential Information). We do not share your

Confidential Information and may only disclose your Confidential Information as permitted by law. Inside SBBT, your information is

accessible only to employees who need the information in order to process your refund. We have a formal Code of Ethics and train

our employees on their responsibility to maintain the privacy of your Confidential Information. We also maintain physical, electronic

and procedural safeguards that comply with federal standards to guard your Confidential Information. If you have any questions

regarding our Privacy Policy, please call 800-901-6663. We may change our privacy policy at any time, giving you any notice that

may then be required.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1