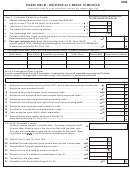

Other Personal Credits–

.00

27 Plastic recycling investment credit ............................................................. 27

.00

28 Colorado minimum tax credit ..................................................................... 28

.00

29 Historic property preservation credit .......................................................... 29

.00

30 Child care center investment credit ........................................................... 30

.00

31 Employer child care facility investment credit ............................................ 31

.00

32 School-to-career investment credit ............................................................ 32

.00

33 Colorado works program credit ................................................................. 33

.00

34 Child care contribution credit ..................................................................... 34

.00

35 Rural technology enterprise zone credit carryforward ............................... 35

.00

36 Long term care insurance credit ................................................................ 36

.00

37 Contaminated land redevelopment credit .................................................. 37

.00

38 Low-income housing credit ........................................................................ 38

.00

39 Weather related livestock sale credit carryforward .................................... 39

.00

40 Total of lines 27 through 39 ................................................................................................... 40

.00

41 Total personal credits, add lines 26 and 40. Enter here and on line 18, Form 104 ............... 41

42 Alternative fuel vehicle credit (Vehicle type_________________) ........... 42

.00

.00

43 Alternative fuel refueling facility credit ...................................................... 43

44 Total alternative fuel credits-Add lines 42 and 43. Enter here and on

.00

line 19 of Form 104 ............................................................................................................... 44

If the total of lines 18, 41, and 44 on this Form 104 CR exceeds the total of lines 14 and 15, Form 104, see the

limitation at the bottom of this form.

Credits to be carried forward to 2006:

LIMITATION: The total credits you claim on lines 18, 41, and 44 of this Form 104CR may not exceed the total tax on lines 14 and 15

of your income tax return, Form 104. If you have excess credits, you must choose which credits you are going to use against your

2005 tax and enter those amounts on lines 18 through 20 of Form 104. Most unused 2005 credits may be carried forward and

claimed on your 2006 Colorado income tax return.

ATTACH THIS FORM TO YOUR COMPLETED INCOME TAX RETURN FORM 104

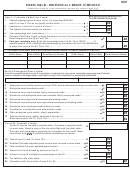

INSTRUCTIONS FOR FORM 104CR

CHILD CARE CREDIT.

4 Enter the percentage from the following table:

If, during 2005, you were a Colorado resident, your federal adjusted

Your Federal Adjusted Gross Income

Your Percentage

gross income was $60,000 or less, and you claim a child care credit

More Than:

But Not More Than:

on your 2005 federal income tax return, you may claim a Colorado

$0

$25,000

50%

child care credit. See

33.

1 Enter the federal adjusted gross income from federal Form

$25,000

$35,000

30%

1040, line 37, or from federal Form 1040A, line 21.

$35,000

$60,000

10%

2 Enter the federal tax from federal Form 1040, line 46, or from

5 Multiply the amount on line 3 by the percentage on line 4.

federal Form 1040A, line 28. If this amount is $0, you do not

6 Part-year residents must apportion their Colorado child

qualify for the child care credit and you must enter $0 on line

care credit by their Colorado percentage from line 34 of

5.

Form 104PN. The resulting credit can not exceed 100% of

3 Enter the child care credit you claimed on your 2005 federal

the credit on line 5.

income tax return. This will be the smaller of the amounts on

7 If you claimed a child care credit on line 5 or 6, enter the

line 46 or 48 of your federal Form 1040, or the smaller of the

name, date of birth and social security number of your

amounts on line 28 or 29 of your federal Form 1040A.

eligible children in the space provided. Attach a schedule if

The Colorado child care credit is allowed only on expenses

additional space is needed.

incurred for the care of children under age 13. Colorado does

8 GROSS CONSERVATION EASEMENT CREDIT

not allow a credit for dependent care expense. If your federal

A tax credit is available for qualified taxpayers who donate

credit is a combined child care and dependent care credit, refer

a Colorado conservation easement in gross. If this credit is

to

33.

claimed, any charitable deduction claimed on the federal

return must be added to taxable income on line 3 of Form

104. You must attach form DR 1305 to your return if you

claim this credit. See

39.

1

1 2

2