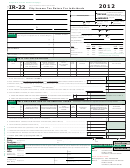

Make checks payable to: CITY TREASURER

Note: Do not send

City of Columbus, Income Tax Division

IR-18

Mail to:

Columbus Income Tax Division

Quarterly Statement of

cash through U.S. Mail

PO Box 182158

Estimated Income Tax Due

Columbus, Ohio 43218-2158

TAX YEAR

SOCIAL SECURITY NUMBER

VOUCHER 2 - (CALENDAR YEAR - DUE JULY 31)

2009

PAYMENT DUE ON

#

2

JULY 31

1. Amount of this installment.............

$

NAME AND ADDRESS:

2. Amount of unused overpayment

credit, if any, applied to this

$

installment........................................

3. Amount of this installment

$

payment (Line 1 less Line 2).........

This form may be electronically filed and paid at

Rev. 11/3/08

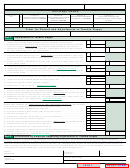

Make checks payable to: CITY TREASURER

City of Columbus, Income Tax Division

Note: Do not send

IR-18

Mail to:

Columbus Income Tax Division

Quarterly Statement of

cash through U.S. Mail

PO Box 182158

Estimated Income Tax Due

Columbus, Ohio 43218-2158

TAX YEAR

SOCIAL SECURITY NUMBER

VOUCHER 3 - (CALENDAR YEAR - DUE OCTOBER 31)

2009

PAYMENT DUE ON

#

3

OCTOBER 31

1. Amount of this installment.............

$

NAME AND ADDRESS:

2. Amount of unused overpayment

credit, if any, applied to this

$

installment........................................

3. Amount of this installment

$

payment (Line 1 less Line 2).........

This form may be electronically filed and paid at

Rev. 11/3/08

Make checks payable to: CITY TREASURER

Note: Do not send

City of Columbus, Income Tax Division

IR-18

Mail to:

Columbus Income Tax Division

Quarterly Statement of

cash through U.S. Mail

PO Box 182158

Estimated Income Tax Due

Columbus, Ohio 43218-2158

TAX YEAR

SOCIAL SECURITY NUMBER

VOUCHER 4 - (CALENDAR YEAR - DUE JANUARY 31, 2010)

2009

PAYMENT DUE ON

#

4

JANUARY 31, 2010

1. Amount of this installment.............

$

NAME AND ADDRESS:

2. Amount of unused overpayment

credit, if any, applied to this

$

installment........................................

3. Amount of this installment

$

payment (Line 1 less Line 2).........

This form may be electronically filed and paid at

PRINT

RESET FORM

Rev.11/3/08

1

1 2

2 3

3