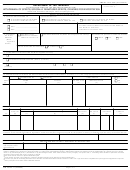

J. Item 14 – How do I report a shortage disclosed by an inventory? When required to take an inventory, you must report any shortages disclosed by that inventory on line

14 of the report covering the period during which the inventory was taken. If you do not voluntarily pay excise taxes on the amount of tobacco products or cigarette papers

and tubes shown as a shortage, TTB may send you a written notice instructing you to explain why an assessment of tax should not be made on the shortage.

K. Item 18 - Who may sign this report?

If your business is a

The report must be signed by:

Sole Proprietorship

(1) You; OR

(2) An individual for whom you have filed an ATF or TTB F 5000.8, Power of Attorney, that grants authority to sign this report

Partnership

(1) Each partner; OR

(2) The partner who has been given the authority to sign by the articles of partnership or similar agreement of all the partners that

you filed for this permit; OR

(3) An individual for whom you filed an ATF or TTB F 5000.8, Power of Attorney, that grants authority to sign this report

Corporation, association, limited

(1) An individual who has signature authority granted by the business documents that you filed for this permit; OR

liability company, or other

(2) An individual for whom you filed an ATF or TTB F 5000.8, Power of Attorney, that grants authority to sign this report

business

QUESTIONS.

L. If I have questions about this TTB form, who can answer my questions? Contact a specialist in the TTB Tobacco Excise Tax Group, National Revenue Center by

phone at 1-877-882-3277 or 1-513-684-7137, or by e-mail at ttbtobacco@ttb.gov.

RECORDS RETENTION. A copy of this report has to be kept for 3 years following the close of the calendar year covered in the report.

PAPERWORK REDUCTION ACT NOTICE

This information request is in accordance with the Paperwork Reduction Act of 1995. The purpose of this information collection is to monitor the operations of industries regulated

by TTB. TTB uses the information to monitor activities and determine errors or omissions on taxable commodities. The information is mandatory by statute (26 U.S.C. 5722).

The estimated average burden associated with this collection of information is 48 minutes per respondent or recordkeeper depending on individual circumstances. Comments

concerning the accuracy of this burden estimate and suggestions for reducing this burden should be addressed to: Reports Management Officer, Regulations and Rulings Division,

Alcohol and Tobacco Tax and Trade Bureau, Washington, DC 20220.

An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a current, valid OMB control number.

TTB F 5220.4 (05/2009) PREVIOUS VERSIONS SUPERSEDED AND MAY NOT BE USED

Instructions: Page 2 of 2

1

1 2

2 3

3 4

4