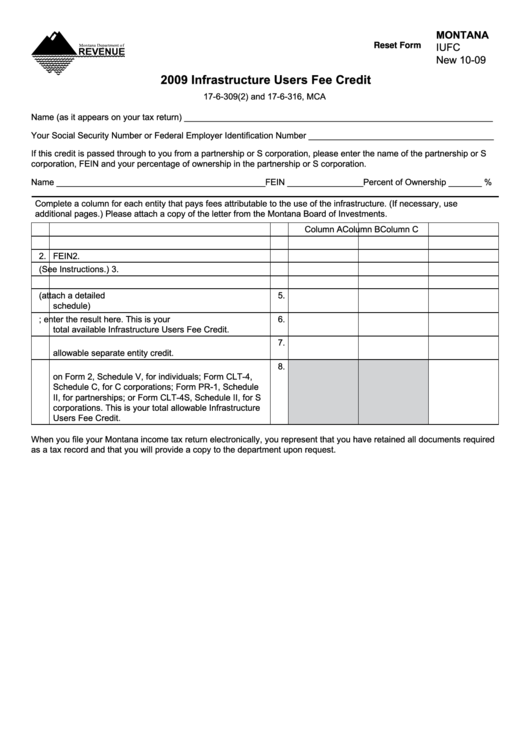

MONTANA

IUFC

Reset Form

New 10-09

2009 Infrastructure Users Fee Credit

17-6-309(2) and 17-6-316, MCA

Name (as it appears on your tax return) _________________________________________________________________

Your Social Security Number or Federal Employer Identification Number _______________________________________

If this credit is passed through to you from a partnership or S corporation, please enter the name of the partnership or S

corporation, FEIN and your percentage of ownership in the partnership or S corporation.

Name ____________________________________________ FEIN ________________ Percent of Ownership _______ %

Complete a column for each entity that pays fees attributable to the use of the infrastructure. (If necessary, use

additional pages.) Please attach a copy of the letter from the Montana Board of Investments.

Column A

Column B

Column C

1. Business Name

1.

2. FEIN

2.

3. Enter your Montana Tax Liability. (See Instructions.)

3.

4. Current Year Infrastructure Users Fee Credit.

4.

5. Credit Carryforward/Carryback (attach a detailed

5.

schedule)

6. Add lines 4 and 5; enter the result here. This is your

6.

total available Infrastructure Users Fee Credit.

7. Enter the lesser of line 3 or line 6 here. This is your

7.

allowable separate entity credit.

8. Add all columns on line 7 and enter the result here and

8.

on Form 2, Schedule V, for individuals; Form CLT-4,

Schedule C, for C corporations; Form PR-1, Schedule

II, for partnerships; or Form CLT-4S, Schedule II, for S

corporations. This is your total allowable Infrastructure

Users Fee Credit.

When you file your Montana income tax return electronically, you represent that you have retained all documents required

as a tax record and that you will provide a copy to the department upon request.

1

1