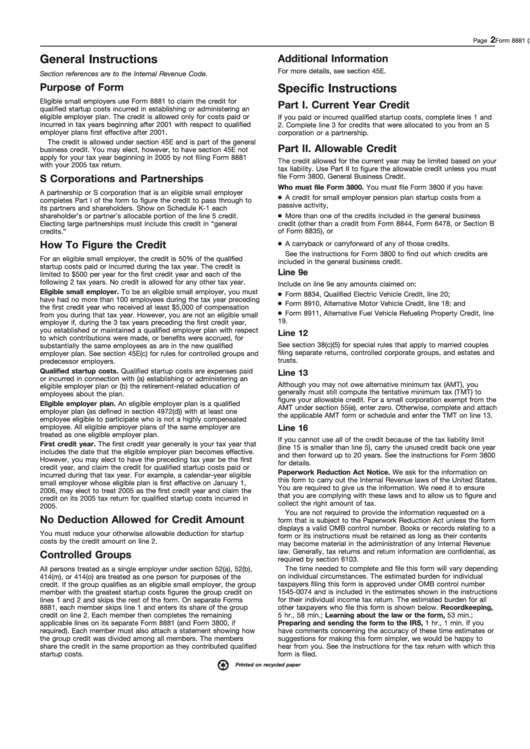

Instructions For Form 8881 - Credit For Small Employer Pension Plan Startup Costs - 2005

ADVERTISEMENT

2

Form 8881 (2005)

Page

General Instructions

Additional Information

For more details, see section 45E.

Section references are to the Internal Revenue Code.

Purpose of Form

Specific Instructions

Eligible small employers use Form 8881 to claim the credit for

Part I. Current Year Credit

qualified startup costs incurred in establishing or administering an

eligible employer plan. The credit is allowed only for costs paid or

If you paid or incurred qualified startup costs, complete lines 1 and

incurred in tax years beginning after 2001 with respect to qualified

2. Complete line 3 for credits that were allocated to you from an S

employer plans first effective after 2001.

corporation or a partnership.

The credit is allowed under section 45E and is part of the general

Part II. Allowable Credit

business credit. You may elect, however, to have section 45E not

apply for your tax year beginning in 2005 by not filing Form 8881

The credit allowed for the current year may be limited based on your

with your 2005 tax return.

tax liability. Use Part II to figure the allowable credit unless you must

file Form 3800, General Business Credit.

S Corporations and Partnerships

Who must file Form 3800. You must file Form 3800 if you have:

A partnership or S corporation that is an eligible small employer

● A credit for small employer pension plan startup costs from a

completes Part I of the form to figure the credit to pass through to

passive activity,

its partners and shareholders. Show on Schedule K-1 each

● More than one of the credits included in the general business

shareholder’s or partner’s allocable portion of the line 5 credit.

Electing large partnerships must include this credit in “general

credit (other than a credit from Form 8844, Form 6478, or Section B

of Form 8835), or

credits.”

● A carryback or carryforward of any of those credits.

How To Figure the Credit

See the instructions for Form 3800 to find out which credits are

For an eligible small employer, the credit is 50% of the qualified

included in the general business credit.

startup costs paid or incurred during the tax year. The credit is

Line 9e

limited to $500 per year for the first credit year and each of the

following 2 tax years. No credit is allowed for any other tax year.

Include on line 9e any amounts claimed on:

Eligible small employer. To be an eligible small employer, you must

● Form 8834, Qualified Electric Vehicle Credit, line 20;

have had no more than 100 employees during the tax year preceding

● Form 8910, Alternative Motor Vehicle Credit, line 18; and

the first credit year who received at least $5,000 of compensation

● Form 8911, Alternative Fuel Vehicle Refueling Property Credit, line

from you during that tax year. However, you are not an eligible small

19.

employer if, during the 3 tax years preceding the first credit year,

you established or maintained a qualified employer plan with respect

Line 12

to which contributions were made, or benefits were accrued, for

See section 38(c)(5) for special rules that apply to married couples

substantially the same employees as are in the new qualified

filing separate returns, controlled corporate groups, and estates and

employer plan. See section 45E(c) for rules for controlled groups and

trusts.

predecessor employers.

Qualified startup costs. Qualified startup costs are expenses paid

Line 13

or incurred in connection with (a) establishing or administering an

Although you may not owe alternative minimum tax (AMT), you

eligible employer plan or (b) the retirement-related education of

generally must still compute the tentative minimum tax (TMT) to

employees about the plan.

figure your allowable credit. For a small corporation exempt from the

Eligible employer plan. An eligible employer plan is a qualified

AMT under section 55(e), enter zero. Otherwise, complete and attach

employer plan (as defined in section 4972(d)) with at least one

the applicable AMT form or schedule and enter the TMT on line 13.

employee eligible to participate who is not a highly compensated

employee. All eligible employer plans of the same employer are

Line 16

treated as one eligible employer plan.

If you cannot use all of the credit because of the tax liability limit

First credit year. The first credit year generally is your tax year that

(line 15 is smaller than line 5), carry the unused credit back one year

includes the date that the eligible employer plan becomes effective.

and then forward up to 20 years. See the instructions for Form 3800

However, you may elect to have the preceding tax year be the first

for details.

credit year, and claim the credit for qualified startup costs paid or

Paperwork Reduction Act Notice. We ask for the information on

incurred during that tax year. For example, a calendar-year eligible

this form to carry out the Internal Revenue laws of the United States.

small employer whose eligible plan is first effective on January 1,

You are required to give us the information. We need it to ensure

2006, may elect to treat 2005 as the first credit year and claim the

that you are complying with these laws and to allow us to figure and

credit on its 2005 tax return for qualified startup costs incurred in

collect the right amount of tax.

2005.

You are not required to provide the information requested on a

No Deduction Allowed for Credit Amount

form that is subject to the Paperwork Reduction Act unless the form

displays a valid OMB control number. Books or records relating to a

You must reduce your otherwise allowable deduction for startup

form or its instructions must be retained as long as their contents

costs by the credit amount on line 2.

may become material in the administration of any Internal Revenue

law. Generally, tax returns and return information are confidential, as

Controlled Groups

required by section 6103.

The time needed to complete and file this form will vary depending

All persons treated as a single employer under section 52(a), 52(b),

414(m), or 414(o) are treated as one person for purposes of the

on individual circumstances. The estimated burden for individual

taxpayers filing this form is approved under OMB control number

credit. If the group qualifies as an eligible small employer, the group

member with the greatest startup costs figures the group credit on

1545-0074 and is included in the estimates shown in the instructions

for their individual income tax return. The estimated burden for all

lines 1 and 2 and skips the rest of the form. On separate Forms

8881, each member skips line 1 and enters its share of the group

other taxpayers who file this form is shown below. Recordkeeping,

5 hr., 58 min.; Learning about the law or the form, 53 min.;

credit on line 2. Each member then completes the remaining

applicable lines on its separate Form 8881 (and Form 3800, if

Preparing and sending the form to the IRS, 1 hr., 1 min. If you

have comments concerning the accuracy of these time estimates or

required). Each member must also attach a statement showing how

the group credit was divided among all members. The members

suggestions for making this form simpler, we would be happy to

hear from you. See the instructions for the tax return with which this

share the credit in the same proportion as they contributed qualified

startup costs.

form is filed.

Printed on recycled paper

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1