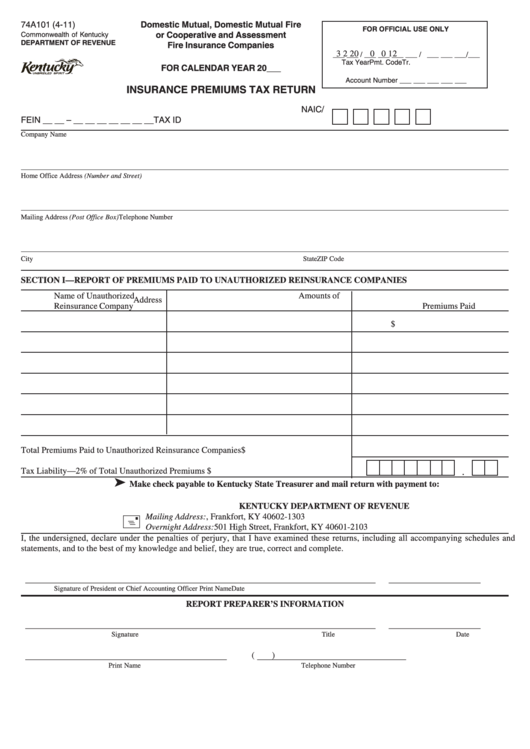

Form 74a101 - Insurance Premiums Tax Return

ADVERTISEMENT

74A101 (4-11)

Domestic Mutual, Domestic Mutual Fire

FOR OFFICIAL USE ONLY

Commonwealth of Kentucky

or Cooperative and Assessment

DEPARTMENT OF REVENUE

Fire Insurance Companies

3

2

2 0

0 0 1 2

___ ___ / ___ ___ ___ ___ / ___ ___ ___/___

Tax

Year

Pmt. Code

Tr.

FOR CALENDAR YEAR 20___

Account Number ___ ___ ___ ___ ___

INSURANCE PREMIUMS TAX RETURN

NAIC/

FEIN __ __ – __ __ __ __ __ __ __

TAX ID

Company Name

Home Office Address (Number and Street)

Mailing Address (Post Office Box)

Telephone Number

City

State

ZIP Code

SECTION I—REPORT OF PREMIUMS PAID TO UNAUTHORIZED REINSURANCE COMPANIES

Name of Unauthorized

Amounts of

Address

Reinsurance Company

Premiums Paid

$

Total Premiums Paid to Unauthorized Reinsurance Companies ................................................... $

Tax Liability—2% of Total Unauthorized Premiums .................................................................... $

.

➤

Make check payable to Kentucky State Treasurer and mail return with payment to:

KENTUCKY DEPARTMENT OF REVENUE

+

Mailing Address:

P.O. Box 1303, Frankfort, KY 40602-1303

Overnight Address:

501 High Street, Frankfort, KY 40601-2103

I, the undersigned, declare under the penalties of perjury, that I have examined these returns, including all accompanying schedules and

statements, and to the best of my knowledge and belief, they are true, correct and complete.

______________________________________________

__________________________________

_____________________

Signature of President or Chief Accounting Officer

Print Name

Date

REPORT PREPARER’S INFORMATION

______________________________________________

__________________________________

_____________________

Signature

Title

Date

(

)

______________________________________________

__________________________________

Print Name

Telephone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2