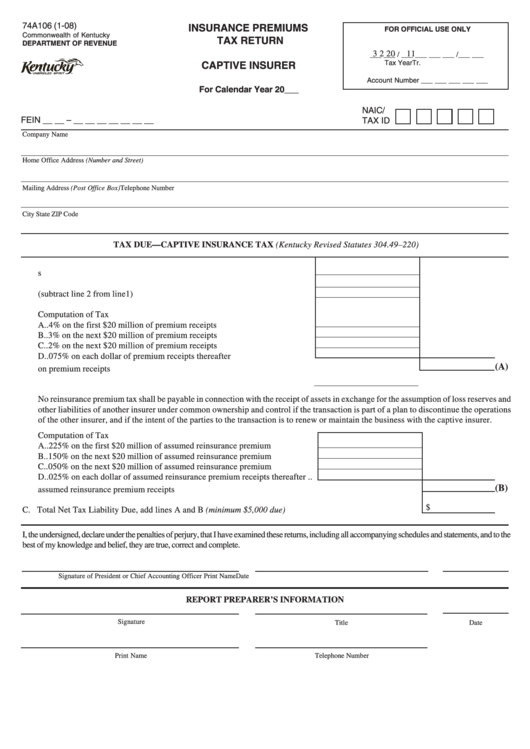

Form 74a106 - Insurance Premiums Tax Return - Captive Insurer

ADVERTISEMENT

74A106 (1-08)

INSURANCE PREMIUMS

FOR OFFICIAL USE ONLY

Commonwealth of Kentucky

TAX RETURN

DEPARTMENT OF REVENUE

3

2

2 0

1 1

___ ___ / ___ ___ ___ ___ / ___ ___

Tax

Year

Tr.

CAPTIVE INSURER

Account Number ___ ___ ___ ___ ___

For Calendar Year 20___

NAIC/

FEIN __ __ – __ __ __ __ __ __ __

TAX ID

Company Name

Home Office Address (Number and Street)

Mailing Address (Post Office Box)

Telephone Number

City

State

ZIP Code

TAX DUE—CAPTIVE INSURANCE TAX (Kentucky Revised Statutes 304.49–220)

A. Insurance Premiums

1. Total premium receipts .............................................................................

2. Returned premiums ...................................................................................

3. Net premium receipts (subtract line 2 from line 1) ..................................

Computation of Tax

A. .4% on the first $20 million of premium receipts .....................................

B. .3% on the next $20 million of premium receipts ....................................

C. .2% on the next $20 million of premium receipts ....................................

D. .075% on each dollar of premium receipts thereafter ..............................

(A)

E. Total tax on premium receipts ..................................................................................................................

B. Assumed Reinsurance Premium Receipts ........................................................

No reinsurance premium tax shall be payable in connection with the receipt of assets in exchange for the assumption of loss reserves and

other liabilities of another insurer under common ownership and control if the transaction is part of a plan to discontinue the operations

of the other insurer, and if the intent of the parties to the transaction is to renew or maintain the business with the captive insurer.

Computation of Tax

A. .225% on the first $20 million of assumed reinsurance premium receipts ....

B. .150% on the next $20 million of assumed reinsurance premium receipts ....

C. .050% on the next $20 million of assumed reinsurance premium receipts ....

D. .025% on each dollar of assumed reinsurance premium receipts thereafter ..

(B)

E. Total tax on assumed reinsurance premium receipts ...................................................................................

$

C. Total Net Tax Liability Due, add lines A and B (minimum $5,000 due) ............................................................

I, the undersigned, declare under the penalties of perjury, that I have examined these returns, including all accompanying schedules and statements, and to the

best of my knowledge and belief, they are true, correct and complete.

Signature of President or Chief Accounting Officer

Print Name

Date

REPORT PREPARER’S INFORMATION

Signature

Title

Date

Print Name

Telephone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2