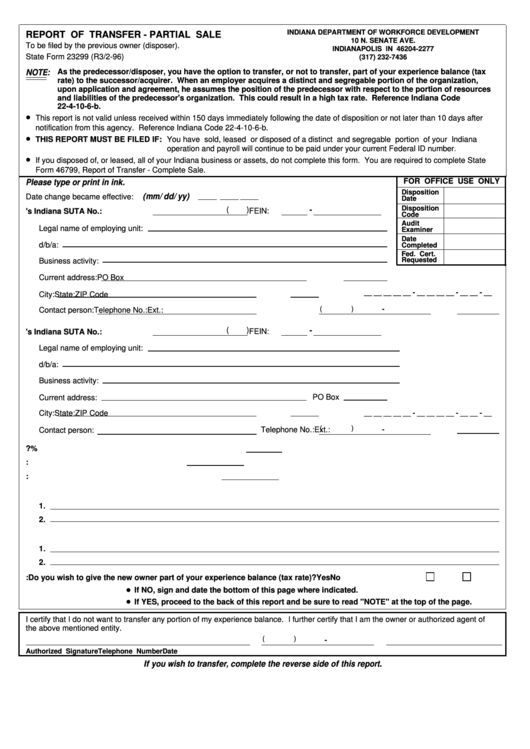

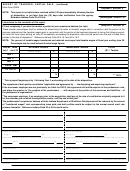

Form 23299 - Report Of Transfer - Partial Sale - 1996

ADVERTISEMENT

INDIANA DEPARTMENT OF WORKFORCE DEVELOPMENT

REPORT OF TRANSFER - PARTIAL SALE

10 N. SENATE AVE.

To be filed by the previous owner (disposer).

INDIANAPOLIS IN 46204-2277

State Form 23299 (R3/2-96)

(317) 232-7436

NOTE:

As the predecessor/disposer, you have the option to transfer, or not to transfer, part of your experience balance (tax

rate) to the successor/acquirer. When an employer acquires a distinct and segregable portion of the organization,

upon application and agreement, he assumes the position of the predecessor with respect to the portion of resources

and liabilities of the predecessor's organization. This could result in a high tax rate. Reference Indiana Code

22-4-10-6-b.

•

This report is not valid unless received within 150 days immediately following the date of disposition or not later than 10 days after

notification from this agency. Reference Indiana Code 22-4-10-6-b.

•

You have sold, leased or disposed of a distinct and segregable portion of your Indiana

THIS REPORT MUST BE FILED IF:

operation and payroll will continue to be paid under your current Federal ID number.

•

If you disposed of, or leased, all of your Indiana business or assets, do not complete this form. You are required to complete State

Form 46799, Report of Transfer - Complete Sale.

Please type or print in ink.

FOR OFFICE USE ONLY

Disposition

(mm/dd/yy)

Date change became effective:

Date

Disposition

(

) FEIN:

-

1. Disposer's Indiana SUTA No.:

Code

Audit

Legal name of employing unit:

Examiner

Date

d/b/a:

Completed

Fed. Cert.

Requested

Business activity:

Current address:

PO Box

__ __ __ __ __ - __ __ __ __ - __ __ - __

City:

State:

ZIP Code

(

)

-

Contact person:

Telephone No.:

Ext.:

(

) FEIN:

-

2. Acquirer's Indiana SUTA No.:

Legal name of employing unit:

d/b/a:

Business activity:

Current address:

PO Box

City:

State:

ZIP Code

__ __ __ __ __ - __ __ __ __ - __ __ - __

(

)

Telephone No.:

Ext.:

-

Contact person:

3. What percentage of your operations were disposed of?

%

4. Number of employees retained by you:

5. Number of employees rehired by the new entity:

6. List all locations that were sold or disposed of. Please attach additional sheets if needed.

1.

2.

7. List any Indiana operations retained by you. Please attach additional sheets if needed.

1.

2.

8. TRANSFER OPTION:

Do you wish to give the new owner part of your experience balance (tax rate)?

Yes

No

•

If NO, sign and date the bottom of this page where indicated.

•

If YES, proceed to the back of this report and be sure to read "NOTE" at the top of the page.

I certify that I do not want to transfer any portion of my experience balance. I further certify that I am the owner or authorized agent of

the above mentioned entity.

(

)

-

Authorized Signature

Telephone Number

Date

If you wish to transfer, complete the reverse side of this report.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2