Form 23299 - Report Of Transfer - Partial Sale - 1996 Page 2

ADVERTISEMENT

(continued)

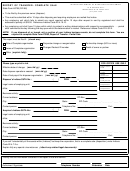

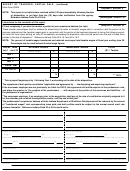

REPORT OF TRANSFER - PARTIAL SALE

State Form 23299

Disposer's Account #

NOTE: This report is not valid unless received within 150 days immediately following the date

of disposition, or not later than ten (10) days after notification from this agency.

(Reassigned Account #)

Reference Indiana Code 22-4-10-6-b.

Instructions for the remainder of this report.

(Acquirer's Account #)

Fill out completely if you wish to transfer a portion of your experience balance (tax rate).

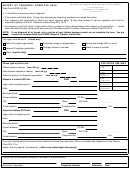

These transfer percentages shall be obtained by determining the ratios of (taxable) wages paid in connection with the portion of the

business retained and the (taxable) wages paid in connection with the portion of the business disposed of during the following period:

the three full fiscal years ending on June 30 immediately preceeding the disposition date and the period from the end of these three

periods to the date of disposition*. Reference Indiana Code 22-4-19-1and 22-4-19-2.

NOTE: The percent of taxable wages transferred and retained must equal total taxable wages of fiscal year ending June 30.

Pecentages may be used instead of actual wage figures.

RETAINED WAGES

TRANSFERED WAGES

FISCAL YEAR

TOTAL

July 1 - June 30

UC-1 Taxable

%

%

Taxable Wages

Taxable Wages

Year 1

Year 2

Year 3

* Partial Year

+

=

T O T A L S

$

$

$

+

= 100%

%

%

* This is payroll beginning July 1 following Year 3, and ending on the date of the disposition.

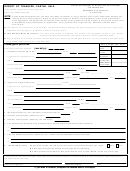

The signatures of both parties constitutes "application and agreement by . . . the disposing and acquiring employers".

If the successor employer was not previously tax liable for SUTA, this agreement will entitle acquirer to the predecessor rate,

and place the acquirer in "the position of the predecessor . . . with respect to the portion of the resources and liabilities ... of

the pedecessor's organization . . . ".

"The successor employer, if an employer prior to the acquisition, shall pay at the rate of contribution originally assigned to it

for the calendar year in which the acquisition occurs, until the end of that year".

The predecessor's experience balance with the Indiana Department of Workforce Development will be reduced by the amount

of "transferred wages" and corresponding taxes paid, and both entities would be subject to the normal annual merit rate

process thereafter. Reference Indiana Code 22-4-10-6-a and b and c.

Signature of

DISPOSER

or Authorized Agent

Signature of

ACQUIRER

or Authorized Agent

Printed Name of

DISPOSER

or Authorized Agent

Printed Name of

ACQUIRER

or Authorized Agent

Date

Date

STATE OF INDIANA

STATE OF INDIANA

County of

SS:

County of

SS:

Subscribed and sworn before me a Notary Public in and said County this

Subscribed and sworn before me a Notary Public in and said County this

day of

19

day of

19

Notary Signature

Notary Signature

Notary's Name (Print or type)

Notary's Name (Print or type)

County of Residence

Commission Expiration Date

County of Residence

Commission Expiration Date

Remarks:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2