School Income Tax Form - City Of Philadelphia - 2008

ADVERTISEMENT

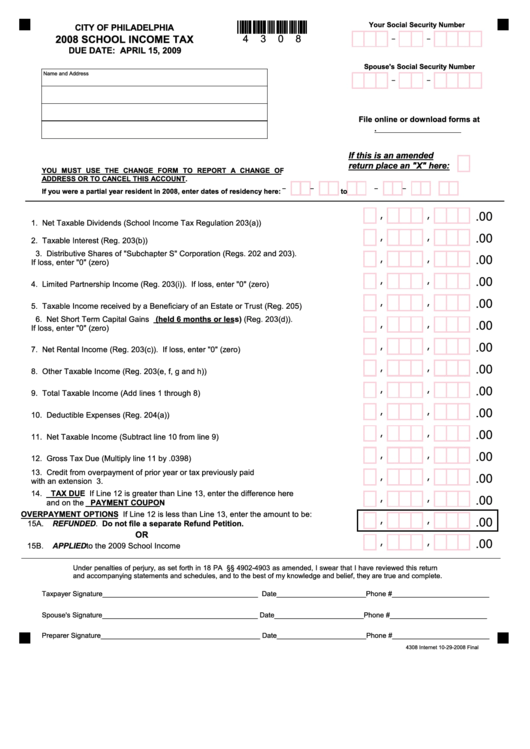

Your Social Security Number

CITY OF PHILADELPHIA

4

3

0

8

2008 SCHOOL INCOME TAX

-

-

DUE DATE: APRIL 15, 2009

Spouse's Social Security Number

Name and Address

-

-

File online or download forms at

If this is an amended

return place an "X" here:

YOU MUST USE THE CHANGE FORM TO REPORT A CHANGE OF

ADDRESS OR TO CANCEL THIS ACCOUNT.

-

-

-

-

If you were a partial year resident in 2008, enter dates of residency here:

to

.00

,

,

1. Net Taxable Dividends (School Income Tax Regulation 203(a)).....................................1.

.00

,

,

2. Taxable Interest (Reg. 203(b)).........................................................................................2.

3. Distributive Shares of "Subchapter S" Corporation (Regs. 202 and 203).

.00

,

,

If loss, enter "0" (zero)......................................................................................................3.

.00

,

,

4. Limited Partnership Income (Reg. 203(i)). If loss, enter "0" (zero)..................................4.

.00

,

,

5. Taxable Income received by a Beneficiary of an Estate or Trust (Reg. 205)...................5.

6. Net Short Term Capital Gains (held 6 months or less) (Reg. 203(d)).

.00

,

,

If loss, enter "0" (zero)......................................................................................................6.

.00

,

,

7. Net Rental Income (Reg. 203(c)). If loss, enter "0" (zero)...............................................7.

.00

,

,

8. Other Taxable Income (Reg. 203(e, f, g and h))..............................................................8.

.00

,

,

9. Total Taxable Income (Add lines 1 through 8).................................................................9.

.00

,

,

10. Deductible Expenses (Reg. 204(a))...............................................................................10.

.00

,

,

11. Net Taxable Income (Subtract line 10 from line 9).........................................................11.

.00

,

,

12. Gross Tax Due (Multiply line 11 by .0398).....................................................................12.

13. Credit from overpayment of prior year or tax previously paid

.00

,

,

with an extension coupon...............................................................................................13.

14. TAX DUE If Line 12 is greater than Line 13, enter the difference here

.00

,

,

and on the PAYMENT COUPON provided....................................................................14.

OVERPAYMENT OPTIONS If Line 12 is less than Line 13, enter the amount to be:

.00

,

,

15A. REFUNDED. Do not file a separate Refund Petition..............................................15A.

OR

.00

,

,

15B. APPLIED to the 2009 School Income Tax..................................................................15B.

Under penalties of perjury, as set forth in 18 PA C.S. §§ 4902-4903 as amended, I swear that I have reviewed this return

and accompanying statements and schedules, and to the best of my knowledge and belief, they are true and complete.

Taxpayer Signature________________________________________ Date_______________________Phone #_________________________

Spouse's Signature________________________________________ Date_______________________Phone #_________________________

Preparer Signature_________________________________________ Date_______________________Phone #_________________________

4308 Internet 10-29-2008 Final

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1