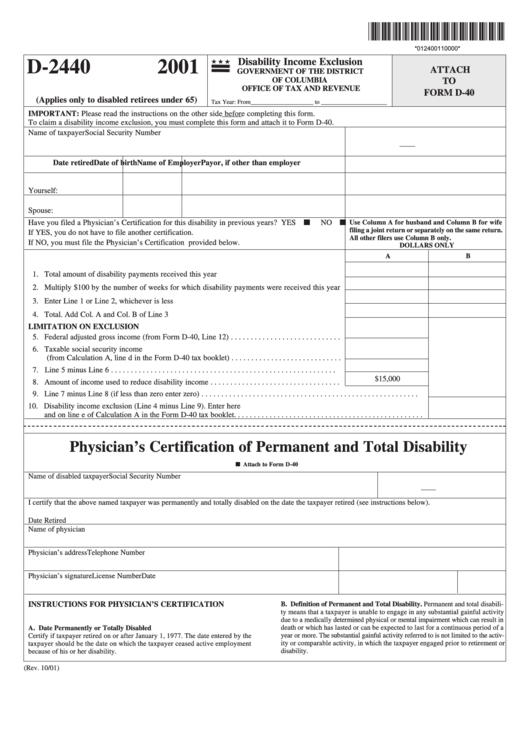

Form D-2440 - Attachment To Form D-40 - Disability Income Exclusion - 2001

ADVERTISEMENT

*012400110000*

*012400110000*

Disability Income Exclusion

D-2440

2001

ATTACH

GOVERNMENT OF THE DISTRICT

OF COLUMBIA

TO

OFFICE OF TAX AND REVENUE

FORM D-40

(Applies only to disabled retirees under 65)

Tax Year: From_____________________ to ______________________

IMPORTANT: Please read the instructions on the other side before completing this form.

To claim a disability income exclusion, you must complete this form and attach it to Form D-40.

Name of taxpayer

Social Security Number

—

—

Date retired

Date of birth

Name of Employer

Payor, if other than employer

Yourself:

Spouse:

Have you filed a Physician’s Certification for this disability in previous years? YES

NO

Use Column A for husband and Column B for wife

filing a joint return or separately on the same return.

If YES, you do not have to file another certification.

All other filers use Column B only.

If NO, you must file the Physician’s Certification provided below.

DOLLARS ONLY

A

B

1. Total amount of disability payments received this year

2. Multiply $100 by the number of weeks for which disability payments were received this year

3. Enter Line 1 or Line 2, whichever is less

4. Total. Add Col. A and Col. B of Line 3

LIMITATION ON EXCLUSION

5. Federal adjusted gross income (from Form D-40, Line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Taxable social security income

(from Calculation A, line d in the Form D-40 tax booklet) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. Line 5 minus Line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$15,000

8. Amount of income used to reduce disability income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. Line 7 minus Line 8 (if less than zero enter zero) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. Disability income exclusion (Line 4 minus Line 9). Enter here

and on line e of Calculation A in the Form D-40 tax booklet. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Physician’s Certification of Permanent and Total Disability

Attach to Form D-40

Name of disabled taxpayer

Social Security Number

—

—

I certify that the above named taxpayer was permanently and totally disabled on the date the taxpayer retired (see instructions below).

Date Retired

Name of physician

Physician’s address

Telephone Number

Physician’s signature

License Number

Date

B. Definition of Permanent and Total Disability. Permanent and total disabili-

INSTRUCTIONS FOR PHYSICIAN’S CERTIFICATION

ty means that a taxpayer is unable to engage in any substantial gainful activity

due to a medically determined physical or mental impairment which can result in

death or which has lasted or can be expected to last for a continuous period of a

A. Date Permanently or Totally Disabled

year or more. The substantial gainful activity referred to is not limited to the activ-

Certify if taxpayer retired on or after January 1, 1977. The date entered by the

ity or comparable activity, in which the taxpayer engaged prior to retirement or

taxpayer should be the date on which the taxpayer ceased active employment

disability.

because of his or her disability.

(Rev. 10/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1