1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

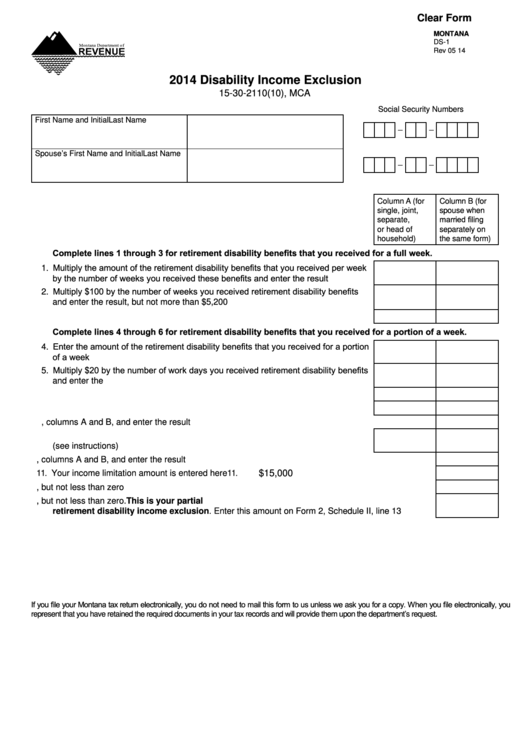

Clear Form

3

3

4

4

MONTANA

DS-1

5

5

Rev 05 14

6

6

7

7

8

8

2014 Disability Income Exclusion

9

9

15-30-2110(10), MCA

10

10

11

11

Social Security Numbers

12

12

First Name and Initial

Last Name

13

13

110

X X X X X X X X X

-

-

100

14

14

15

15

Spouse’s First Name and Initial

Last Name

16

16

-

-

130

17

120

17

18

18

19

19

20

20

Column A (for

Column B (for

21

21

single, joint,

spouse when

married filing

22

separate,

22

or head of

separately on

23

23

household)

the same form)

24

24

Complete lines 1 through 3 for retirement disability benefits that you received for a full week.

25

25

26

26

1. Multiply the amount of the retirement disability benefits that you received per week

140

150

27

27

by the number of weeks you received these benefits and enter the result ........... 1.

28

28

2. Multiply $100 by the number of weeks you received retirement disability benefits

29

29

160

170

and enter the result, but not more than $5,200 ..................................................... 2.

30

30

31

31

180

190

3. Enter the smaller of line 1 or line 2 ........................................................................ 3.

32

32

Complete lines 4 through 6 for retirement disability benefits that you received for a portion of a week.

33

33

34

4. Enter the amount of the retirement disability benefits that you received for a portion

34

200

210

35

of a week ...............................................................................................................4.

35

36

36

5. Multiply $20 by the number of work days you received retirement disability benefits

220

230

37

37

and enter the result................................................................................................5.

38

38

240

250

6. Enter the smaller of line 4 or line 5 ........................................................................ 6.

39

39

40

40

260

270

7. Add line 3 and line 6 and enter the result .............................................................. 7.

41

41

8. Add the amounts on line 7, columns A and B, and enter the result ................................................. 8.

280

42

42

9. Enter your Montana adjusted gross income before your disability income exclusion

43

43

290

300

(see instructions) ...................................................................................................9.

44

44

310

45

45

10. Add the amounts on line 9, columns A and B, and enter the result ............................................... 10.

46

46

11. Your income limitation amount is entered here ............................................................................. 11.

$15,000

320

47

47

330

12. Subtract line 11 from line 10 and enter the result, but not less than zero ...................................... 12.

48

48

49

49

13. Subtract line 12 from line 8 and enter the result, but not less than zero. This is your partial

340

50

50

retirement disability income exclusion. Enter this amount on Form 2, Schedule II, line 13 ..... 13.

51

51

52

52

53

53

54

54

55

55

56

56

57

57

58

58

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically, you

59

59

60

represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

60

61

61

62

62

63

63

64

64

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84 85

66

66

1

1 2

2