Senior Citizen Or Disabled Veteran Property Tax Exemption Applicaton - 2016

ADVERTISEMENT

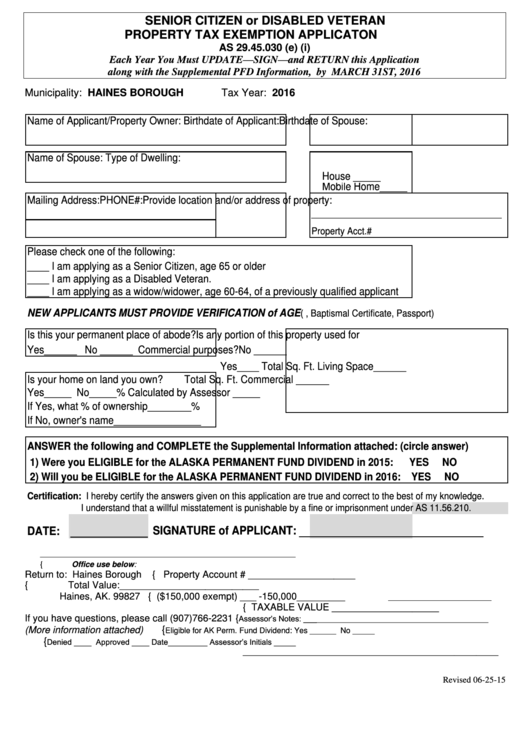

SENIOR CITIZEN or DISABLED VETERAN

PROPERTY TAX EXEMPTION APPLICATON

AS 29.45.030 (e) (i)

Each Year You Must UPDATE—SIGN—and RETURN this Application

along with the Supplemental PFD Information, by MARCH 31ST, 2016

Municipality: HAINES BOROUGH

Tax Year: 2016

Name of Applicant/Property Owner:

Birthdate of Applicant: Birthdate of Spouse:

Name of Spouse:

Type of Dwelling:

House _____

Mobile Home_____

Mailing Address:

PHONE#:

Provide location and/or address of property:

_______________________________________

Property Acct.#

Please check one of the following:

____ I am applying as a Senior Citizen, age 65 or older

____ I am applying as a Disabled Veteran.

____ I am applying as a widow/widower, age 60-64, of a previously qualified applicant

NEW APPLICANTS MUST PROVIDE VERIFICATION of AGE

(i.e. Birth Certificate, Baptismal Certificate, Passport)

Is this your permanent place of abode?

Is any portion of this property used for

Yes______ No ______

Commercial purposes?

No ______

Yes____ Total Sq. Ft. Living Space______

Is your home on land you own?

Total Sq. Ft. Commercial ______

Yes_____ No_____

% Calculated by Assessor _____

If Yes, what % of ownership________%

If No, owner's name________________

ANSWER the following and COMPLETE the Supplemental Information attached: (circle answer)

1) Were you ELIGIBLE for the ALASKA PERMANENT FUND DIVIDEND in 2015:

YES

NO

2) Will you be ELIGIBLE for the ALASKA PERMANENT FUND DIVIDEND in 2016: YES

NO

Certification: I hereby certify the answers given on this application are true and correct to the best of my knowledge.

I understand that a willful misstatement is punishable by a fine or imprisonment under AS 11.56.210.

DATE: ______________ SIGNATURE of APPLICANT:

_______________________________

__________________________________________________________

{Office use below:

Return to: Haines Borough

{

Property Account # ____________________

P.O. Box 1209

{

Total Value:__________________________

Haines, AK. 99827

{

($150,000 exempt) ___ -150,000_________

{

TAXABLE VALUE ____________________

If you have questions, please call (907)766-2231

{

Assessor’s Notes: __________________________________________

{

(More information attached)

Eligible for AK Perm. Fund Dividend: Yes ______ No _____

{

Denied ____ Approved ____ Date_________ Assessor’s Initials _____

__________________________________________________________

Revised 06-25-15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2