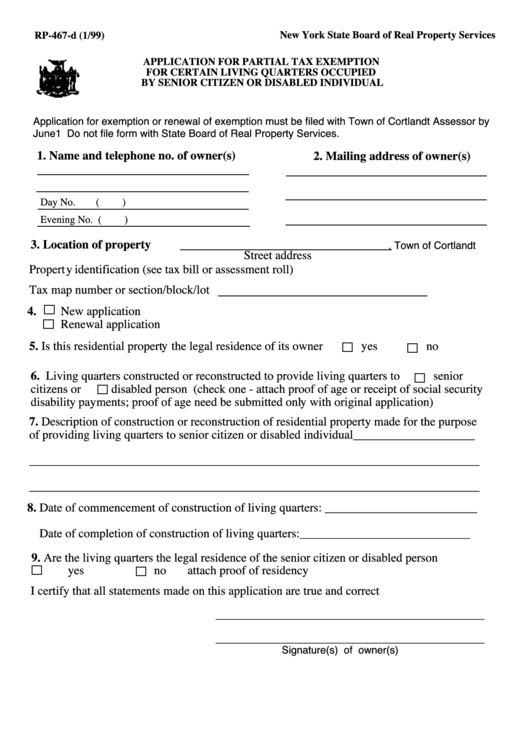

Form Rp-467-D - Application For Partial Tax Exemption For Certain Living Quarters Occupied By Senior Citizen Or Disabled Individual

ADVERTISEMENT

New York State Board of Real Property Services

RP-467-d (1/99)

APPLICATION FOR PARTIAL TAX EXEMPTION

FOR CERTAIN LIVING QUARTERS OCCUPIED

BY SENIOR CITIZEN OR DISABLED INDIVIDUAL

Application for exemption or renewal of exemption must be filed with Town of Cortlandt Assessor by

June1 Do not file form with State Board of Real Property Services.

1. Name and telephone no. of owner(s)

2. Mailing address of owner(s)

Day No.

(

)

Evening No. (

)

3. Location of property

, Town of Cortlandt

Street address

Property identification (see tax bill or assessment roll)

Tax map number or section/block/lot

4.

New application

Renewal application

5. Is this residential property the legal residence of its owner

yes

no

6. Living quarters constructed or reconstructed to provide living quarters to

senior

citizens or

disabled person (check one - attach proof of age or receipt of social security

disability payments; proof of age need be submitted only with original application)

7. Description of construction or reconstruction of residential property made for the purpose

of providing living quarters to senior citizen or disabled individual____________________

__________________________________________________________________________

__________________________________________________________________________

8. Date of commencement of construction of living quarters: _________________________

Date of completion of construction of living quarters:____________________________

9. Are the living quarters the legal residence of the senior citizen or disabled person

yes

no

attach proof of residency

I certify that all statements made on this application are true and correct

_______________________________________________

_______________________________________________

Signature(s) of owner(s)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1