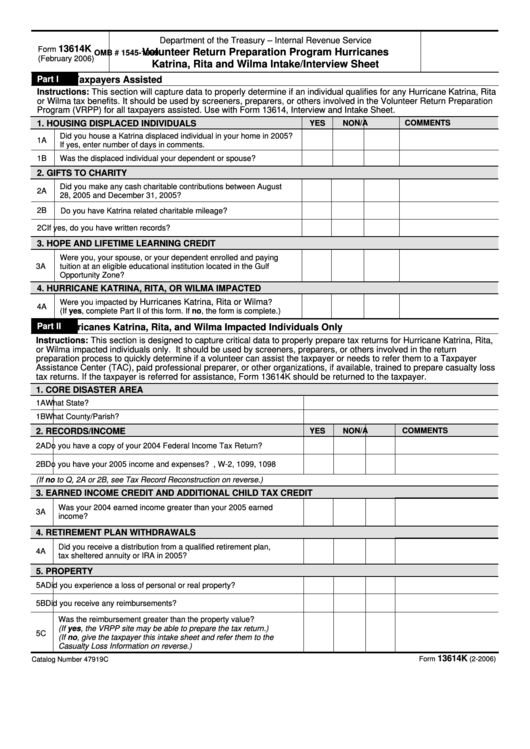

Department of the Treasury – Internal Revenue Service

13614K

Form

Volunteer Return Preparation Program Hurricanes

OMB # 1545-1999

(February 2006)

Katrina, Rita and Wilma Intake/Interview Sheet

Part I

All Taxpayers Assisted

Instructions: This section will capture data to properly determine if an individual qualifies for any Hurricane Katrina, Rita

or Wilma tax benefits. It should be used by screeners, preparers, or others involved in the Volunteer Return Preparation

Program (VRPP) for all taxpayers assisted. Use with Form 13614, Interview and Intake Sheet.

1. HOUSING DISPLACED INDIVIDUALS

N/A

COMMENTS

YES

NO

Did you house a Katrina displaced individual in your home in 2005?

1A

If yes, enter number of days in comments.

1B

Was the displaced individual your dependent or spouse?

2. GIFTS TO CHARITY

Did you make any cash charitable contributions between August

2A

28, 2005 and December 31, 2005?

2B

Do you have Katrina related charitable mileage?

2C

If yes, do you have written records?

3. HOPE AND LIFETIME LEARNING CREDIT

Were you, your spouse, or your dependent enrolled and paying

tuition at an eligible educational institution located in the Gulf

3A

Opportunity Zone?

4. HURRICANE KATRINA, RITA, OR WILMA IMPACTED

Hurricanes Katrina, Rita or Wilma

Were you impacted by

?

4A

(If yes, complete Part II of this form. If no, the form is complete.)

Part II

Hurricanes Katrina, Rita, and Wilma Impacted Individuals Only

Instructions: This section is designed to capture critical data to properly prepare tax returns for Hurricane Katrina, Rita,

or Wilma impacted individuals only. It should be used by screeners, preparers, or others involved in the return

preparation process to quickly determine if a volunteer can assist the taxpayer or needs to refer them to a Taxpayer

Assistance Center (TAC), paid professional preparer, or other organizations, if available, trained to prepare casualty loss

tax returns. If the taxpayer is referred for assistance, Form 13614K should be returned to the taxpayer.

1. CORE DISASTER AREA

1A

What State?

1B

What County/Parish?

2. RECORDS/INCOME

YES

NO

N/A

COMMENTS

2A

Do you have a copy of your 2004 Federal Income Tax Return?

2B

Do you have your 2005 income and expenses? i.e., W-2, 1099, 1098

(If no to Q, 2A or 2B, see Tax Record Reconstruction on reverse.)

3. EARNED INCOME CREDIT AND ADDITIONAL CHILD TAX CREDIT

Was your 2004 earned income greater than your 2005 earned

3A

income?

4. RETIREMENT PLAN WITHDRAWALS

Did you receive a distribution from a qualified retirement plan,

4A

tax sheltered annuity or IRA in 2005?

5. PROPERTY

5A

Did you experience a loss of personal or real property?

5B

Did you receive any reimbursements?

Was the reimbursement greater than the property value?

(If yes, the VRPP site may be able to prepare the tax return.)

5C

(If no, give the taxpayer this intake sheet and refer them to the

Casualty Loss Information on reverse.)

13614K

Form

(2-2006)

Catalog Number 47919C

1

1 2

2