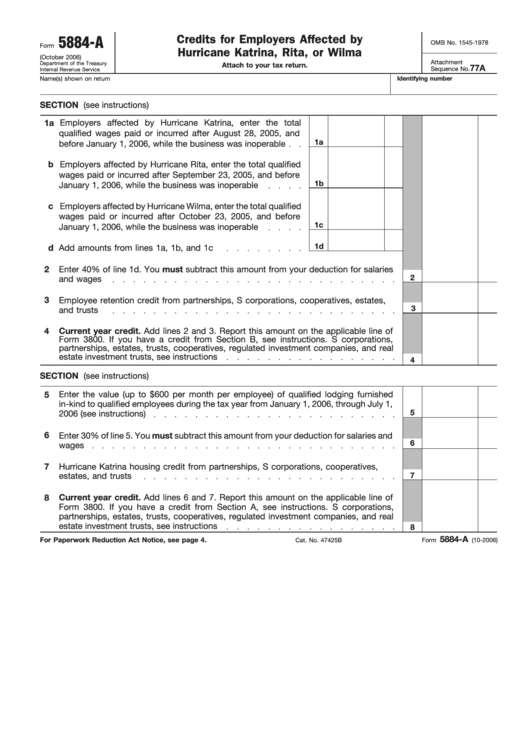

Credits for Employers Affected by

5884-A

OMB No. 1545-1978

Form

Hurricane Katrina, Rita, or Wilma

(October 2006)

Attachment

Department of the Treasury

Attach to your tax return.

77A

Sequence No.

Internal Revenue Service

Name(s) shown on return

Identifying number

SECTION A. Employee Retention Credit (see instructions)

1a Employers affected by Hurricane Katrina, enter the total

qualified wages paid or incurred after August 28, 2005, and

1a

before January 1, 2006, while the business was inoperable

b Employers affected by Hurricane Rita, enter the total qualified

wages paid or incurred after September 23, 2005, and before

1b

January 1, 2006, while the business was inoperable

c Employers affected by Hurricane Wilma, enter the total qualified

wages paid or incurred after October 23, 2005, and before

1c

January 1, 2006, while the business was inoperable

1d

d

Add amounts from lines 1a, 1b, and 1c

2

Enter 40% of line 1d. You must subtract this amount from your deduction for salaries

2

and wages

3

Employee retention credit from partnerships, S corporations, cooperatives, estates,

3

and trusts

Current year credit. Add lines 2 and 3. Report this amount on the applicable line of

4

Form 3800. If you have a credit from Section B, see instructions. S corporations,

partnerships, estates, trusts, cooperatives, regulated investment companies, and real

estate investment trusts, see instructions

4

SECTION B. Hurricane Katrina Housing Credit (see instructions)

Enter the value (up to $600 per month per employee) of qualified lodging furnished

5

in-kind to qualified employees during the tax year from January 1, 2006, through July 1,

5

2006 (see instructions)

6

Enter 30% of line 5. You must subtract this amount from your deduction for salaries and

6

wages

7

Hurricane Katrina housing credit from partnerships, S corporations, cooperatives,

estates, and trusts

7

Current year credit. Add lines 6 and 7. Report this amount on the applicable line of

8

Form 3800. If you have a credit from Section A, see instructions. S corporations,

partnerships, estates, trusts, cooperatives, regulated investment companies, and real

estate investment trusts, see instructions

8

5884-A

For Paperwork Reduction Act Notice, see page 4.

Cat. No. 47425B

Form

(10-2006)

1

1