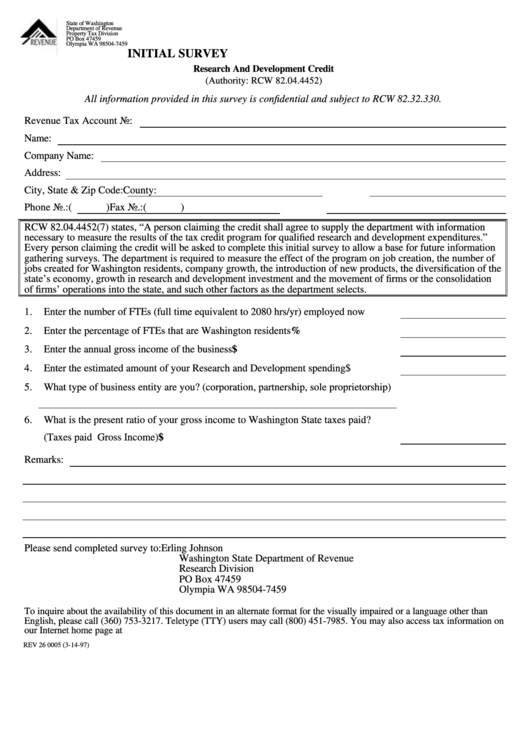

Form Rev 26 0005 - Initial Survey

ADVERTISEMENT

State of Washington

Department of Revenue

Property Tax Division

PO Box 47459

Olympia WA 98504-7459

INITIAL SURVEY

Research And Development Credit

(Authority: RCW 82.04.4452)

All information provided in this survey is confidential and subject to RCW 82.32.330.

Revenue Tax Account No:

Name:

Company Name:

Address:

City, State & Zip Code:

County:

Phone No.:

(

)

Fax No.: (

)

RCW 82.04.4452(7) states, “A person claiming the credit shall agree to supply the department with information

necessary to measure the results of the tax credit program for qualified research and development expenditures.”

Every person claiming the credit will be asked to complete this initial survey to allow a base for future information

gathering surveys. The department is required to measure the effect of the program on job creation, the number of

jobs created for Washington residents, company growth, the introduction of new products, the diversification of the

state’s economy, growth in research and development investment and the movement of firms or the consolidation

of firms’ operations into the state, and such other factors as the department selects.

1.

Enter the number of FTEs (full time equivalent to 2080 hrs/yr) employed now ...........

2.

Enter the percentage of FTEs that are Washington residents....................................... %

3.

Enter the annual gross income of the business............................................................. $

4.

Enter the estimated amount of your Research and Development spending................... $

5.

What type of business entity are you? (corporation, partnership, sole proprietorship)

6.

What is the present ratio of your gross income to Washington State taxes paid?

÷

(Taxes paid

Gross Income)........................................................................................ $

Remarks:

Please send completed survey to:

Erling Johnson

Washington State Department of Revenue

Research Division

PO Box 47459

Olympia WA 98504-7459

To inquire about the availability of this document in an alternate format for the visually impaired or a language other than

English, please call (360) 753-3217. Teletype (TTY) users may call (800) 451-7985. You may also access tax information on

our Internet home page at

REV 26 0005 (3-14-97)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1