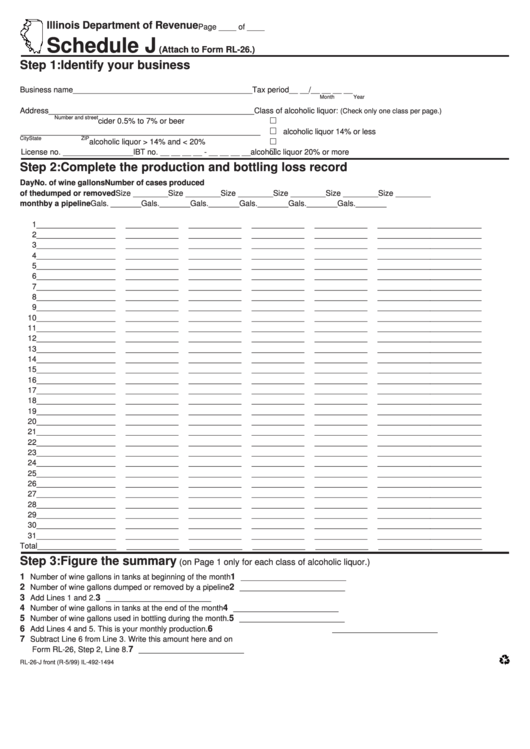

Form Rl-26-J - Schedule J(Attach To Form Rl-26.)

ADVERTISEMENT

Illinois Department of Revenue

Page ____ of ____

Schedule J

(Attach to Form RL-26.)

Step 1: Identify your business

Business name

_________________________________________

Tax period

__ __/__ __ __ __

Month

Year

Address _______________________________________________

Class of alcoholic liquor:

(Check only one class per page.)

Number and street

cider 0.5% to 7% or beer

______________________________________________________

alcoholic liquor 14% or less

City

State

ZIP

alcoholic liquor > 14% and < 20%

License no. ________________

IBT no. __ __ __ __ - __ __ __ __

alcoholic liquor 20% or more

Step 2: Complete the production and bottling loss record

Day

No. of wine gallons

Number of cases produced

of the

dumped or removed

Size ________

Size ________

Size ________

Size ________

Size ________

Size ________

month

by a pipeline

Gals . _______

Gals. _______

Gals. _______

Gals. _______

Gals. _______

Gals. _______

1

__________________

____________

____________

____________

____________

____________

___________

2

__________________

____________

____________

____________

____________

____________

___________

3

__________________

____________

____________

____________

____________

____________

___________

4

__________________

____________

____________

____________

____________

____________

___________

5

__________________

____________

____________

____________

____________

____________

___________

6

__________________

____________

____________

____________

____________

____________

___________

7

__________________

____________

____________

____________

____________

____________

___________

8

__________________

____________

____________

____________

____________

____________

___________

9

__________________

____________

____________

____________

____________

____________

___________

10

__________________

____________

____________

____________

____________

____________

___________

11

__________________

____________

____________

____________

____________

____________

___________

12

__________________

____________

____________

____________

____________

____________

___________

13

__________________

____________

____________

____________

____________

____________

___________

14

__________________

____________

____________

____________

____________

____________

___________

15

__________________

____________

____________

____________

____________

____________

___________

16

__________________

____________

____________

____________

____________

____________

___________

17

__________________

____________

____________

____________

____________

____________

___________

18

__________________

____________

____________

____________

____________

____________

___________

19

__________________

____________

____________

____________

____________

____________

___________

20

__________________

____________

____________

____________

____________

____________

___________

21

__________________

____________

____________

____________

____________

____________

___________

22

__________________

____________

____________

____________

____________

____________

___________

23

__________________

____________

____________

____________

____________

____________

___________

24

__________________

____________

____________

____________

____________

____________

___________

25

__________________

____________

____________

____________

____________

____________

___________

26

__________________

____________

____________

____________

____________

____________

___________

27

__________________

____________

____________

____________

____________

____________

___________

28

__________________

____________

____________

____________

____________

____________

___________

29

__________________

____________

____________

____________

____________

____________

___________

30

__________________

____________

____________

____________

____________

____________

___________

31

__________________

____________

____________

____________

____________

____________

___________

Total

__________________

____________

____________

____________

____________

____________

___________

Step 3: Figure the summary

(on Page 1 only for each class of alcoholic liquor.)

1

1

Number of wine gallons in tanks at beginning of the month

________________________

2

2

Number of wine gallons dumped or removed by a pipeline

________________________

3

3

Add Lines 1 and 2.

________________________

4

4

Number of wine gallons in tanks at the end of the month

________________________

5

5

Number of wine gallons used in bottling during the month.

________________________

6

6

Add Lines 4 and 5. This is your monthly production.

________________________

7

Subtract Line 6 from Line 3. Write this amount here and on

7

Form RL-26, Step 2, Line 8.

________________________

RL-26-J front (R-5/99) IL-492-1494

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1