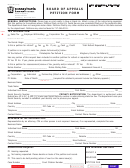

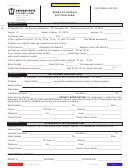

Administrative Appeal Petition Form - York Adams Tax Bureau

ADVERTISEMENT

York Adams Tax Bureau

York Office

Gettysburg Office

1415 N. Duke St.

900 Biglerville Road

PO Box 15627

PO Box 4374

York, PA 17405-0156

Gettysburg, PA 17325

Phone (717) 845-1584

Phone (717) 334-4000

Fax (717) 854-6376

Fax (717) 337-2565

email:

ADMINISTRATIVE APPEAL PETITION

The York Adams Tax Bureau has established and provides for an administrative

process to receive and produce a determination on petitions from taxpayers pertaining

to the assessment, determination or refund of an eligible tax. This Bureau’s

administrative process consists of the provision for a hearing and decision by a

hearing officer who shall be the Bureau Administrator, or the Administrator’s

authorized representative who is appointed by the Bureau’s Board of Directors.

In the case of an “assessment and collection of underpayment of the tax,” this

Bureau’s provisions within Section 16 of the Bureau’s Rules and Regulations shall

govern to resolve the appeal.

Deadlines for filing of a timely petition are as follows (when received by mail, the date

of the filing is determined by the United States Postal Service, or other mail service,

postmark):

1.

Refund petitions must be filed within three (3) years after the due date

for filing the tax returns as extended, or one (1) year after the actual

payment of the tax, whichever is later.

2.

Petitions for reassessment of an eligible tax shall be filed within ninety

(90) days of the date of the assessment. The form and content of the

petition shall be in conformity with the Bureau’s adopted regulations

specifying the form and content of petitions, including the process and

deadlines. These regulations shall not be governed by 2 Pa. C.S Chapter

5, subchapter B (relating to judicial review of local agencies), since the

Bureau has adopted regulations governing practice and procedure under

PA Act 50, approved May 5, 1998.

3.

Mail or present this Administrative Appeal Petition form, when

completed, to the address on this letterhead c/o the Bureau

Administrator.

A mutually agreeable time and date shall be scheduled during normal Bureau office

hours for the purpose of conducting a hearing at the Bureau office.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2