Form It-9 - 2008 Application For Extension Of Time To File Indiana Form It-40 Or Form It-40pnr

ADVERTISEMENT

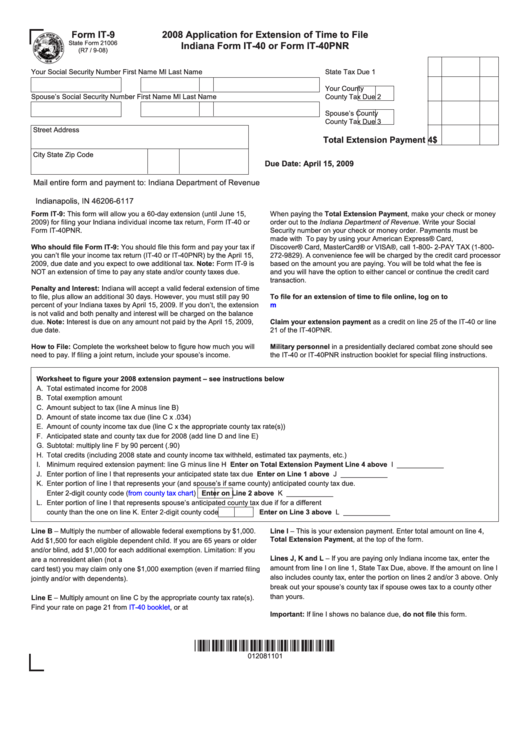

Form IT-9

2008 Application for Extension of Time to File

State Form 21006

Indiana Form IT-40 or Form IT-40PNR

(R7 / 9-08)

Your Social Security Number

First Name

MI

Last Name

State Tax Due

1

Your

County

Spouse’s Social Security Number

First Name

MI

Last Name

County

Tax Due

2

Spouse’s

County

County

Tax Due

3

Street Address

Total Extension Payment 4$

City

State

Zip Code

Due Date: April 15, 2009

Mail entire form and payment to: Indiana Department of Revenue

P.O. Box 6117

Indianapolis, IN 46206-6117

Form IT-9: This form will allow you a 60-day extension (until June 15,

When paying the Total Extension Payment, make your check or money

2009) for filing your Indiana individual income tax return, Form IT-40 or

order out to the Indiana Department of Revenue. Write your Social

Form IT-40PNR.

Security number on your check or money order. Payments must be

made with U.S. funds.

To pay by using your American Express® Card,

Who should file Form IT-9: You should file this form and pay your tax if

Discover® Card, MasterCard® or VISA®, call 1-800- 2-PAY TAX (1-800-

you can’t file your income tax return (IT-40 or IT-40PNR) by the April 15,

272-9829). A convenience fee will be charged by the credit card processor

2009, due date and you expect to owe additional tax. Note: Form IT-9 is

based on the amount you are paying. You will be told what the fee is

NOT an extension of time to pay any state and/or county taxes due.

and you will have the option to either cancel or continue the credit card

transaction.

Penalty and Interest: Indiana will accept a valid federal extension of time

to file, plus allow an additional 30 days. However, you must still pay 90

To file for an extension of time to file online, log on to

percent of your Indiana taxes by April 15, 2009. If you don’t, the extension

is not valid and both penalty and interest will be charged on the balance

due. Note: Interest is due on any amount not paid by the April 15, 2009,

Claim your extension payment as a credit on line 25 of the IT-40 or line

due date.

21 of the IT-40PNR.

How to File: Complete the worksheet below to figure how much you will

Military personnel in a presidentially declared combat zone should see

need to pay. If filing a joint return, include your spouse’s income.

the IT-40 or IT-40PNR instruction booklet for special filing instructions.

Worksheet to figure your 2008 extension payment – see instructions below

A.

Total estimated income for 2008 ..................................................................................................................................................... A ____________

B.

Total exemption amount .................................................................................................................................................................. B ____________

C.

Amount subject to tax (line A minus line B) ..................................................................................................................................... C ____________

D.

Amount of state income tax due (line C x .034) .............................................................................................................................. D ____________

E.

Amount of county income tax due (line C x the appropriate county tax rate(s)) .............................................................................. E ____________

F.

Anticipated state and county tax due for 2008 (add line D and line E) ............................................................................................. F ____________

G.

Subtotal: multiply line F by 90 percent (.90) .................................................................................................................................... G ____________

H.

Total credits (including 2008 state and county income tax withheld, estimated tax payments, etc.) ............................................... H ____________

I.

Minimum required extension payment: line G minus line H .......................... Enter on Total Extension Payment Line 4 above I ____________

J.

Enter portion of line I that represents your anticipated state tax due ........................................................ Enter on Line 1 above J ____________

K.

Enter portion of line I that represents your (and spouse’s if same county) anticipated county tax due.

Enter 2-digit county code

(from county tax

chart)

................................................................. Enter on Line 2 above K ____________

L.

Enter portion of line I that represents spouse’s anticipated county tax due if for a different

....................................................... Enter on Line 3 above L ____________

county than the one on line K. Enter 2-digit county code

Line B – Multiply the number of allowable federal exemptions by $1,000.

Line I – This is your extension payment. Enter total amount on line 4,

Total Extension Payment, at the top of the form.

Add $1,500 for each eligible dependent child. If you are 65 years or older

and/or blind, add $1,000 for each additional exemption. Limitation: If you

Lines J, K and L – If you are paying only Indiana income tax, enter the

are a nonresident alien (not a U.S. citizen and does not meet the green

amount from line I on line 1, State Tax Due, above. If the amount on line I

card test) you may claim only one $1,000 exemption (even if married filing

also includes county tax, enter the portion on lines 2 and/or 3 above. Only

jointly and/or with dependents).

break out your spouse’s county tax if spouse owes tax to a county other

than yours.

Line E – Multiply amount on line C by the appropriate county tax rate(s).

Find your rate on page 21 from

IT-40

booklet, or at

Important: If line I shows no balance due, do not file this form.

*012081101*

012081101

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1