Reset Form

Print Form

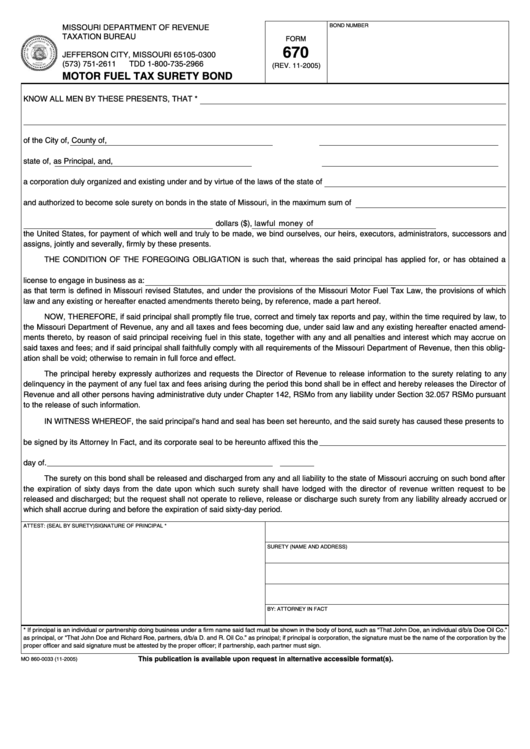

BOND NUMBER

MISSOURI DEPARTMENT OF REVENUE

TAXATION BUREAU

FORM

P.O. BOX 300

670

JEFFERSON CITY, MISSOURI 65105-0300

(573) 751-2611

TDD 1-800-735-2966

(REV. 11-2005)

MOTOR FUEL TAX SURETY BOND

KNOW ALL MEN BY THESE PRESENTS, THAT *

of the City of

, County of

,

state of

, as Principal, and

,

a corporation duly organized and existing under and by virtue of the laws of the state of

and authorized to become sole surety on bonds in the state of Missouri, in the maximum sum of

dollars ($

), lawful money of

the United States, for payment of which well and truly to be made, we bind ourselves, our heirs, executors, administrators, successors and

assigns, jointly and severally, firmly by these presents.

THE CONDITION OF THE FOREGOING OBLIGATION is such that, whereas the said principal has applied for, or has obtained a

license to engage in business as a:

as that term is defined in Missouri revised Statutes, and under the provisions of the Missouri Motor Fuel Tax Law, the provisions of which

law and any existing or hereafter enacted amendments thereto being, by reference, made a part hereof.

NOW, THEREFORE, if said principal shall promptly file true, correct and timely tax reports and pay, within the time required by law, to

the Missouri Department of Revenue, any and all taxes and fees becoming due, under said law and any existing hereafter enacted amend-

ments thereto, by reason of said principal receiving fuel in this state, together with any and all penalties and interest which may accrue on

said taxes and fees; and if said principal shall faithfully comply with all requirements of the Missouri Department of Revenue, then this oblig-

ation shall be void; otherwise to remain in full force and effect.

The principal hereby expressly authorizes and requests the Director of Revenue to release information to the surety relating to any

delinquency in the payment of any fuel tax and fees arising during the period this bond shall be in effect and hereby releases the Director of

Revenue and all other persons having administrative duty under Chapter 142, RSMo from any liability under Section 32.057 RSMo pursuant

to the release of such information.

IN WITNESS WHEREOF, the said principal’s hand and seal has been set hereunto, and the said surety has caused these presents to

be signed by its Attorney In Fact, and its corporate seal to be hereunto affixed this the

day of

.

The surety on this bond shall be released and discharged from any and all liability to the state of Missouri accruing on such bond after

the expiration of sixty days from the date upon which such surety shall have lodged with the director of revenue written request to be

released and discharged; but the request shall not operate to relieve, release or discharge such surety from any liability already accrued or

which shall accrue during and before the expiration of said sixty-day period.

ATTEST: (SEAL BY SURETY)

SIGNATURE OF PRINCIPAL *

SURETY (NAME AND ADDRESS)

BY: ATTORNEY IN FACT

* If principal is an individual or partnership doing business under a firm name said fact must be shown in the body of bond, such as “That John Doe, an individual d/b/a Doe Oil Co.”

as principal, or “That John Doe and Richard Roe, partners, d/b/a D. and R. Oil Co.” as principal; if principal is corporation, the signature must be the name of the corporation by the

proper officer and said signature must be attested by the proper officer; if partnership, each partner must sign.

This publication is available upon request in alternative accessible format(s).

MO 860-0033 (11-2005)

1

1