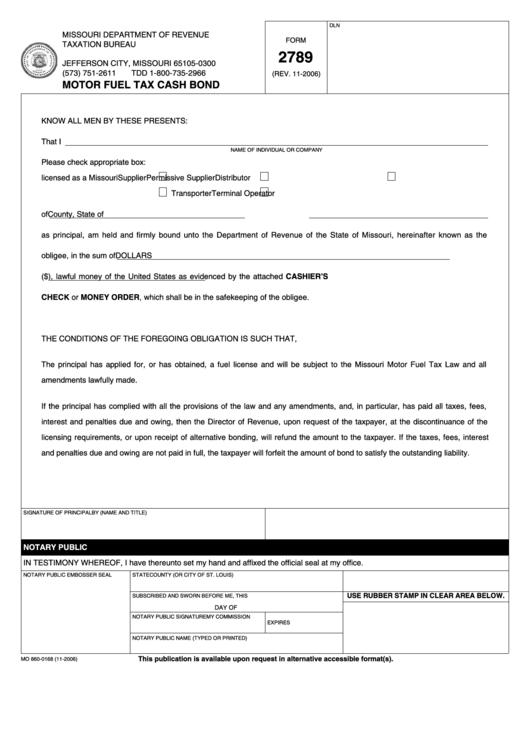

DLN

Reset Form

Print Form

MISSOURI DEPARTMENT OF REVENUE

FORM

TAXATION BUREAU

P.O. BOX 300

2789

JEFFERSON CITY, MISSOURI 65105-0300

(573) 751-2611

TDD 1-800-735-2966

(REV. 11-2006)

MOTOR FUEL TAX CASH BOND

KNOW ALL MEN BY THESE PRESENTS:

That I

NAME OF INDIVIDUAL OR COMPANY

Please check appropriate box:

licensed as a Missouri

Supplier

Permissive Supplier

Distributor

Transporter

Terminal Operator

of

County, State of

as principal, am held and firmly bound unto the Department of Revenue of the State of Missouri, hereinafter known as the

obligee, in the sum of

DOLLARS

($

), lawful money of the United States as evidenced by the attached CASHIER’S

CHECK or MONEY ORDER, which shall be in the safekeeping of the obligee.

THE CONDITIONS OF THE FOREGOING OBLIGATION IS SUCH THAT,

The principal has applied for, or has obtained, a fuel license and will be subject to the Missouri Motor Fuel Tax Law and all

amendments lawfully made.

If the principal has complied with all the provisions of the law and any amendments, and, in particular, has paid all taxes, fees,

interest and penalties due and owing, then the Director of Revenue, upon request of the taxpayer, at the discontinuance of the

licensing requirements, or upon receipt of alternative bonding, will refund the amount to the taxpayer. If the taxes, fees, interest

and penalties due and owing are not paid in full, the taxpayer will forfeit the amount of bond to satisfy the outstanding liability.

SIGNATURE OF PRINCIPAL

BY (NAME AND TITLE)

NOTARY PUBLIC

IN TESTIMONY WHEREOF, I have thereunto set my hand and affixed the official seal at my office.

NOTARY PUBLIC EMBOSSER SEAL

STATE

COUNTY (OR CITY OF ST. LOUIS)

USE RUBBER STAMP IN CLEAR AREA BELOW.

SUBSCRIBED AND SWORN BEFORE ME, THIS

DAY OF

NOTARY PUBLIC SIGNATURE

MY COMMISSION

EXPIRES

NOTARY PUBLIC NAME (TYPED OR PRINTED)

This publication is available upon request in alternative accessible format(s).

MO 860-0168 (11-2006)

1

1