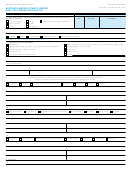

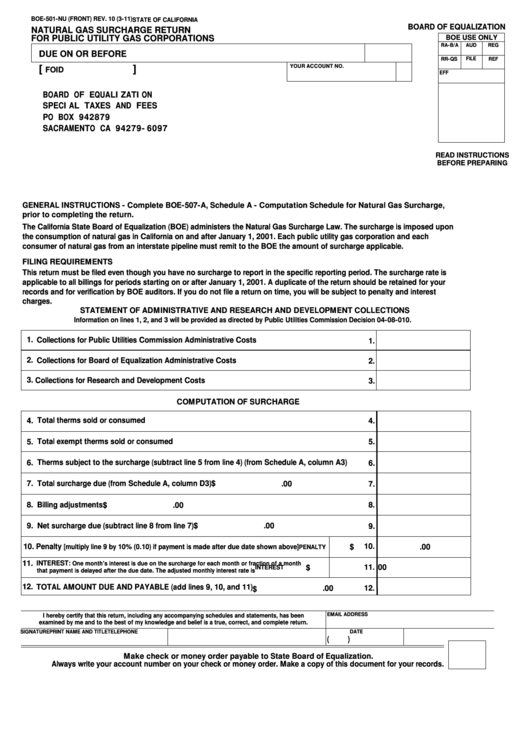

BOE-501-NU (FRONT) REV. 10 (3-11)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

NATURAL GAS SURCHARGE RETURN

FOR PUBLIC UTILITY GAS CORPORATIONS

BOE USE ONLY

RA-B/A

AUD

REG

DUE ON OR BEFORE

RR-QS

FILE

REF

YOUR ACCOUNT NO.

[

]

FOID

EFF

BOARD OF EQUALIZATION

SPECIAL TAXES AND FEES

PO BOX 942879

SACRAMENTO CA 94279-6097

READ INSTRUCTIONS

BEFORE PREPARING

GENERAL INSTRUCTIONS - Complete BOE-507-A, Schedule A - Computation Schedule for Natural Gas Surcharge,

prior to completing the return.

The California State Board of Equalization (BOE) administers the Natural Gas Surcharge Law. The surcharge is imposed upon

the consumption of natural gas in California on and after January 1, 2001. Each public utility gas corporation and each

consumer of natural gas from an interstate pipeline must remit to the BOE the amount of surcharge applicable.

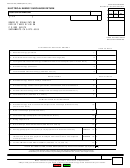

FILING REQUIREMENTS

This return must be filed even though you have no surcharge to report in the specific reporting period. The surcharge rate is

applicable to all billings for periods starting on or after January 1, 2001. A duplicate of the return should be retained for your

records and for verification by BOE auditors. If you do not file a return on time, you will be subject to penalty and interest

charges.

STATEMENT OF ADMINISTRATIVE AND RESEARCH AND DEVELOPMENT COLLECTIONS

Information on lines 1, 2, and 3 will be provided as directed by Public Utilities Commission Decision 04-08-010.

1. Collections for Public Utilities Commission Administrative Costs

1.

2. Collections for Board of Equalization Administrative Costs

2.

3. Collections for Research and Development Costs

3.

COMPUTATION OF SURCHARGE

4. Total therms sold or consumed

4.

5. Total exempt therms sold or consumed

5.

6. Therms subject to the surcharge (subtract line 5 from line 4) (from Schedule A, column A3)

6.

7. Total surcharge due (from Schedule A, column D3)

7.

$

.00

8. Billing adjustments

8.

$

.00

9. Net surcharge due (subtract line 8 from line 7)

$

.00

9.

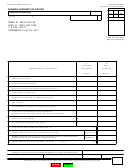

10. Penalty

10.

$

.00

[multiply line 9 by 10% (0.10) if payment is made after due date shown above]

PENALTY

11.

INTEREST:

One month's interest is due on the surcharge for each month or fraction of a month

11.

.00

$

INTEREST

that payment is delayed after the due date. The adjusted monthly interest rate is

12. TOTAL AMOUNT DUE AND PAYABLE (add lines 9, 10, and 11)

12.

.00

$

EMAIL ADDRESS

I hereby certify that this return, including any accompanying schedules and statements, has been

examined by me and to the best of my knowledge and belief is a true, correct, and complete return.

SIGNATURE

PRINT NAME AND TITLE

TELEPHONE

DATE

(

)

Make check or money order payable to State Board of Equalization.

Always write your account number on your check or money order. Make a copy of this document for your records.

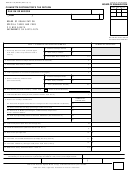

CONTINUE

1

1 2

2 3

3 4

4