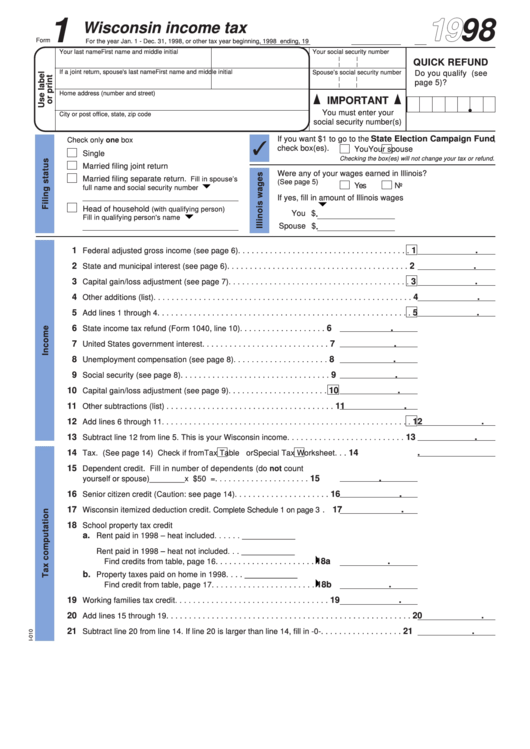

1

1998

Wisconsin income tax

Form

For the year Jan. 1 - Dec. 31, 1998, or other tax year beginning

, 1998 ending

, 19

Your last name

First name and middle initial

Your social security number

QUICK REFUND

If a joint return, spouse's last name

First name and middle initial

Spouse’s social security number

Do you qualify (see

page 5)?

Home address (number and street)

IMPORTANT

You must enter your

City or post office, state, zip code

social security number(s)

State Election Campaign Fund

If you want $1 to go to the

,

Check only one box

check box(es).

You

Your spouse

Single

Checking the box(es) will not change your tax or refund.

Married filing joint return

Were any of your wages earned in Illinois?

Married filing separate return.

Fill in spouse’s

(See page 5)

Yes

No

full name and social security number

If yes, fill in amount of Illinois wages

Head of household

(with qualifying person)

You $

.

Fill in qualifying person's name

Spouse $

.

.

1

1

Federal adjusted gross income (see page 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

2

2

State and municipal interest (see page 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

3

3

Capital gain/loss adjustment (see page 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

4

4

Other additions (list) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

5

5

Add lines 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

6

6

State income tax refund (Form 1040, line 10) . . . . . . . . . . . . . . . . . . .

.

7

7

United States government interest . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

8

8

Unemployment compensation (see page 8) . . . . . . . . . . . . . . . . . . . . .

.

9

9

Social security (see page 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

10

10

Capital gain/loss adjustment (see page 9) . . . . . . . . . . . . . . . . . . . . . .

.

11

11

Other subtractions (list) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

12

12

Add lines 6 through 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

13

13

Subtract line 12 from line 5. This is your Wisconsin income . . . . . . . . . . . . . . . . . . . . . . . . . .

.

14

14

Tax. (See page 14) Check if from

Tax Table or

Special Tax Worksheet . . .

15

Dependent credit. Fill in number of dependents (do not count

.

15

yourself or spouse)

________ x $50 = . . . . . . . . . . . . . . . . . . . . .

.

16

16

Senior citizen credit (Caution: see page 14) . . . . . . . . . . . . . . . . . . . . .

.

17

17

Wisconsin itemized deduction credit. Complete Schedule 1 on page 3 .

18

School property tax credit

a.

Rent paid in 1998 – heat included . . . . . .

____________

Rent paid in 1998 – heat not included . . .

____________

.

18a

Find credits from table, page 16 . . . . . . . . . . . . . . . . . . . . . .

b.

Property taxes paid on home in 1998 . . . .

____________

.

18b

Find credit from table, page 17 . . . . . . . . . . . . . . . . . . . . . . .

.

19

19

Working families tax credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

20

20

Add lines 15 through 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

21

21

Subtract line 20 from line 14. If line 20 is larger than line 14, fill in -0- . . . . . . . . . . . . . . . . . .

1

1 2

2 3

3