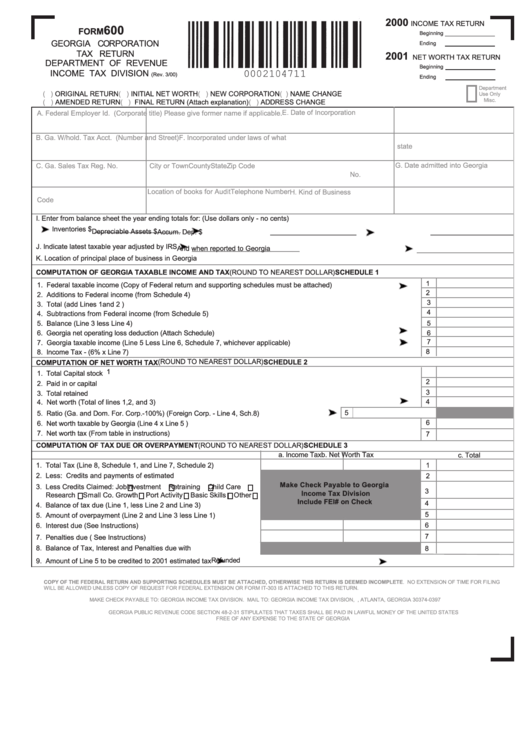

Form 600 - Georgia Corporation Tax Return - Department Of Revenue Income Tax Division 2000-2001

ADVERTISEMENT

2000

INCOME TAX RETURN

600

FORM

Beginning

GEORGIA CORPORATION

Ending

TAX RETURN

2001

NET WORTH TAX RETURN

DEPARTMENT OF REVENUE

Beginning

INCOME TAX DIVISION

(Rev. 3/00)

Ending

Department

( )

ORIGINAL RETURN

( )

INITIAL NET WORTH

( )

NEW CORPORATION

( )

NAME CHANGE

Use Only

Misc.

( )

AMENDED RETURN

( )

FINAL RETURN (Attach explanation)

( )

ADDRESS CHANGE

E. Date of Incorporation

A. Federal Employer Id. No.

Name (Corporate title) Please give former name if applicable.

B. Ga. W/hold. Tax Acct. No.

Business Address (Number and Street)

F. Incorporated under laws of what

state

G. Date admitted into Georgia

C. Ga. Sales Tax Reg. No.

City or Town

County

State

Zip Code

No.

D.Standard Industrial Classification

Location of books for Audit

Telephone Number H. Kind of Business

Code

I. Enter from balance sheet the year ending totals for: (Use dollars only - no cents)

Inventories $

Depreciable Assets $

Accum. Dep. $

J. Indicate latest taxable year adjusted by IRS

And when reported to Georgia

K. Location of principal place of business in Georgia

COMPUTATION OF GEORGIA TAXABLE INCOME AND TAX

(ROUND TO NEAREST DOLLAR)

SCHEDULE 1

1

1. Federal taxable income (Copy of Federal return and supporting schedules must be attached).............................

2

2. Additions to Federal income (from Schedule 4).......................................................................................................

3

3. Total (add Lines 1and 2 ).........................................................................................................................................

4

4. Subtractions from Federal income (from Schedule 5).............................................................................................

5. Balance (Line 3 less Line 4)....................................................................................................................................

5

6. Georgia net operating loss deduction (Attach Schedule).................................................................................................

6

7

7. Georgia taxable income (Line 5 Less Line 6, Schedule 7, whichever applicable)..................................................

8

8. Income Tax - (6% x Line 7)...............................................................................................................................................

(ROUND TO NEAREST DOLLAR)

SCHEDULE 2

COMPUTATION OF NET WORTH TAX

1

1. Total Capital stock issued......................................................................................................................................................

2

2. Paid in or capital surplus.......................................................................................................................................................

3

3. Total retained earnings...........................................................................................................................................................

4

4. Net worth (Total of lines 1,2, and 3)............................................................................................................................

5

5. Ratio (Ga. and Dom. For. Corp.-100%) (Foreign Corp. - Line 4, Sch.8).......................................

6

6. Net worth taxable by Georgia (Line 4 x Line 5 )....................................................................................................................

7. Net worth tax (From table in instructions).............................................................................................................................

7

COMPUTATION OF TAX DUE OR OVERPAYMENT

(ROUND TO NEAREST DOLLAR)

SCHEDULE 3

a. Income Tax

b. Net Worth Tax

c. Total

1. Total Tax (Line 8, Schedule 1, and Line 7, Schedule 2)......................

1

2. Less: Credits and payments of estimated tax...................................

2

Make Check Payable to Georgia

3. Less Credits Claimed: Job

Investment

Retraining

Child Care

3

Income Tax Division

Research

Small Co. Growth

Port Activity

Basic Skills

Other

Include FEI# on Check

4

4. Balance of tax due (Line 1, less Line 2 and Line 3)...........................

5. Amount of overpayment (Line 2 and Line 3 less Line 1)....................

5

6. Interest due (See Instructions)...........................................................

6

7

7. Penalties due ( See Instructions)........................................................

8. Balance of Tax, Interest and Penalties due with return......................

8

Refunded

9. Amount of Line 5 to be credited to 2001 estimated tax

COPY OF THE FEDERAL RETURN AND SUPPORTING SCHEDULES MUST BE ATTACHED, OTHERWISE THIS RETURN IS DEEMED INCOMPLETE. NO EXTENSION OF TIME FOR FILING

WILL BE ALLOWED UNLESS COPY OF REQUEST FOR FEDERAL EXTENSION OR FORM IT-303 IS ATTACHED TO THIS RETURN.

MAKE CHECK PAYABLE TO: GEORGIA INCOME TAX DIVISION. MAIL TO: GEORGIA INCOME TAX DIVISION, P.O. BOX 740397, ATLANTA, GEORGIA 30374-0397

GEORGIA PUBLIC REVENUE CODE SECTION 48-2-31 STIPULATES THAT TAXES SHALL BE PAID IN LAWFUL MONEY OF THE UNITED STATES

FREE OF ANY EXPENSE TO THE STATE OF GEORGIA

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2