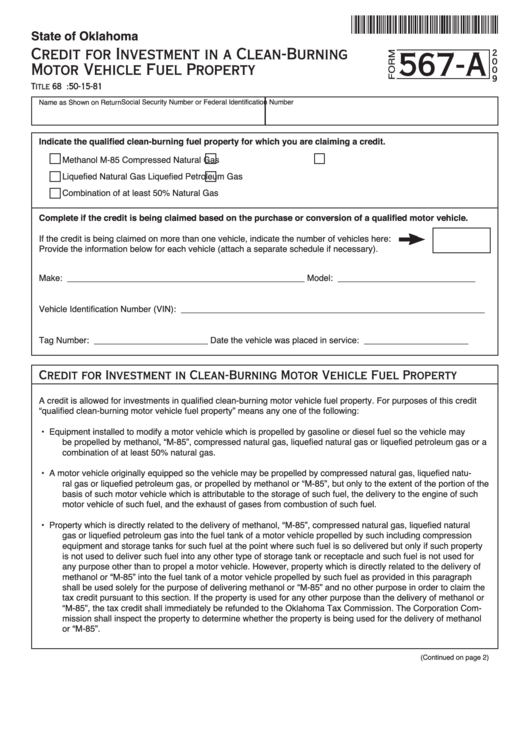

State of Oklahoma

a

Credit for Investment in a Clean-Burning

567-

2

0

Motor Vehicle Fuel Property

0

9

Title 68 O.S. Section 2357.22 and Rule 710:50-15-81

Social Security Number or Federal Identification Number

Name as Shown on Return

Indicate the qualified clean-burning fuel property for which you are claiming a credit.

Methanol

M-85

Compressed Natural Gas

Liquefied Natural Gas

Liquefied Petroleum Gas

Combination of at least 50% Natural Gas

Complete if the credit is being claimed based on the purchase or conversion of a qualified motor vehicle.

If the credit is being claimed on more than one vehicle, indicate the number of vehicles here:

Provide the information below for each vehicle (attach a separate schedule if necessary).

Make: __________________________________________________

Model: _____________________________

Vehicle Identification Number (VIN): ________________________________________________________________

Tag Number: ________________________

Date the vehicle was placed in service: ______________________

Credit for Investment in Clean-Burning Motor Vehicle Fuel Property

A credit is allowed for investments in qualified clean-burning motor vehicle fuel property. For purposes of this credit

“qualified clean-burning motor vehicle fuel property” means any one of the following:

• Equipment installed to modify a motor vehicle which is propelled by gasoline or diesel fuel so the vehicle may

be propelled by methanol, “M-85”, compressed natural gas, liquefied natural gas or liquefied petroleum gas or a

combination of at least 50% natural gas.

• A motor vehicle originally equipped so the vehicle may be propelled by compressed natural gas, liquefied natu-

ral gas or liquefied petroleum gas, or propelled by methanol or “M-85”, but only to the extent of the portion of the

basis of such motor vehicle which is attributable to the storage of such fuel, the delivery to the engine of such

motor vehicle of such fuel, and the exhaust of gases from combustion of such fuel.

• Property which is directly related to the delivery of methanol, “M-85”, compressed natural gas, liquefied natural

gas or liquefied petroleum gas into the fuel tank of a motor vehicle propelled by such including compression

equipment and storage tanks for such fuel at the point where such fuel is so delivered but only if such property

is not used to deliver such fuel into any other type of storage tank or receptacle and such fuel is not used for

any purpose other than to propel a motor vehicle. However, property which is directly related to the delivery of

methanol or “M-85” into the fuel tank of a motor vehicle propelled by such fuel as provided in this paragraph

shall be used solely for the purpose of delivering methanol or “M-85” and no other purpose in order to claim the

tax credit pursuant to this section. If the property is used for any other purpose than the delivery of methanol or

“M-85”, the tax credit shall immediately be refunded to the Oklahoma Tax Commission. The Corporation Com-

mission shall inspect the property to determine whether the property is being used for the delivery of methanol

or “M-85”.

(Continued on page 2)

1

1 2

2