Form 706me - Worksheet For Determining Estate Filing Requirement For Deaths Occurring In 2006

ADVERTISEMENT

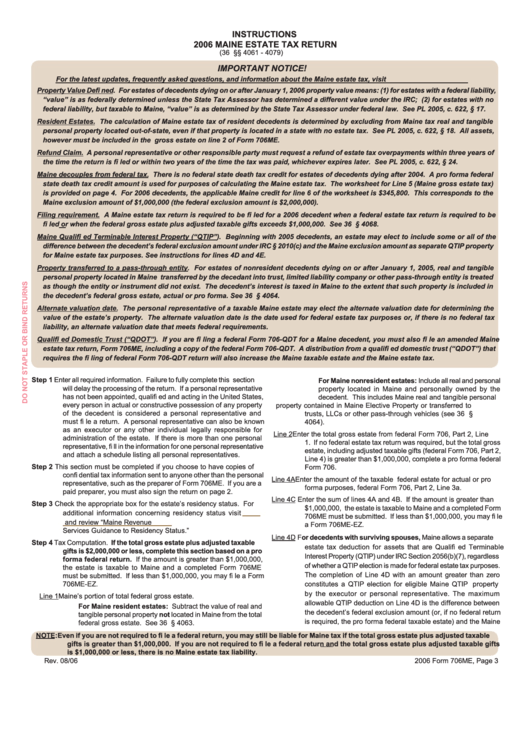

INSTRUCTIONS

2006 MAINE ESTATE TAX RETURN

(36 M.R.S.A. §§ 4061 - 4079)

IMPORTANT NOTICE!

For the latest updates, frequently asked questions, and information about the Maine estate tax, visit

Property Value Defi ned. For estates of decedents dying on or after January 1, 2006 property value means: (1) for estates with a federal liability,

“value” is as federally determined unless the State Tax Assessor has determined a different value under the IRC; (2) for estates with no

federal liability, but taxable to Maine, “value” is as determined by the State Tax Assessor under federal law. See PL 2005, c. 622, § 17.

Resident Estates. The calculation of Maine estate tax of resident decedents is determined by excluding from Maine tax real and tangible

personal property located out-of-state, even if that property is located in a state with no estate tax. See PL 2005, c. 622, § 18. All assets,

however must be included in the gross estate on line 2 of Form 706ME.

Refund Claim. A personal representative or other responsible party must request a refund of estate tax overpayments within three years of

the time the return is fi led or within two years of the time the tax was paid, whichever expires later. See PL 2005, c. 622, § 24.

Maine decouples from federal tax. There is no federal state death tax credit for estates of decedents dying after 2004. A pro forma federal

state death tax credit amount is used for purposes of calculating the Maine estate tax. The worksheet for Line 5 (Maine gross estate tax)

is provided on page 4. For 2006 decedents, the applicable Maine credit for line 6 of the worksheet is $345,800. This corresponds to the

Maine exclusion amount of $1,000,000 (the federal exclusion amount is $2,000,000).

Filing requirement. A Maine estate tax return is required to be fi led for a 2006 decedent when a federal estate tax return is required to be

fi led or when the federal gross estate plus adjusted taxable gifts exceeds $1,000,000. See 36 M.R.S.A. § 4068.

Maine Qualifi ed Terminable Interest Property (“QTIP”). Beginning with 2005 decedents, an estate may elect to include some or all of the

difference between the decedent’s federal exclusion amount under IRC § 2010(c) and the Maine exclusion amount as separate QTIP property

for Maine estate tax purposes. See instructions for lines 4D and 4E.

Property transferred to a pass-through entity. For estates of nonresident decedents dying on or after January 1, 2005, real and tangible

personal property located in Maine transferred by the decedant into trust, limited liability company or other pass-through entity is treated

as though the entity or instrument did not exist. The decedent’s interest is taxed in Maine to the extent that such property is included in

the decedent’s federal gross estate, actual or pro forma. See 36 M.R.S.A. § 4064.

Alternate valuation date. The personal representative of a taxable Maine estate may elect the alternate valuation date for determining the

value of the estate’s property. The alternate valuation date is the date used for federal estate tax purposes or, if there is no federal tax

liability, an alternate valuation date that meets federal requirements.

Qualifi ed Domestic Trust (“QDOT”). If you are fi ling a federal Form 706-QDT for a Maine decedent, you must also fi le an amended Maine

estate tax return, Form 706ME, including a copy of the federal Form 706-QDT. A distribution from a qualifi ed domestic trust (“QDOT”) that

requires the fi ling of federal Form 706-QDT return will also increase the Maine taxable estate and the Maine estate tax.

Step 1

Enter all required information. Failure to fully complete this section

For Maine nonresident estates: Include all real and personal

will delay the processing of the return. If a personal representative

property located in Maine and personally owned by the

has not been appointed, qualifi ed and acting in the United States,

decedent. This includes Maine real and tangible personal

every person in actual or constructive possession of any property

property contained in Maine Elective Property or transferred to

of the decedent is considered a personal representative and

trusts, LLCs or other pass-through vehicles (see 36 M.R.S.A. §

must fi le a return. A personal representative can also be known

4064).

as an executor or any other individual legally responsible for

Line 2

Enter the total gross estate from federal Form 706, Part 2, Line

administration of the estate. If there is more than one personal

1. If no federal estate tax return was required, but the total gross

representative, fi ll in the information for one personal representative

estate, including adjusted taxable gifts (federal Form 706, Part 2,

and attach a schedule listing all personal representatives.

Line 4) is greater than $1,000,000, complete a pro forma federal

Step 2

This section must be completed if you choose to have copies of

Form 706.

confi dential tax information sent to anyone other than the personal

Line 4A

Enter the amount of the taxable federal estate for actual or pro

representative, such as the preparer of Form 706ME. If you are a

forma purposes, federal Form 706, Part 2, Line 3a.

paid preparer, you must also sign the return on page 2.

Line 4C

Enter the sum of lines 4A and 4B. If the amount is greater than

Step 3

Check the appropriate box for the estate’s residency status. For

$1,000,000, the estate is taxable to Maine and a completed Form

additional information concerning residency status visit

www.

706ME must be submitted. If less than $1,000,000, you may fi le

maine.gov/revenue/incomeestate

and review “Maine Revenue

a Form 706ME-EZ.

Services Guidance to Residency Status.”

Line 4D

For decedents with surviving spouses, Maine allows a separate

Step 4

Tax Computation. If the total gross estate plus adjusted taxable

estate tax deduction for assets that are Qualifi ed Terminable

gifts is $2,000,000 or less, complete this section based on a pro

Interest Property (QTIP) under IRC Section 2056(b)(7), regardless

forma federal return. If the amount is greater than $1,000,000,

of whether a QTIP election is made for federal estate tax purposes.

the estate is taxable to Maine and a completed Form 706ME

The completion of Line 4D with an amount greater than zero

must be submitted. If less than $1,000,000, you may fi le a Form

706ME-EZ.

constitutes a QTIP election for eligible Maine QTIP property

by the executor or personal representative. The maximum

Line 1

Maine’s portion of total federal gross estate.

allowable QTIP deduction on Line 4D is the difference between

For Maine resident estates: Subtract the value of real and

the decedent’s federal exclusion amount (or, if no federal return

tangible personal property not located in Maine from the total

is required, the pro forma federal taxable estate) and the Maine

federal gross estate. See 36 M.R.S.A. § 4063.

NOTE:

Even if you are not required to fi le a federal return, you may still be liable for Maine tax if the total gross estate plus adjusted taxable

gifts is greater than $1,000,000. If you are not required to fi le a federal return and the total gross estate plus adjusted taxable gifts

is $1,000,000 or less, there is no Maine estate tax liability.

Rev. 08/06

2006 Form 706ME, Page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3