Form 1042 General And Specific Instructions

ADVERTISEMENT

2

Form 1042 (2009)

Page

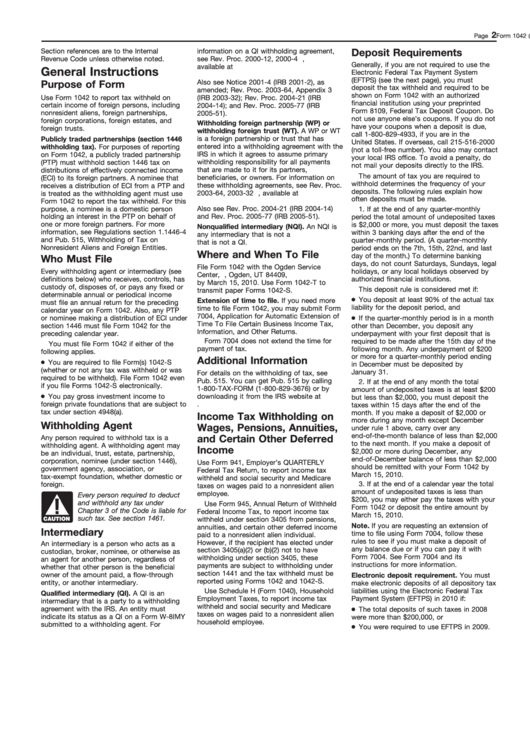

Section references are to the Internal

information on a QI withholding agreement,

Deposit Requirements

Revenue Code unless otherwise noted.

see Rev. Proc. 2000-12, 2000-4 I.R.B. 387,

Generally, if you are not required to use the

available at

General Instructions

Electronic Federal Tax Payment System

(EFTPS) (see the next page), you must

Also see Notice 2001-4 (IRB 2001-2), as

Purpose of Form

deposit the tax withheld and required to be

amended; Rev. Proc. 2003-64, Appendix 3

shown on Form 1042 with an authorized

Use Form 1042 to report tax withheld on

(IRB 2003-32); Rev. Proc. 2004-21 (IRB

financial institution using your preprinted

certain income of foreign persons, including

2004-14); and Rev. Proc. 2005-77 (IRB

Form 8109, Federal Tax Deposit Coupon. Do

nonresident aliens, foreign partnerships,

2005-51).

not use anyone else’s coupons. If you do not

foreign corporations, foreign estates, and

Withholding foreign partnership (WP) or

have your coupons when a deposit is due,

foreign trusts.

withholding foreign trust (WT). A WP or WT

call 1-800-829-4933, if you are in the

is a foreign partnership or trust that has

Publicly traded partnerships (section 1446

United States. If overseas, call 215-516-2000

entered into a withholding agreement with the

withholding tax). For purposes of reporting

(not a toll-free number). You also may contact

IRS in which it agrees to assume primary

on Form 1042, a publicly traded partnership

your local IRS office. To avoid a penalty, do

withholding responsibility for all payments

(PTP) must withhold section 1446 tax on

not mail your deposits directly to the IRS.

that are made to it for its partners,

distributions of effectively connected income

The amount of tax you are required to

(ECI) to its foreign partners. A nominee that

beneficiaries, or owners. For information on

withhold determines the frequency of your

these withholding agreements, see Rev. Proc.

receives a distribution of ECI from a PTP and

deposits. The following rules explain how

2003-64, 2003-32 I.R.B. 306, available at

is treated as the withholding agent must use

often deposits must be made.

Form 1042 to report the tax withheld. For this

Also see Rev. Proc. 2004-21 (IRB 2004-14)

purpose, a nominee is a domestic person

1. If at the end of any quarter-monthly

holding an interest in the PTP on behalf of

and Rev. Proc. 2005-77 (IRB 2005-51).

period the total amount of undeposited taxes

one or more foreign partners. For more

is $2,000 or more, you must deposit the taxes

Nonqualified intermediary (NQI). An NQI is

information, see Regulations section 1.1446-4

within 3 banking days after the end of the

any intermediary that is not a U.S. person and

and Pub. 515, Withholding of Tax on

quarter-monthly period. (A quarter-monthly

that is not a QI.

Nonresident Aliens and Foreign Entities.

period ends on the 7th, 15th, 22nd, and last

Where and When To File

day of the month.) To determine banking

Who Must File

days, do not count Saturdays, Sundays, legal

File Form 1042 with the Ogden Service

holidays, or any local holidays observed by

Every withholding agent or intermediary (see

Center, P.O. Box 409101, Ogden, UT 84409,

definitions below) who receives, controls, has

authorized financial institutions.

by March 15, 2010. Use Form 1042-T to

custody of, disposes of, or pays any fixed or

This deposit rule is considered met if:

transmit paper Forms 1042-S.

determinable annual or periodical income

● You deposit at least 90% of the actual tax

Extension of time to file. If you need more

must file an annual return for the preceding

liability for the deposit period, and

time to file Form 1042, you may submit Form

calendar year on Form 1042. Also, any PTP

7004, Application for Automatic Extension of

● If the quarter-monthly period is in a month

or nominee making a distribution of ECI under

Time To File Certain Business Income Tax,

section 1446 must file Form 1042 for the

other than December, you deposit any

Information, and Other Returns.

preceding calendar year.

underpayment with your first deposit that is

Form 7004 does not extend the time for

required to be made after the 15th day of the

You must file Form 1042 if either of the

payment of tax.

following month. Any underpayment of $200

following applies.

or more for a quarter-monthly period ending

Additional Information

● You are required to file Form(s) 1042-S

in December must be deposited by

(whether or not any tax was withheld or was

January 31.

For details on the withholding of tax, see

required to be withheld). File Form 1042 even

Pub. 515. You can get Pub. 515 by calling

2. If at the end of any month the total

if you file Forms 1042-S electronically.

1-800-TAX-FORM (1-800-829-3676) or by

amount of undeposited taxes is at least $200

● You pay gross investment income to

downloading it from the IRS website at

but less than $2,000, you must deposit the

foreign private foundations that are subject to

taxes within 15 days after the end of the

tax under section 4948(a).

month. If you make a deposit of $2,000 or

Income Tax Withholding on

more during any month except December

Withholding Agent

Wages, Pensions, Annuities,

under rule 1 above, carry over any

end-of-the-month balance of less than $2,000

Any person required to withhold tax is a

and Certain Other Deferred

to the next month. If you make a deposit of

withholding agent. A withholding agent may

Income

$2,000 or more during December, any

be an individual, trust, estate, partnership,

end-of-December balance of less than $2,000

corporation, nominee (under section 1446),

Use Form 941, Employer’s QUARTERLY

should be remitted with your Form 1042 by

government agency, association, or

Federal Tax Return, to report income tax

March 15, 2010.

tax-exempt foundation, whether domestic or

withheld and social security and Medicare

3. If at the end of a calendar year the total

foreign.

taxes on wages paid to a nonresident alien

amount of undeposited taxes is less than

employee.

Every person required to deduct

$200, you may either pay the taxes with your

and withhold any tax under

Use Form 945, Annual Return of Withheld

Form 1042 or deposit the entire amount by

Chapter 3 of the Code is liable for

Federal Income Tax, to report income tax

March 15, 2010.

such tax. See section 1461.

CAUTION

withheld under section 3405 from pensions,

Note. If you are requesting an extension of

annuities, and certain other deferred income

Intermediary

time to file using Form 7004, follow these

paid to a nonresident alien individual.

rules to see if you must make a deposit of

However, if the recipient has elected under

An intermediary is a person who acts as a

any balance due or if you can pay it with

section 3405(a)(2) or (b)(2) not to have

custodian, broker, nominee, or otherwise as

Form 7004. See Form 7004 and its

withholding under section 3405, these

an agent for another person, regardless of

instructions for more information.

payments are subject to withholding under

whether that other person is the beneficial

section 1441 and the tax withheld must be

owner of the amount paid, a flow-through

Electronic deposit requirement. You must

reported using Forms 1042 and 1042-S.

entity, or another intermediary.

make electronic deposits of all depository tax

Use Schedule H (Form 1040), Household

liabilities using the Electronic Federal Tax

Qualified intermediary (QI). A QI is an

Payment System (EFTPS) in 2010 if:

Employment Taxes, to report income tax

intermediary that is a party to a withholding

withheld and social security and Medicare

● The total deposits of such taxes in 2008

agreement with the IRS. An entity must

taxes on wages paid to a nonresident alien

indicate its status as a QI on a Form W-8IMY

were more than $200,000, or

household employee.

submitted to a withholding agent. For

● You were required to use EFTPS in 2009.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3